UK pipeline decommissioning provides potential for innovation

Mick Borwell

Oil & Gas UK

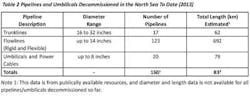

Since 1966, 45,000 km (27,962 mi) of pipeline has been installed in theNorth Sea to transport hydrocarbons from the UK continental shelf (UKCS) to shore. Of this pipeline, less than 2% has been decommissioned.

The UK government and industry continue to focus onmaximizing recovery of around 15-24 Bboe from the UKCS, and 2013 brought record investment in new projects. Collaborative work has resulted in fiscal change and technological advances, but as the basin continues to mature, decommissioning is emerging as a parallel and growing business opportunity.

Decommissioning expertise is available within the UK supply chain, but without significant activity in this area, the sector has not been fully tested. To help contractors better understand the opportunities, Oil & Gas UK has produced several documents.

In its "Decommissioning Insight" published in 2013, the association forecasts that between 2013 and 2022 more than 2,300 km (1,429 mi) of pipeline, infrastructure from 74 fields, more than 70 subsea projects, and about 130 installations are scheduled for decommissioning at a total forecast expenditure of £10.4 billion ($17 billion).

Inventory of UKCS pipelines

The pipelines mentioned in the forecast represent a fraction of the extensive network of pipeline currently installed in the North Sea to transport oil and gas production to host platforms or to shore. Overall, the UKCS pipeline inventory covers a broad range of equipment designed to accommodate the transportation of many different fluids under diverse conditions, varying water depths, and different oceanographic environments.

In many cases, the existence of nearby pipeline infrastructure has led directly to the exploitation of marginal fields that would otherwise be uneconomic. Such opportunities remain a key factor in the timing of any pipeline decommissioning. A more detailed description of the different types of pipeline infrastructure can be found in Oil & Gas UK's 2013 report, "The Decommissioning of Pipelines in the North Sea Region."

Trunklines represent the major element of subsea infrastructure transporting large quantities of oil and gas from offshore to onshore receiving facilities and end users across Europe. They account for 18% of the total number of pipelines and 63% of the total pipeline length in the North Sea inventory.

Such pipelines include some of the longest in the North Sea, often with diameters of more than 30 in., and tend to be installed offshore using the S-lay pipelay method from a specialist lay vessel.

The pipeline inventory also includes rigid flowlines, flexible flowlines, umbilicals, and power cables, as well as associated equipment such as the concrete mattresses used extensively in the UKCS to provide protection and stability to subsea pipelines, cables, and umbilicals. These flexible mattresses are typically manufactured by joining different shapes of concrete blocks together with polypropylene or Kevlar rope. Oil & Gas UK estimates that 35,000-40,000 mattresses have been deployed since operations began in the North Sea.

While pipelines are integral to field life extension and future development opportunities, some fields in the UKCS have reached the end of their economic life. Specific parts of the pipeline system naturally become redundant, and with no potential future use, they are available to be decommissioned.

Decommissioning to date

Oil and gas pipeline decommissioning has been taking place in the North Sea since the early 1990s, when the Crawford field pipelines were decommissioned. Since then, pipeline decommissioning has continued at a modest rate and only when all potential reuse options for the infrastructure, including new field developments, have been carefully considered.

Less than 2% of the North Sea pipeline inventory has been decommissioned, and of the pipelines which have been decommissioned, 80% are less than 16-in. in diameter. Half of the larger diameter pipelines (16 in. or greater) decommissioned to date were removed; these were all infield pipelines less than 1 km (0.6 mi) long. The longest large diameter trunkline to be decommissioned so far is the 35-km (21.7-mi) Piper A to Claymore 30-in. export line, which was decommissioned in situ.

Under current regulations, decommissioning ofoil and gas pipelines is considered on a case-by-case basis using the comparative assessment (CA) process to determine the best option for decommissioning. The CA process enables the particular diameter, length, and configuration of individual pipelines to be taken into account when considering decommissioning options against the criteria of safety, environmental impact, cost, and technical feasibility.

Health and safety is a dominant factor in any CA, with the focus aimed at minimizing the long-term risks to other users of the sea and the short-term risks to those carrying out decommissioning operations. An integral part of the process is the environmental impact assessment, which is prepared to support all pipeline decommissioning plans.

Each decommissioning solution needs to be considered on its individual merits, as pipeline installations vary widely according to model, location, environment, and maintenance status. It is at the CA stage, when a number of options are considered, that significant opportunities exist for supply chain companies to develop innovative technologies for decommissioning pipelines.

Opportunities for innovation

When evaluating a preferred option for decommissioning a pipeline and its associated equipment, the availability and track record of technology used in previous projects provides the context for the other key CA criteria of safety, environmental impact, and cost.

Supply chain companies specializing in particular services will have the opportunity to develop innovative techniques in the key technology areas for pipeline decommissioning, many of which are in their infancy. These are:

- Pipeline cleaning

- Trenching, burial, and de-burial

- Subsea cutting

- Lifting

- Reverse installation methods

- Mattress removal.

Pipeline cleaning is performed prior to decommissioning and involves the depressurization of a pipeline and the removal of any hydrocarbons in accordance with the Pipelines Safety Regulations. At this stage there are opportunities for companies skilled at minimizing the potential contamination of the marine environment.

The technology for trenching and burial of pipelines during installation is well established, and a number of contractors offer a range of trenching tools capable of trenching and burying pipelines of various diameters in all soil types. There is, however, limited experience of existing pipelines, laid on the seabed surface, being buried specifically for decommissioning in situ.

While there are different methods and types of equipment for cutting pipelines subsea using "cold cutting" tools such as abrasive water jets, diamond wire cutting, reciprocating cutting, and hydraulic shears, significant opportunities exist for contractors capable of developing new technologies to improve these techniques. These might include automated techniques to help reduce the use of divers in these activities. Lifting sections of infrastructure from the seabed is another area where innovative thinking is in demand. The "cut and lift" process of decommissioning requires cut sections of pipeline to be lifted from the seabed to a transportation vessel; supply chain companies providing innovative cutting techniques could help increase efficiency in this area by reducing the duration of lifting operations for long lengths of pipeline.

Reverse installation methods encompass both reverse reeling and reverse S-lay techniques. The process by which rigid or flexible pipelines can be recovered from the seabed by reeling them from the seabed using a specialist reel vessel is known as "reverse reeling."

For rigid pipe, there are a limited number of specialist reel vessels available from the leading installation contractors. These vessels are usually engaged in installation activities, but can be adapted to recover pipelines as part of a decommissioning project. Subsea 7'sSeven Navica is one vessel capable of performing this work.

For larger diameter and concrete coated trunklines, the industry is considering a reversal of the S-lay installation process by which pipelines could be removed and recovered on to the deck of a specialist S-lay vessel. However, this has not been done in the North Sea, and more study is needed before the technique can be considered feasible for decommissioning long distance large diameter pipelines.

As yet, no established technique or technology has been universally adopted for mattress recovery. Solutions developed by contractors will need to take into account the age and condition of the mattresses being recovered.

Regional variations

Oil & Gas UK's 2013 "Decommissioning Insight" highlights the contrast between different UKCS basins, noting that in the central and northern North Sea (CNS and NNS), decommissioning of pipelines and mattresses is estimated to cost more than £400 million ($655 million) from 2013 to 2022. Over this period, nearly 40 trunklines (130 km/81 mi), 115 rigid and flexible flowlines (420 km/261 mi), 87 umbilicals (250 km/155 mi), and almost 900 mattresses have been identified for decommissioning in these basins.

The forecast indicates significant expenditure will take place from 2019 to 2022, suggesting that pipeline decommissioning will occur toward the latter end of decommissioning programs. The peak in 2019 can be attributed to at least 10 pipeline decommissioning projects.

While containing a similar number of pipelines to the southern North Sea (SNS), the decommissioning of rigid and flexible flowlines in the CNS and NNS basins is more expensive, suggesting a greater degree of complexity in these regions.

Over the same period in the SNS and the Irish Sea, four trunklines (64 km), 116 other pipelines (1,300 km/808 mi), and 21 umbilicals (150 km/93 mi) will be decommissioned at a cost of around £100 million ($164 million). Additionally, 2,100 mattresses have been scheduled for decommissioning.

While these decommissioning activities represent a fraction of the overall market of oil and gas activities, they are part of a burgeoning sector. By making more information on decommissioning available, Oil & Gas UK aims to help the industry prepare for decommissioning projects, increase the efficiency of processes involved, and help ensure that future projects are enabled by an "at the ready" supply chain.