Mexico's deepwater round to employ license contract structures, production sharing

Emma Mulders • Marco Nieto

Baker & McKenzie

Late last year, the Mexican government published the bidding guidelines and the contract model fordeepwater contracts related to Round One’s fourth call for bids.

The legal, regulatory, and economic structure of the documents related to this call will be relevant to those that may be interested in participating in this bid round.

The goal here is to set out the difference between the license contract structure, which was used in the third call (onshore fields) and is also used in the fourth call; and the production-sharing contract structure, which was used in the first and second calls regarding shallow waters.

This analysis focuses on the procedure for determining the state/contractor payment differences under the license contract and the production-sharing contract.

License contract models

On Dec. 17, 2015, the call for bidders in document CNH-R01-C04/2015 was published inMexico’s Federal Official Gazette by the National Hydrocarbons Commission (CNH). In this call, the CNH invited interested local and international private companies as well as state production companies to participate in an international public tender for the award of hydrocarbon exploration and extraction license contracts, in connection with 10 contractual areas in deepwater and ultra-deepwater.

Along with the publication of the call for bidders, the corresponding license contract models have been published as in the previous calls: contract model (i) for individuals and (ii) for a consortium.

These license contract models differ from the previous contracts (calls for bids in exploration and production in shallow waters) that had been published by the CNH, more specifically in connection with the payment mechanism. To help explain the differences, it is useful to show the main specifics of this license contract model as compared to the production-sharing contracts that have been used in previous calls.

In order to provide an accurate overview of the economic impact of the license contract, it is necessary to first briefly describe the different types of contracts allowed pursuant to the energy reform. It should be noted that the consideration established in any of these agreements is subject to the provisions of the Hydrocarbons Revenue Law. The types of contracts include:

Production-sharing agreement.This type of contract allows the private parties to receive as payment a percentage of the production.

Profit-sharing agreement.This type of contract allows private parties to receive payments in cash, but unlike service agreements, the consideration will consist of a certain percentage of the net income obtained from the sale of hydrocarbons.

License agreement.This type of contract allows private parties to receive, in exchange for consideration, the onerous transfer of the hydrocarbons extracted from the subsoil.

Service agreement. This type of contract allows private parties (such as oil field services companies) to receive cash as payment for the specific oil service contracted by the government.

A combination of the above. In accordance with the energy reform, a special agreement with the combination of the above mentioned contracts is allowed.

Only licensing and production-sharing agreements allow the contractor to take ownership of all or part of the hydrocarbon production for its own marketing and to recover its investment accordingly. Under the other agreement models, the contractor will receive payment in cash directly from the Mexican Oil Fund, but the hydrocarbons will be owned by the Mexican state, to be marketed for its benefit by a designated marketer.

The periodical payments, fees/considerations, calculus scheme and the settlement structure is determined for each specific tender following the rules, terms and measurement conditions are set forth in the Hydrocarbons Revenue Law. With this in mind, the authors reviewed the last bidding guidelines, where the contract models for production sharing as well as the license are included.

Contract crude oil price

In general terms, according to Annex 3 of the second call and fourth call of theRound One by CNH, there are different assumptions to determine the contractual price of crude oil per barrel:

i. If at every period, the contractor sells at least 50% of the crude oil volume received by the Mexican state, then the contractual price (in which the deal has been registered) shall be equal to the weighted average observed sale price (applicable for license and production sharing structure).

ii. If at every period, the contractor has not marketed at least 50% of the crude oil volume received by the Mexican state but the deal has been registered by the marketer, then the contractual price shall be equal to the weighted average price registered by the marketer for the deal (only applicable for the production- sharing contract).

iii. If at the end of the period, the contractor has not registered a deal of at least 50% of the crude oil volume received by the Mexican state, the contractual price in the specific period shall be calculated as a function of the API gravity and sulfur content corresponding to the crude oil extracted in the specific contract area. The contractual price will also take into consideration the prices for Light Louisiana Sweet and Brent, and if such crude oil has been marketed or not (applicable for license and production-sharing structure).

iv. If there is a case in which the crude oil is registered as in item (iii) above, in the last one or two periods, but during the current period there is a deal following items (i) for license structure or (i) and (ii) for production-sharing structure, then the contractual price will be determined as per other formulas which are a function of the observed price in marketing of crude oil; volume of production of crude oil registered at the measurement point in the last available periods; the differences in the oil value at every period, and it is weighted by the total volume of crude oil. Another formula is considered if the difference between the price estimated by the aforementioned formula and the observed price during the crude oil marketing is more than 50% (applicable for license and production-sharing structure).

There are also certain price treatments for the case of condensates and natural gas, similar than in the crude oil aforementioned (i), (iii) and (iv), except for case (ii) when the contractor has not marketed at least 50% of the condensate or natural gas volumes, received by the Mexican state but the deal has been registered (only applicable for production-sharing contract).

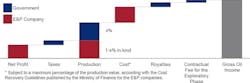

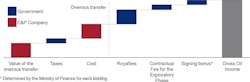

Source: Baker & McKenzie analysis.

With the formulas of crude oil, condensates and natural gas prices, the contractual hydrocarbons value can be calculated with the multiplication of prices and volume at each period for crude oil, condensates and natural gas (applicable for license and production-sharing structure). There is a relevant difference included only in the production-sharing scheme, regarding cost recovery calculation, the formula for the operating profit to be shared from the Mexican state to the contractor, that will be briefly explained in the following section.

Cost recovery

Pursuant to Annex 3 of the production-sharing structure, there is a cost recovery percentage of 60% for each period to be applicable during its state of being in force. This percentage shall be used to obtain the recoverable cost limit by multiplying it for the hydrocarbons value for each period. In this sense, the correspondent consideration or payment regarding the reimbursement of recoverable costs will be the smaller amount between the recoverable costs limit and the recognized costs that are recoverable costs.

In consequence, the operating profit for the production-sharing contract structure of Round One, second call will be the result of the subtraction from the contractual hydrocarbons value plus other revenues to recoverable costs reimbursement and royalties effectively paid to the Mexican state.

The contractors awarded in any contractual area shall receive the value (in kind) from the Mexican state the remaining of the percentage of the operating profit presented in its awarded proposal. For that reason, its operating result will be the operating profit previously explained minus the recoverable costs and other recorded costs at each period.

Source: Baker & McKenzie analysis.

Adjustment mechanisms

A different approach for the adjustment mechanism has been established for each contractual structure:

Production-sharing structure.The adjustment mechanism will be calculated as a percentage of the operating profit depending of the operating result of the contractor before taxes. Additional revenues received by the contractor for the provision of services to third parties or derived from the sale or disposal of sub-products, shall be deemed as contract revenues, thus it will be included in the measurement of profit at every period.

License structure. The adjustment mechanism will be calculated as a percentage of the contract value of hydrocarbons at every period depending on an initial percentage of the contract value of the hydrocarbons produced in a contract area plus and quarterly adjustment updated from the amount of the initial percentage.

Conclusion

In order to promote the medium and long-term investment in Mexico’s E&P infrastructure, CNH has published the fourth call for bidding under a license contract structure. The advantage is that the process is less complex, mainly regarding the cost recovery scheme for the production-sharing contract as mandated in the legislation. It implies that the considerations will derivate from the hydrocarbons value and not from the operating result.

In this regard, one important income source in the license scheme that was established in the Hydrocarbons Revenue Law for the Mexican state is the signing bonus. However, authorities have decided not to apply such bonuses for the fourth call, which may be considered from a certain legal point of view as an obligation to be included in every bidding process.

Lastly, the federal government expects a better investment promotion through the license structure in the fourth call, but in terms of Annex 3 for production-sharing and license structures analyzed here there are two main differences: cost recovery schemes, and adjustment mechanisms. In both cases, it is applied in different ways to every structure, mainly because in the first item there is an incentive to evidence potential higher costs for production-sharing contracts; while in the second it is the opposite. In the second item there is a different promptness to be applied to such adjustments among these contract structures.