OGA tackles UK decommissioning needs

OGA tackles UK decommissioning needs

Decommissioning costs on the UK continental shelf (UKCS) between now and 2050 could reach £47 billion ($62.4 billion), according to analysis commissioned by the Oil & Gas Authority (OGA) and the Department of Energy and Climate Change (DECC). The uncertainty range for this figure is +/-40%: OGA is targeting a cost reduction of at least below the mid-point under its newly unveiled Decommissioning Strategy.

The sector is relatively immature on the UKCS, the authority points out, but also presents opportunities for innovation. More than 250 fixed installations, 250 subsea productions systems, 3,000 pipelines, and around 5,000 wells in UK waters will eventually have to be shut down or removed, and the infrastructure is highly integrated, with many installations dependent on each other to sustain production and export to the shore. The complexity means that decommissioning planning will have to be performed at a regional and area level rather than for individual assets alone.

OGA has identified a need for short-, medium-, and long-term improvements in the execution of decommissioning and related cost efficiencies. Its strategy/delivery program will focus on influencing and promoting new removal methods not just through increased collaboration, but also more transformative solutions that address constraints, liabilities, and risks.

At current oil prices many UK offshore operators are looking at bringing forward Cessation of Production (CoP) dates, OGA says, but at the same time are anxious to delay decommissioning expenditure where possible as this prevents them from allocating scarce capital to value-generating activities. Decommissioning liabilities can also impact the transfer of some of these assets to smaller operators, leading to a premature CoP.

High costs in this sector are due to numerous factors such as the decommissioning industry’s relative immaturity and a lack of direct experience among operators and the supply chain. OGA therefore plans to ensure the industry has access to sound and transparent data concerning cost estimates, execution methodologies, and best practices. In this regard it will seek to encourage dialogue and experience-sharing with other relevant industries such as the salvage sector.

Another goal is to capture and share data on supply chain expertise and competencies across the industry, facilitating a transparent, predictable, and sustainable UK decommissioning market that may stimulate investment. Deliverables will include tools to help the industry implement cost-effective risk allocation, contractual and commercial positions in order to drive down costs. OGA will also work with DECC to encourage operators to communicate to operators the importance of early engagement with those regulating decommissioning to ensure the new guidance is understood and that experience from other operators is passed on.

North Sea Rutil on faster track

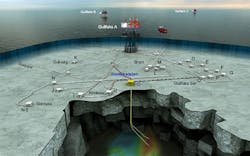

Statoil is close to starting up subsea facilities at the 80-MMboe Rutil gas/condensate field in the Gullfaks Rimfaks valley in the Tampen area of the North Sea. The development features a four-slot, standardized subsea template with an initial two gas production wells, with the wellstream sent to the Gullfaks A platform for processing via a connection to an existing pipeline. In addition, the company plans to drill two more wells from an existing subsea template to import more injection gas via a new pipeline connected to an injection system already in place in this area. Statoil had originally expected to start production fro Rutil early next year, and according to the Norwegian Petroleum Directorate (NPD), the final development cost will likely be $457 million, around $127 million below the original estimate.

NPD has also sanctioned BP’s request to extend use of the production facilities at the Tambar oil field in the southern Norwegian North Sea to early 2022. Tambar, 16 km (9.9 mi) southeast of the Ula field, produces through a remotely controlled wellhead platform without process equipment, and operates under depressurization. The oil is exported by pipeline to the Teesside terminal on the northeast English coast.

Transocean sets horizontal course for Wisting well

OMV has completed drilling and testing of its Wisting Central II appraisal well on Norway’s most northerly oil discovery to date, 310 km (192 mi) north of Hammerfest in license PL537 in a water depth of 302 m (991 ft). This was also the first horizontal appraisal well in the Norwegian Barents Sea, and the shallowest horizontal offshore well ever drilled from a floating drilling rig (theTransocean Spitsbergen), the operator claimed, with the targeted reservoir 250 m (829 ft) below the seabed.

Drilling started vertically with the well the steered to a horizontal orientation within a 250-m vertical depth interval, and subsequently landed horizontally with a 12¼-in. hole size. The total length of the well was 2,354 m (7,723 ft), with a horizontal section of 1,452 m (4,764 ft). Aside from assessing reserves in Wisting Central’s South and Central West segments, OMV wanted to determine the feasibility of long-reach horizontal development wells through the shallow reservoir. Results have reduced uncertainties associated with the technique, as well as raising the field’s estimated reserves.

West of Shetland in UK waters, the same rig has started a pilot well on Hurricane Energy’s fractured basement Lancaster oil field on the P1638 Central license. This is the first of two wells designed to improve definition of the field’s resource range. Goals include assessing potential upside in the overlying Victory sandstone. The second well, which will assess the potential for other parts of the reservoir to deliver commercial flow rates, will be recompleted as a producer, assuming Hurricane can attract partners to co-fund what would be its first UK offshore development project.

Elsewhere in the UK sector, EnQuest has proven small but commercial volumes of oil with a well on the Eagle prospect in the central North Sea, which it will look to tieback through existing infrastructure to the Kittiwake platform, having earlier completed wells tying back the Scolty and Crathes fields to the same facility. However, a report by Britain’sDaily Telegraphsuggested the OGA may need to step in support EnQuest, which the newspaper claimed has financial problems. Aside from the Greater Kittiwake Area, EnQuest operates Kraken, one of the UK’s major new oil field development projects, along with various other producing fields in the central and northern North Sea.