Study examines riser system applications, industry trends

Brittany Turner

Ricky Thethi

2H Offshore

Since the early 1980s, there have been a number of trends in the development of offshore fields and the riser systems attached to floating production vessels. Developments have moved into increasing water depths and into most regions of the world. There has also been an increase in alternative riser systems like freestanding hybrid risers; improvements in equipment used in existing riser systems; and technologies introduced that make previously inaccessible or cost-prohibitive fields economic to develop. But where is the riser market headed in the coming decade?

Houston-based riser and conductor engineering specialist 2H Offshore has conducted a worldwide floating systems riser market study spanning the past 35 years and identified regional trends that have subsequently been applied on the fields expected to be developed over the next 10 years. The objective was to paint a picture of what can be expected in the riser industry in the coming decade.

The study

Riser and vessel data was collected for historical developments, including fields currently under development, with known riser details. The developments were divided into five water depth ranges, from very shallow to ultra-deep. From this data, a map was developed which shows the percentage split between water depths and between riser types for each of the major oil-producing offshore regions of the world. By looking at this data from different perspectives, the company can better understand the relationships between water depth, riser type, and world region.

Historical trends

Riser type, historically, has been driven primarily by region and water depth. Globally, in terms of riser length, flexible risers make up the largest volume. The Golden Triangle, comprised of the Gulf of Mexico, Brazil, and West Africa dominates the market.

In terms of riser volume, Brazil is the largest market region. It does not manifold subsea wells and almost all risers below 5,000 ft (1,524 m) water depth are flexible risers. Brazil is also the only region which has used production flexibles in water greater than 5,000 ft deep.

Historically, the deepwater range (3,000 to 5,000 ft, or 914 to 1,524 m) has the most volume in all regions except the North Sea, where developments this deep are minimal.

Dominated by steel rigid risers, top tensioned risers (TTRs), and steel catenary risers (SCRs), the GoM is the only region in which flexibles are not a large player, primarily because FPSOs have not been used until recently. This is currently the only region which has ultra-deepwater developments (over 7,500 ft, or 2,286 m).

In Asia, TTRs dominate in terms of total riser length, with flexibles coming in second. Though, regionally, only a small percentage of developments use this riser system, there are many TTR strings per vessel which drives the large volume. There are no free standing hybrid riser (FSHR) systems yet in Asia or in the North Sea/Europe, and neither region currently has developments over 5,000 ft (1,524 ft).

Riser selection

To understand why a riser type is dominating a region or a water depth range, it helps to understand the drivers for riser type selection and some of its advantages and disadvantages.

Flexible risers are compliant, and can be used with high motion vessels like FPSOs in harsh environments and shallow-water. They can be delivered and installed quickly and easily, which can bring initial production online faster. However, in terms of disadvantages, they are limited by water depth; currently, few flexibles installed over 5,000 ft. They can also fall victim to long-term integrity issues. A field service life of 20-30 years is difficult to meet and replacement cost therefore needs to be accounted for. Additionally, flexible risers require a higher up-front capex in comparison to rigid steel riser systems. There are also regional preferences to take into account: The widespread use of flexible risers in Brazil and the North Sea result in a local well established supply chain and service providers.

In the case of rigid steel risers, dry tree TTRs are typically used with spars and tension leg platforms (TLP), where wells need to be clustered beneath the platform and regular well intervention is required during the field life. Although SCRs are generally not feasible in shallow-water depths; they can be used in deeper water with heave-optimized vessels such as semisubmersibles, spars, and TLPs. In addition, SCRs are sensitive to vessel motions, and are therefore often incompatible with high motion vessels like FPSOs. These systems can offer capex savings up-front and avoid the cost of replacement during a long field life that can occur with flexibles. SCRs and TTRs impose greater payload on the vessel with increasing water depth, while lazy wave SCRs improve global performance with high-motion vessels while reducing payload. In terms of regions, those working in the GoM have preferred to predominantly use rigid steel risers over flexibles.

Freestanding hybrid risers are used with FPSOs in areas lacking pipeline infrastructure, and where water is too deep for flexibles. These compliant systems are used in harsh environments where vessel motions are too high to use SCRs. They minimize riser payload on the vessel. Additionally, they comprise multiple component packages, some of which can be made in-country, thereby assisting in meeting local content requirements in regions like West Africa. However, they require an expensive up-front capex.

Predictions and trends

Field data was collected for developments planned for the next 10 years. Predictions were made as to the number of these developments that were likely to be sanctioned based on a sliding probability scale linked to the current planning phase of prospect. Very shallow-water depth developments were not included in the future predictions, since it is not possible to know whether these fields will be developed using a floating platforms, fixed platforms, or tiebacks to existing facilities.

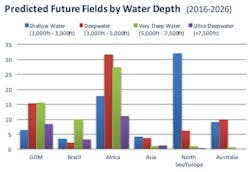

This assessment showed the largest number of new developments over the next 10 years is expected to be in Africa. This is true for all water depth ranges except for the shallowest water depths, for which the North Sea has the most fields predicted. To date, the only region with ultra-deepwater developments (over 7,500 ft or 2,286 m) has been the GoM, but more ultra-deep developments are expected in Africa than in the GoM over the next 10 years.

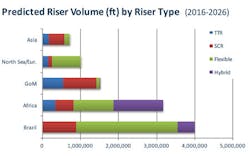

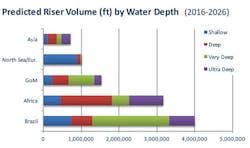

The large majority of recent and expected upcoming vessel installations (2005-2018) are FPSOs, and this trend is expected to continue. For Brazil and the North Sea, this means that flexibles will continue to dominate. In Africa and Asia, flexibles will also still be widely used. However, in Africa, a considerable increase in the use of FSHRs is also anticipated due to increased activity in deeper water and the local content options that these risers provide to operators. Some of the market share currently held by flexible risers in Brazil will go to SCRs and FSHRs. The change is due to the shift to much deeper water and uncertainty with regard to flexible service life as a result of the corrosion challenges in the presalt fields. In the North Sea, some activity is expected in deep and very deepwater, and therefore a slightly larger percentage of rigid steel risers will likely be used than in previous years.

Steel rigid risers will continue to dominate in the GoM, with primarily TTRs and SCRS utilized. The volume of SCRs is expected to increase slightly relative to TTRs with the higher percentage of future deepwater developments.

In Asia, a shift to deeper water implies an increase in the use of FPSOs and, with it, turret-moored, disconnectable, lazy wave SCRs. FSHR activity is not currently predicted in Asia based on historical riser selection trends since local content is less of a driver. Flexibles will still be a big player due to continued development in shallower depths.

The highest overall volume of risers over the next 10 years is predicted to be in Brazil and Africa. The number of developments in Africa is the largest, although Brazil typically has more risers per development, allowing it to pull ahead in terms of total riser length. The highest rate of growth relative to historic development is predicted to be in Africa, Asia, and the North Sea. In Africa and Asia, the growth is in deeper water. For the North Sea and Europe, the growth is still mainly in shallower water.

In most oil-producing regions, a general movement into deeper water is expected to continue, while maintaining a high level of activity in shallower water. Flexible use, particularly with FPSOs, is still expected to dominate the riser market. However, with continued movement into deeper water, there will be further opportunities for rigid steel risers and FSHR systems to compete with flexible riser market share.