Bruce Beaubouef

Managing Editor

Operators and developers are studying, planning and building almost 4,000 mi (6,436 km) ofoil and gas export and transmission pipelines to bring these supplies from offshore fields to onshore markets.

The total from this year’soffshore pipeline construction survey reflects a significant decrease from last year, which showed a total of 6,577 mi (10,582 km) - a dramatic 39.8% decrease. The lower number is explained by the completion of a number of large-scale projects; the cancellation of Turkish Stream project; and the generally anemic state of the market.

Some of the more notable completed projects include: the 298-mi, 36-in. Polarled pipeline; the 140-mi, 44-in. Wheatstone pipeline; the 552-mi, 42-in. Ichthys pipeline; and the 249-mi, 24-in. Rota 2 pipeline offshore Brazil. The completion of these projects removed some 1,239 miles from the survey.

The cancellation of the Turkish Stream project, however, was the single biggest factor in the survey’s lowered numbers. That project had called for four 566-mi pipelines to move Russian natural gas to Turkey via the Black Sea. The project was cancelled in late 2015 due to rising tensions between the two countries. The cancellation of that project removed 2,264 miles from the survey. Nevertheless, there are a number of new construction projects going forward.

As usual, Europe is the leader in offshore projects, with some 2,323 mi of pipelines being built and planned, representing 58.6% of the worldwide total.

Work on the long-planned Trans Adriatic pipeline will begin this year, and Saipem has been selected by Trans Adriatic Pipeline AG to construct the offshore section. The Trans Adriatic pipeline is designed to take gas from the Azeri sector of the Caspian Sea to southern and central Europe.

Saipem will install the final section of the gas line across the Adriatic Sea between Albania and Italy. The workscope includes marine surveys; laying of the 105-km (65-mi), 36-in. pipeline in water depths of up to 820 m (2,690 ft) using the semisubmersible pipelay vesselCastoro Sei and the trench/pipelay barge Castoro 10; supply and installation of an offshore fiberoptic cable; pre-commissioning activities; and civil works at the landfalls in the two countries.

The landfall in San Foca, Puglia, on Italy’s east coast will be constructed using micro-tunnelling technology. Saipem will start its construction program this year.

Even more notable are the plans for Nord Stream 2, which proposes to double the capacity of the original dual-pipeline system completed in 2012. Nord Stream 2 calls for another dual pipeline system to run with two 745-mi, 48-in. pipelines across the Baltic Sea from Russia’s Baltic coast to the German coast near Greifswald, without an intermediate compressor station.

This second Nord Stream system was first announced last September, when an international consortium of six major companies announced plans for the project. The consortium includes Russia’s Gazprom, German companies Uniper SE and BASF SE/Wintershall Holding GmbH, Royal Dutch Shell, Austria’s OMV, and France’s Engie S.A.

Recently, the Nord Stream 2 consortium awarded line pipe supply contracts to Europipe, United Metallurgical Co., and Chelyabinsk Pipe-Rolling Plant. These companies will collectively supply some 2,500 km of line pipe for the project starting in September.

The consortium has also awarded a contract to Wasco Coatings Europe BV for the concrete weight coating and storing of more than 200,000 pipe joints. Pipe deliveries to concrete weight coating facilities are planned to start this September, with the concrete weight coating process starting at the beginning of 2017. Construction of both Nord Stream 2 pipelines is scheduled to begin in 2018.

TheMiddle East comes in second in the survey, with some 1,093 mi of pipelines being built and planned, representing 27.6% of the worldwide total. Perhaps most notable project here is the proposed Iran-Oman gas pipeline, which would deliver Iranian gas through the Persian Gulf to Omani gas markets.

The project is still undergoing feasibility studies, but seven foreign companies have expressed interest in working with Iranian contractors on the construction of the line.

The 400-km (248-mi) pipeline will have both onshore and offshore sections. The land part would run approximately 200 km (124 mi) from Rudan to Mobarak Mount in Iran’s southern Hormozgan province. The subsea pipeline will run another 200 km from that point through the Persian Gulf to reach Sohar Port in Oman. Cost of the subsea construction has been estimated at $1.5 billion.

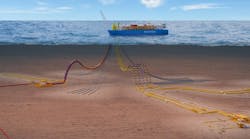

The most notable pipelay project in the Gulf of Mexico is the proposed Texas-Tuxpan natural gas pipeline, designed to move natural gas from south Texas through the Gulf to onshore power markets in Mexico.

TransCanada says that it has been selected by the Comisión Federal de Electricidad, Mexico’s state-owned power company, to build, own, and operate the pipeline. Plans call for this system to run 800 km (497 mi) with 42-in. pipe, with at least 690 km (429 mi) of it to run offshore.

TransCanada expects to invest approximately $1.3 billion in the pipeline, which will begin in the Gulf of Mexico at the border point near Brownsville, Texas, then run offshore along the Mexican coast. The system will have three laterals that extend onshore to power generation markets in Matamoros in Tamaulipas state, and Altamira and Tuxpan in the state of Veracruz.

The bid for the Sur de Texas-Tuxpan project was presented in partnership with IEnova, a subsidiary of Sempra Energy. The joint venture, Infraestructura Marina del Golfo (IMG), is targeting a late 2018 in-service date for the pipeline.

Shawcor says its pipeline coating group has received a conditional contract from IMG to provide coating solutions for the project. The contract involves coating around 690 km (429 mi) of 42-in. pipe with concrete weight coating in a variety of thicknesses (2.25-in., 2.752-in. and 3.5-in.); and Shawcor will also supply and install 5,000 sacrificial anodes. Coating is expected to begin in early 2017 and be completed by the end of the year.