Gulf operators seek to navigate stormy year

Bruce Beaubouef

Managing Editor

The new year finds E&P activity in theGulf of Mexico suffering from the effects of low oil prices, as with many other offshore oil and gas provinces around the world. For a while after the price decline that started in mid-2014, it seemed that the GoM might remain immune to the effects of lower oil prices.

But in 2015, several developers began to scale back theirdrilling campaigns and project activity. Indeed, a few have begun to divest their Gulf interests, and still others are exiting deepwater exploration.

Nevertheless, many of the traditional players in the Gulf are pressing forward with plans to advance their projects, and expect to continue E&P activities into the new year and beyond.

A number of new discoveries have been announced recently, prompting the need for additional exploration and appraisal drilling; and field development activity will continue on several projects in the coming year. This report highlights some of the key trends that the industry expects to see in the GoM in 2016.

Drilling forecast

Drilling activities in the Gulf have been suffering from the lower oil price environment for months. In mid-December, the US offshore rig count was 23, down two rigs from the previous week, and down 37 rigs year over year, according to the Baker Hughes weekly rig count.

Thedrilling rig outlook for the US Gulf for 2016 is expected to continue to be rough, in particular for jackups, says Cinnamon Odell of IHS Petrodata. “Without a significant increase in oil prices, demand for jackups is forecast to remain at about 7-9 units throughout the year,” Odell observes.

For floating rigs, which have much longer contracts than those typically awarded for jackups, “those that roll off contract in 2016 are very likely to not be renewed, and to have either a small gap between jobs, or they may remain idle for the rest of the year,” she notes. In the US Gulf, the forecast for overall rig demand is expected to be in the mid 40s throughout 2016. Semis are expected to be harder hit by idle time than drillships, as seven semis are currently scheduled to finish their contracts in 2016, while five drillships are due to roll off contract.

New discoveries

Some recent discoveries in the Gulf by major operating companies augur brighter prospects for continued drilling activity in the coming year. For example, in October Chevron announced that it had a successful appraisal well at its Anchor discovery in Green Canyon block 807 in the deepwater Gulf. The appraisal drilling found 694 ft (211 m) of net oil pay.

To date, Chevron has confirmed a hydrocarbon column of at least 1,800 ft (549 m) in the Lower Tertiary Wilcox reservoirs at Anchor. Complete appraisal of the field requires further delineation wells and technical studies, Chevron said.

The original Anchor discovery well, approximately 140 mi (225 km) off the coast of Louisiana in 5,180 ft of water (1,579 m), was drilled to a depth of 33,750 ft (10,287 m) and encountered 690 ft (210 m) of net oil pay.

Chevron U.S.A. Inc. is the operator of Anchor, with a 55% working interest. Anchor co-owners are Cobalt International Energy, L.P. (20%), Samson Offshore Anchor, LLC (12.5%), and Venari Resources, LLC (12.5%).

In November, Shell announced that it had successfully drilled its longest well ever, and had confirmed 100 MMboe of pay in the Kaikias well, close to its existing infrastructure in the deepwater Gulf of Mexico’s Mars-Ursa basin.

Located about 60 mi (96 km) offshore the Louisiana coast, the well drilled reached 34,500 ft (10,515 m) measured depth. Even with the record-setting depth, Shell said that the drilling and appraisal of Kaikias was ahead of schedule and under budget, resulting in a 20% cost savings.

Kaikias was discovered in August 2014. Appraisal drilling took place one year later and proved more than 300 ft (91.4 m) of net oil pay.

Meanwhile, Stone Energy Corp. recently provided an update on its various drilling and production activities in the deepwater Gulf.

At the Cardona field in Mississippi Canyon block 29, the Cardona #6 well has been tied into the existing Cardona subsea infrastructure which flows into the company’s Pompano platform. Gross production from the Cardona field is about 15,000 boe/d.

The drilling of the Cardona well #7 with theENSCO 8503 is expected to begin once completion of the Amethyst prospect is finished. Drilling is expected to take about two months. The Cardona #7 well is an offset well to the existing TB-9 well in and the fourth well to be drilled in the Cardona development program. Production is expected to start in 2Q 2016. Stone holds a 65% working interest in the project and is the operator.

In Mississippi Canyon block 35, the Vernaccia exploration well, which targets the Miocene interval, was spudded in late September and is operated by Eni. After a sell down of a portion of its position, Stone now has approximately 4% working interest in the drilling cost of the well and will have an approximate 22% working interest ownership thereafter. Drilling is estimated to take three months.

In Mississippi Canyon block 26, theENSCO 8503 is performing completion operations at the Amethyst discovery. Stone Energy has 100% working interest. The well will be prepared for an initial production test prior to final flowline and umbilical hook up. First production is expected by 1Q 2016 to the Pompano platform, located less than 5 mi (8 km) from the discovery.

In Alaminos Canyon block 943, the Lamprey exploration well is projected to spud in 2Q 2016. Stone currently controls 100% working interest in the prospect and is the operator. Drilling is expected to take two to three months. If the initial exploration well is successful, Stone plans to immediately drill an appraisal well.

In Viosca Knoll block 989, the company has secured and is mobilizing a platform rig for its Pompano platform drilling program, which was expected to start in late 2015. The program is expected to consist of three to four development wells. Stone says the rig may also be used for workovers or to drill other potential prospects located near the facility.

“We have taken steps to reduce our overhead and operating costs,” said Chairman, President and CEO David Welch, “and expect to curtail capital spending in 2016 to more closely align with our cash flow projection.”

For more information on the latest deepwater Gulf of Mexico discoveries, turn to page 36.

Field development

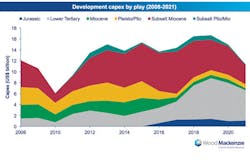

Field development activity is expected to continue this year on at least a handful of major deepwater Gulf projects.

Shell says it is one step closer to achieving first oil at its Stones development from the world’s deepest floating production facility. In November, theTurritellaFPSO set sail from the Keppel yard in Singapore, en route to its new home in the deepwater Gulf.

Once it reaches the Gulf, the vessel will connect to subsea infrastructure located in the Lower Tertiary play, beneath 9,500 ft (2,896 m) of water, which Shell says breaks the existing water depth record for an oil and gas production facility. The Stones field is located about 200 mi (320 km) southwest of New Orleans in the Walker Ridge area.

Shell says it selected this vessel design to optimize field development and produce the ultra-deepwater discovery in a safe and responsible manner. Using this floating vessel allows it to address the relative lack of infrastructure, seabed complexity, and unique reservoir properties.

Aside from being the world’s deepest facility, it also features an industry-first application of combining a disconnectable buoy with steel lazy wave risers - steel pipe with in-line buoyancy that absorbs the vessel’s motion and boosts riser performance at extreme depths.

SBM Offshore was contracted to build the vessel, which is a converted Suezmax FPSO. It will have a processing facility capacity of 60,000 b/d of oil and 15 MMcf/d of gas treatment and export. The project is expected to be placed online in 2017.

Meanwhile, Walter Oil & Gas Corp. says it is moving forward with its Coelacanth project. In December, the company announced that it had successfully installed the Coelacanth field platform at Ewing Bank block 834 (EW 834).

The 1,312-ft (400-m) tall, conventional four-leg, nine-slot platform is the third-largest fixed conventional platform in the GoM and was built in Gulf Marine Fabricators’ yard in Ingleside, Texas. It required over two million man hours to complete.

After a two and a half-day process of loading the platform’s 60,000,000-lb jacket onto the launch barge, sail-away took place on Oct. 15, 2015.

The Coelacanth field is in approximately 1,200 ft (366 m) of water and spreads across four GoM outer continental shelf blocks: EW 834, EW 835, EW 790, and Mississippi Canyon 793, approximately 125 mi (201 km) south of New Orleans.

The field will produce from two geo-pressured reservoirs below 20,000 ft (6,096 m) on the north side of a salt structure. The Coelacanth platform is designed to produce 30,000 b/d of oil and 60 MMcf/d of gas, and is expected to serve as host for future discoveries in the area.

Elsewhere, Anadarko says that its Heidelberg spar has made the 400-mile trip from Ingleside, Texas, to Green Canyon block 860 offshore Louisiana, where it has been upended and moored in place at a water depth of 5,300 ft (1,600 m). Intermoor says it provided Anadarko with rapid hook-up services for its Heidelberg truss spar in the deepwater after stepping in at short notice for another contractor, hooking up the 80,000 b/d spar to three mooring lines. The project’s original contractor then resumed the job and completed the remaining six mooring lines along with the completion of the spar installation. First oil is expected in the 2Q 2016.

Production

Still other Gulf projects are moving into the production phase. In October, Noble Energy reported that oil production has started from the Big Bend field in the deepwater GoM.

The single-well field is ramping as expected and is anticipated to reach a maximum gross production rate of about 20,000 boe/d over the next couple of weeks. Approximately 90% of the volumes being produced are oil.

In addition, the company has continued to accelerate the Dantzler, and first production was expected late last year. Big Bend and Dantzler, located in Mississippi Canyon 698 and 782, respectively, are subsea tiebacks to the third-party Thunder Hawk production facility.

Noble Energy operates Big Bend with a 54% working interest, along with W & T Energy VI LLC with 20%, Red Willow Offshore LLC with 15.4%, and Houston Energy Deepwater Ventures V LLC with 10.6%.

The company is also the operator of Dantzler with a 45% working interest. Partners include Ridgewood Energy Corp. (including ILX Holdings II LLC a portfolio company of Riverstone Holdings LLC) with 35%, and W & T Energy VI LLC with 20%.

Gary W. Willingham, Noble Energy’s executive vice president of operations, observed that “short cycle times to first production, strong well deliverability, and low production costs from our Gulf of Mexico projects deliver attractive returns even in today’s environment.”

Elsewhere, Freeport-McMoRan says it expects initial production from its Horn Mountain Deep discovery sometime during the first half of 2017. The company further expects the discovery well combined with two development wells to be drilled could produce a total of 30,000 boe/d.

The Horn Mountain Deep discovery well was drilled to a TD of 16,925 ft (5,159 m). FM O&G said that logging-while-drilling indicated a total of approximately 142 net ft (43 net m) of Middle Miocene oil pay with excellent reservoir characteristics.

In addition, these results indicate the presence of sand sections deeper than known pay sections in the field.

Freeport-McMoRan says that success at Horn Mountain Deep follows the positive drilling results from three wells drilled in the Horn Mountain area, including the Quebec/Victory, Kilo/Oscar, and Horn Mountain Updip tieback prospects. In aggregate, these wells may be capable of producing more than 27,000 boe/d, with initial production expected in mid-year 2016.

Exiting the Gulf

The low oil price environment has led many operators and developers to re-evaluate their portfolios, and some have begun to liquidate their assets in the Gulf.

In November, Marathon Oil announced that it had signed an agreement for the sale of most of its GoM oil and gas assets. Marathon’s GoM portfolio included its operated producing assets in the greater Ewing Bank area and its non-operated producing interests in the Petronius and Neptune fields in the Gulf of Mexico. They are being sold for $205 million.

Marathon operates the Arnold, Lobster, and Oyster fields in Ewing Bank blocks 963, 873, and 917, holding 65% working interest in Ewing Bank; 66.67% WI in Lobster and Oyster and 62.5% WI in Arnold. It holds a 30% non-operated WI in Neptune, and a 50% non-operated WI in Petronius/Perseus development in Viosca Knoll blocks 786/830.

Marathon said it will retain its interests in certain other producing assets and acreage in the Gulf, as well as its interests in the Gunflint development and Shenandoah discovery.

Marathon holds a 10% non-operated WI in the Shenandoah discovery, located in Walker Ridge block 52, and an 18% non-operated working interest in Gunflint, located on Mississippi Canyon blocks 948, 949, 992(N/2) and 993(N/2). The unnamed buyer will assume all future abandonment obligations for the acquired assets.

That same month, ConocoPhillips said that it would exit deepwater exploration by 2017, and that it plans to sell the offshore leases where it does not intend to drill.

Its exit from deepwater exploration would free up roughly $800 million in capital, the amount it has budgeted for exploration next year. The decision is part of the company’s plan to sell $1 to $2 billion assets a year as it braces for lower oil prices. At the time of the announcement, ConocoPhillips had about 2.2 million acres and three recent discoveries in the Gulf of Mexico.

“It’s a strategic decision to exit deepwater exploration,” said Matt Fox, ConocoPhillips’ executive vice president in early November. Quoted in a Houston Chronicle report, Fox was also quoted to say that the company’s decision on whether to develop the discoveries “is quite some ways off.”

“We may choose to stay with those developments but we may choose to exit before development happens,” Fox said. He also clarified the company’s deepwater policy: “We haven’t made a commitment to exit deepwater, per se, but deepwater exploration,” he explained.

ConocoPhillips said last summer that it would scale back on exploration spending, cutting its exploration spending to $1.8 billion of its estimated $11.5 billion budget.

ConocoPhillips lost about $1.1 billion in 3Q 2015 as it took impairments and restructuring charges and paid a penalty for terminating a contract for a Gulf of Mexico deepwater rig.

The company says it will cut some $1.3 billion from its capital budget guidance to $10.2 billion, and will compress its operating costs by another $1 billion to $8.2 billion as it braces for a long downturn.

Looking forward

Even with persistently lower oil prices, analysts expect development activity in the Gulf to accelerate slightly in the coming months and years. James C. West, Senior Managing Director & Partner with Evercore ISI, says he believes that the Gulf of Mexico “will be the only relative bright spot for deepwater activity in 2016-2017.”

Yet for many operators and developers, the stormclouds of 2016 are full of foreboding. Only time will tell if the decisions made by some operators to liquidate their Gulf assets, or exit deepwater exploration, will set a precedent that others follow.