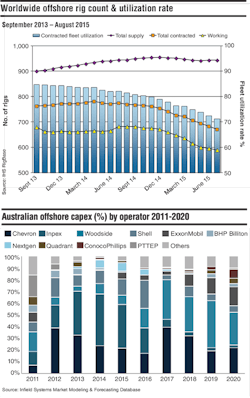

Australia has large natural gas resources; this, coupled with its proximity to the Asian gas markets has seen the country become an increasingly important player in the export of LNG. There are currently three onshore LNG projects under construction which will source feedstock gas from offshore sources: Chevron's Gorgon and Wheatstone LNG projects and INPEX's Ichthys LNG project. Other onshore LNG projects are also under construction but these will source gas from onshore sources.

Australia is expected to see increasing interest in FLNG technology in the future to unlock some of its remote offshore resources. Indeed, the country will see one of the world's first FLNG projects enter production over the next few years, Shell's Prelude FLNG project in the remote Browse basin. Once deployed the Prelude FLNG FPSO will be the world's largest offshore production facility capable of producing around 3.6 mtpa of LNG. Other operators are also considering the possibilities of using FLNG FPSOs in the country, such as Woodside, which is currently looking to develop its Browse resources using FLNG technology.

-George Griffiths, Senior Energy Researcher, Infield Systems