Rising capex and opex may prompt deepwater reassessment

Rachel Stonehouse

Douglas-Westwood

Capital expenditures (capex) have been rising dramatically, resulting in a concern over some large and ultra-deepwater projects, as oil prices remain at a stable level. In addition, operational expenditures (opex) are also on the rise, placing further pressure on budgets. With some operators canceling/delayingdeepwater projects, is this the time to refocus on the lower-cost, shallow-water basins? Or does the deepwater supply chain need to adapt, with equipment being standardized and costs reduced, in order to increase the viability of larger deepwater developments?

Douglas-Westwood (DW) expects deepwater capex to soar post-2016, driven by continued development of deepwater fields offLatin America and West Africa, and new developments off East Africa. However, in the short term, delays are causing slower levels of growth. Shallow-water developments provide a more robust outlook in the near-term, with an influx of newbuild mobile offshore drilling rigs entering the market to meet increased demand and replace the aging fleet. Shallow water continues to comprise the majority of offshore production (84% in 2014), but deepwater production is increasing as a percentage. Furthermore, shallow-water reserves are dominated by NOCs, whose long-term view makes them less susceptible to current constraints in the market.

Deepwater drivers

Deepwater exploration and production (E&P) activity is driven by a variety of supply and demand-side factors:

- The need to offset declining production from onshore and shallow water basins

- Potential for discoveries of large hydrocarbon reserves such as in East Africa and

- Economic viability of deepwater developments.

As production from mature basins onshore and in shallow water declines, development of deepwater reserves has become increasingly vital. Robust oil prices over the past few years have increased confidence in the sector; however, rising costs are a cause for concern for some large or ultra-deepwater projects.

Large, deepwater fields such as the natural gas discoveries off Tanzania and Mozambique and the recent discovery of the Orca field, offshore Angola, require capex-intensive solutions; however, they could provide a large return on investment.

Deepwater economics

The deepwater market requires significant and continued investment in infrastructure. While the economic feasibility of deepwater fields vary, oil prices of $80-$100 per barrel (WTI) over the long-term ensure the viability of most deepwater developments.

However, a number of flagship projects have been canceled, or perhaps more correctly postponed, due to surging E&P costs (capex costs per barrel have risen at around 11% per annum since 2000), which are growing at a much faster rate than oil prices. A notable example isChevron's Rosebank development off the West of Shetlands.

Project execution

Project execution challenges continue to result in major delays and cost increases, with imposition of local content requirements in countries such as Angola and Brazil compounding problems with project delivery. In Brazil's 12th oil & gas round, local content requirement for exploration was increased further.

Market summary

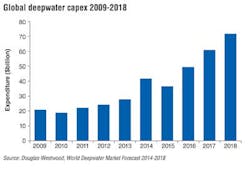

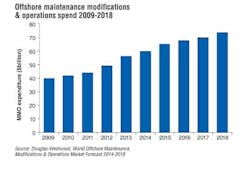

Deepwater expenditure is set to grow by almost 130% compared to the preceding five-year period, totaling $260 billion (billion) between 2014 and 2018.

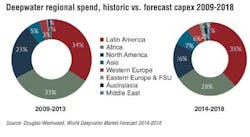

This growth is driven primarily by Africa and the Americas, which account for 82% of capex. Continued development of traditional deepwater regions – W. Africa, Latin America, and GoM – coupled with the emergence of East Africa, drives growth over the forecast period. The GoM remains a key deepwater region despite a limited growth forecast (2% CAGR 2014-2018).

Capex declined following the global recession (2009-2011), which led to a sharp fall in oil prices. This, coupled with the significant capital requirements of deepwater developments, rendered many fields economically unviable relative to shallow-water or near-shore developments. This resulted in project delays/cancelations and thus reduced levels of capex until 2014.

Despite rising costs, the recent consistency in oil price has given operators confidence, and most deepwater developments are viable at current oil prices. Appropriately, DW forecasts growth in deepwater capex of 14% per annum. We have identified a temporary trough in expenditure in 2015, primarily driven by delays to FPS units in Africa and Latin America. The delay to African projects results in a surge in capex from 2016 onwards.

E&P operators take a long term view of deepwater projects and following decreases in oil prices, operators merely delay rather than cancel projects. Barclay's Capital Survey estimates that global E&P budgets will increase by 6% in 2014. However, in light of recent cost increases, this seems an optimistic figure. However, 37% of all companies interviewed are increasing the percentage of their budget dedicated to E&P. Therefore, the outlook for oil companies remains positive.

Latin America

Latin America continues to lead investment in deepwater activity, despite Petrobras' struggles and the OGX failure. In Brazil, production targets for 2020 have been cut due to decline in aging fields and delays in bringing new fields onstream. The revised production target still remains ambitious. The bankruptcy of Brazilian operator OGX has caused further disruption and the cancellation of a number of high-profile field developments.

Mexico, however, shows much promise after reform of its energy sector to allow foreign upstream participants. The first licences are not expected to be awarded until 2015; however, the vast area of unexplored acreage is expected to yield deepwater finds and perhaps even reverse Mexico's production decline.

East Africa

East Africa is a potential deepwater natural gas hub, with discoveries in Tanzania and Mozambique likely to come onstream toward the end of the forecast period. Development of these fields, coupled with the high Asian gas price, creates a promising outlook for the region.

Other regions

North America is expected to experience the slowest growth in capex globally (2% CAGR). High cost inflation has resulted in some projects becoming unviable, slowing growth.

The installation of major deepwater pipelines (e.g. South Stream in Eastern Europe & FSU) boosts expenditure forecasts in countries with limited deepwater production potential.

Western Europe's capex is expected to grow fastest at a CAGR of 56% to $15.5billion. The Middle East will grow second fastest (38%) with Eastern Europe & FSU third (32%).

Despite moderate growth of 8% CAGR, Asia will remain the largest deepwater market outside Africa and the Americas. However, the lack of available deepwater rigs is causing delays to some projects in Asia; Reliance Industries had to delay exploratory drilling on block D3 until mid-to-late 2014 following issues with rig availability.

Australasia is the second smallest deepwater region by capex ($3.9billion). However, it has a promising outlook, especially if the high gas prices in Asia can be exploited through continued development of Australia's deepwater gas fields.

Components

Drilling and completion (D&C) represents by far the largest segment of the deepwater market with expenditure totaling over $90 billion, the majority of which will be spent on subsea well completions. DW forecast capex on D&C will grow at a CAGR of 17% between 2014 and 2018. The greatest number of wells drilled (40%) will be located off Africa, although the greatest levels of capex will be in Latin America due to lengthier drilling and completion times in this region.

Floating production systems (FPS) account for the second-largest segment of deepwater capex, with over a quarter to be spent on FPS units and installations and dominated by Latin America with almost half of forecast FPS capex. Deepwater expenditure on FPS units will primarily be on FPSOs, accounting for almost 80% of forecast FPS expenditure. However, DW forecast FPS capex to grow the least of all segments due to high cost inflation causing operators to reevaluate development plans for fields ultimately leading to project delays/cancellations.

Subsea equipment (subsea production hardware and SURF) jointly account for almost a third of global expenditures over the forecast period. Subsea production hardware is driven by the number of wells drilled; therefore, capex is related to D&C capex, and is expected to total in excess of $35billion between 2014 and 2018. Africa is the largest market for subsea production hardware over the forecast, both in terms of units and capex. SURF is also primarily driven by subsea well numbers; capex on SURF and production hardware is similar at almost $40 billion.

Capex on trunklines totals $25billion over the forecast period; Eastern Europe and the former Soviet Union will dominate trunkline capex – driven by large projects such as South Stream, which will transport gas from Russia. However, the present political situation over the Crimea causes concerns over future pipeline plans for Russian gas.

Deepwater market conclusions

Despite the potential delays caused by local content requirements and capex compression, significant investment continues in Africa and the Americas. Petrobras will maintain heavy investment levels to develop the Brazilian presalt basins, despite recent announcements suggesting a reduction in their production targets. Regions such as Eastern Europe and FSU, the Middle East, and Western Europe, with historically low levels of deepwater activity, will experience considerable growth over the next five years, primarily due to the installation of major deepwater trunklines. Recent discoveries in East Africa will come onstream towards the latter years of the forecast, creating a potential deepwater province of the future. The deepwater market is now poised for a period of significant growth, with capex totaling over $260 billion between 2014 and 2018.

Operational expenditure

Operational costs are also rising, placing further pressure on operators.

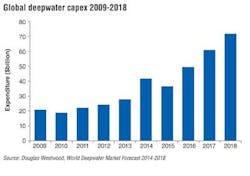

In addition to the capex spent on developing new discoveries, operators must maintain their existing assets, in order to prevent problems occurring, remedy underperformance, address the effects of emergency shutdowns, or to extend asset life. Key drivers of maintenance modification and operational (MMO) spend are the age of infrastructure, increased size and complexity of offshore platforms, new platforms and pricing.

In 2013, demand for offshore MMO services totaled $112 billion for the world's 8,948 offshore platforms. DW expects this to increase at a CAGR of 4% 2014-2018 driven by high oil prices, buoyant offshore development, aging infrastructure requiring modifications, and price inflation for equipment and services.

Asia is expected to become the market leader in MMO expenditure, overtaking North America, with a share of 30% over the forecast period. This shift is driven by a combination of increasing offshore production in Asia and the move towards deepwater in less mature regions.

Over the 2014-2018 period, $238 billion is estimated to be spent on MMO relating to fixed platforms and $24.5 billion on MMO relating to floating platforms. MMO spend is much larger for fixed platforms, compared to floating platforms, due to the much larger population. However, spend on floating platforms is expected to increase at a CAGR of 6%, compared with 4% CAGR for fixed platforms. This is due to the number of new installations in deepwater fields where floating platforms are used.

MMO costs per barrel are rising throughout the offshore sector; in 2013 these averaged $6.14 but ranged from $0.93 in Eastern Europe and the FSU to $24.32 in the mature North Sea. Beyond the next five years, we expect MMO cost per barrel to rise, as more offshore installations require increasing amounts of investment in order to maintain their economic viability in the light of declining production.

Conclusions

Rising capex costs have raised concerns in the industry, with operators delaying and even canceling deepwater projects. Potential remedies to this problem are a higher oil price, or reduced costs in order to avoid further project delays, with the latter more likely. However, this will require operators to work with the service companies in order to standardize equipment and reduce hardware costs, which is not easily achieved.

Further pressures on operators' budgets are felt, as operators must maintain existing assets, in addition to developing new discoveries. Over $672 billion is forecast to be spent over the next five years on offshore oil and gas MMO activity. Growth of 4% in expenditure is forecast annually from 2014 to 2018, with investment being essential for the continuation of production levels to overcome the effects of maturing fields, and driven by increasing asset base and rising costs.

Despite these factors, most deepwater developments remain viable at current oil prices, therefore deepwater expenditure is expected to grow, albeit slowly for the next few years, with a surge post-2016, and $260 billion being spent in the 2014-2018 timeframe. Shallow-water fields provide a lower risk, lower cost option for operators, and thus have a more robust growth profile in the short-term.

The author

Rachel Stonehouse is analyst and assistant editor of The World Deepwater Market Forecast 2014-2018, and author of The World Deepwater Market Forecast 2013-2017. She joined Douglas-Westwood in 2012, and has since conducted research into various oil gas and renewables sectors, with a focus on offshore drilling and deepwater activity. Stonehouse graduated from the University of Kent with a first-class degree in Economics with Econometrics.