Ziff Energy recently completed the 9th edition of its "Gulf of Mexico Deepwater Improving Field Performance (IFP)" study, which evaluates three years (2010 to 2012) of operations performance for 24 deepwater producing assets in the GoM.

Participation included six deepwater operators, with majors such as Shell and Chevron and leading independents Anadarko and Murphy taking part. The study participants collectively account for 736,000 boe/d total produced in the deepwater region and $887 million in operating expense.

The study says that the GoM deepwater region represents the most important domestic oil supply area for the US, with the Permian basin, Bakken, and Eagle Ford onshore plays accounting for the other notable domestic supply areas.

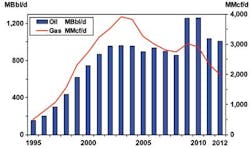

In recent years, operators have developed many new "world class" discoveries in the GoM deepwater areas, the study notes. But it also points out that in 2011, production fell in the wake of the Macondo incident. Deepwater oil production in 2012 was stable, the study says, but has not recovered to the pre-Macondo level. By way of contrast, the gas production decline was more significant, and the current level of 2 bcf/d is only half of the peak reached in 2003-4.

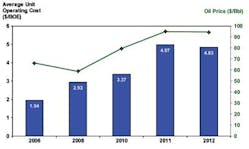

The average unit operating cost ($/boe) in the deepwater Gulf during the past two years has increased significantly (about 45% higher) relative to 2010 as a result both operating cost spending increases (the primary factor; up over 40% between 2011 and 2010) and production declines (down about 10%). However, at less than $5/boe opex, the oil netbacks are highly attractive.

This year's study updated the "Operating Cost Efficiency and Uptime Reliability Metrics" last measured in 2011 with the 8th Edition. This year, Ziff Energy collected data for 2011 and 2012 and conducted extensive trend analysis over the three-year period 2010 to 2012 at both field and company levels. Ziff Energy says that its database of historical costs in the deepwater, which goes back to 1998, allows it to examine cost trends over more than a decade, covering the life cycle of a number of fields.

"The study analyzes the effectiveness of each participant's operating philosophies on production loss control, surface repair and maintenance programs, staffing levels, logistics, and chemical and well servicing programs," said Shuqiang Feng, Ziff Energy's project manager for the study. "The study identifies key opportunities to lower operating cost in these areas by benchmarking new key performance indicators (KPIs) for operations, such as asset complexity factor, staffing index, and energy index. The study also identifies key opportunities to improve production efficiency and reliability by benchmarking production uptime performance metrics." The uptime metrics are based on analysis of daily production and include "deferred production," mean time between downtime incidents (MTBI), and mean time to recover production (MTTR). Ziff Energy also collects information on the reasons for downtime incidents to understand why production is being lost.

Ziff Energy says its deepwater study found a surprisingly wide range of uptime performance, which indicates an improvement opportunity for industry worth hundreds of millions of dollars of annual revenue.

The study examined deferred production for 2012 associated with planned and unplanned downtime by type of cause: facility failures (on the platform), well failures (subsurface), midstream and market (e.g. pipeline), reservoir, weather, and other external causes. Weather was a significant factor in 2012. Ziff Energy notes that the value of the unplanned deferment ($1.7 billion) was 1.9 times the total opex ($0.9 billion) of the assets.

Olympus TLP leaves for Shell's Mars B

TheOlympus TLP has departed the Kiewit Offshore Services yard in Ingleside, Texas, bound for Shell's Mars field in the Mississippi Canyon area of the Gulf of Mexico.

The 120,000-ton TLP, believed to be the largest ever deployed in the Gulf of Mexico, will be moored in 3,000-ft (914-m) water depths about 1 mi from the existing Mars platform, which started production in 1996. The new TLP hosts a 24-slot drilling unit and includes capacity for six subsea wells to gather production from the nearby West Boreas and South Diemos fields.

The platform, centerpiece of what Shell has dubbed the Mars B development, has a production capacity of about 100,000 boe/d. The project is expected to extend the field life of Mars to at least 2050.

Apache to sell GoM shelf assets

Apache Corp. has agreed to sell its GoM shelf operations and properties to Fieldwood Energy for $3.75 billion. Fieldwood is an affiliate of Riverstone Holdings.

Apache will retain 50% ownership interest in all exploration blocks and in horizon below production in existing blocks.

The effective date is July 1, 2013, and the project closing date is Sept. 30, 2013, subject to regulatory and closing conditions being met.

Apache's shelf to 1,000 ft (305 m) water depth comprises more than 500 blocks with 1.9 million net acres and year-end 2012 estimated proved reserves of 133 MMbbl of oil and natural gas liquids, and 636 bcf of natural gas. In 1Q 2013, the fields averaged net production of approximately 50,000 b/d of liquid hydrocarbons and 254 MMcf/d of natural gas.

"The shallower horizons in the Shelf have matured to the point that dependable production growth is more difficult to achieve than from our onshore liquids plays," said Steven Farris, chairman and CEO of Apache. "We remain excited about the potential associated with the emerging plays under existing salt domes, which is why we retained 50% of the deep rights on 406 blocks held by production and 50% of all rights in 146 primary term blocks."