Mozambique, Tanzania emerging as prolific deepwater gas plays

Mozambique is shaping up as a rival to Australia as a major new source of LNG. This follows Anadarko's continued run of gas discoveries in Rovuma basin deep offshore Area 1, and Eni's potentially larger strike in adjacent Area 4.

Like Anadarko, Eni hit the target with its first well on its concession, Mamba South 1 off northern Mozambique. The well proved large volumes of gas in the Oligocene and in the Eocene interval below. The company has since discovered more gas at Mamba North in deeper water (1,690 m, or 5,544 ft), 23 km (14 mi) to the north, and 45 km (28 mi) offshore.

This latest find has lifted the resource estimate at the Mamba structure to 30 tcf. Eni plans to drill at least five other wells in nearby structures this year to assess the upside potential. The company has also started to market the gas both locally and internationally. Its partners in Area 4 are Portugal's Galp Energi, South Korea's KOGAS, and Mozambique state-owned company ENH, which is carried for a 10% interest during the exploration phase.

Anadarko resumed its campaign in Area 1 last fall, with a successful appraisal of the Barquentine discovery and a further large find in the Camarao prospect in 4,730 ft (1,442 m) of water, respectively 5 mi (8 mi) south and 10 mi (16 km) north of the Windjammer and Lagosta discoveries. Camarao-1 confirmed static pressure connectivity with both these structures, and additionally delivered 140 ft net (43 m) of gas pay from shallower Miocene and Oligocene sand intervals not encountered in the previous wells.

Shortly afterwards, the deepwater drillshipBelford Dolphin drilled more productive appraisal wells, Barquentine-3 and Lagosta-2. The latter, 4.4 mi (7 km) north of Lagosta-1, generated 777 net ft (237 m) of gas pay from multiple zones, the largest pay count of any well in the complex to date. The result also confirmed Anadarko's recently revised estimate of 15-30 tcf recoverable from its block.

Belford Dolphin's next assignment was a third appraisal well on Lagosta. Anadarko has since brought in a second drillship, Deepwater Milennium, to undertake an accelerated test program that will include installing observation gauges and performing drillstem tests, in the run-up to the final investment decision for a development in 2013.

Last year, the company and its partners Mitsui, BPRL Ventures, Videocon, Cove Energy, and ENH contracted KBR and Technip for pre-FEED studies for an LNG plant on the Mozambique coast, comprising at least two trains with flexibility to add four more. Anadarko President and COO Al Walker said recently that "we also plan to leverage our experience with Independence Hub [in the Gulf of Mexico] by constructing an offshore hub facility that will be tied back to the LNG plant onshore."

At the recent GE Oil & Gas annual meeting in Florence, Don Vardeman, VP Worldwide Projects for Anadarko, said the partners had so far drilled eight deepwater wells on Area 1, acquired 7,500 sq km (2,896 sq mi) of 3D data and invested $750 million in the program. "This has led to six major discoveries with over 425 bcm of recoverable gas, with other prospective areas still to drill," he said. The volume of resources has yet to be fully determined, he added, "and it will take operators in this area quite a while to firm it up."

Anadarko has been working with Mozambique's government on an Environmental Impact Assessment "to determine the best way to develop this resource," he added, acknowledging that there were many species of animals in the vicinity of the proposed gas pipeline landfall and LNG complex, including wandering elephants. But he was confident development would go forward, and that this would be one of the top five projects coming onstream around the world this decade, alongside the Gorgon and Browse basin LNG projects off Northwest Australia.

Mozambique's government was anxious for work on the project to start, he said, both for the incoming tax revenue in the longer term and for the near-term impact on jobs creation in the area. At peak, he forecast that construction of the initial LNG plant would involve 7,000 workers, with more employment opportunities for the second train.

Phase 1 of the development will be based 35 mi (56 km) offshore, with gas export lines laid directly to the onshore site. Here, the focus is on design of two 5 MMt/yr LNG trains with space on the layout for a third. Currently the partners are evaluating two established LNG processes, and talks have been held with GE concerning relevant equipment, potentially aero-derivative turbines. As exploration drilling progresses, Vardeman said, the partners hope to identify additional gas that could in time feed up to six trains. He expected full FEED to start mid-2012 onwards.

Following meetings with local villagers, fishermen and farmers, Anadarko has filed an application for land to build the onshore reception and process facilities. The port of Ofungi is the chosen site for the LNG plant. "The nearby city of Palma only just received electric power for the first time last year, so there is potential for this project to change the area significantly," Vardeman observed. "Also, an aircraft landing strip will be built of sufficient size to land a 747 at least." At the coastal location, materials offloading and LNG loading facilities will be constructed. The proposed beach front site is large enough to accommodate LNG carriers turning, he said, although when the tide goes out a large area of flat sand appears.

Assuming the final investment decision is taken toward the end of 2013, first gas could flow in 2018. But this is a very competitive market, Vardeman noted, "and we must convince buyers that this will be a reliable source of LNG. Also, this will be our first LNG plant, so they need to count on us to be there a long time." On the other hand, Vardeman explained, having Bharat Petroleum, Videocon, and Mitsui as partners was helpful for marketing the Area 1 gas to India and Japan. "It's an optimal location, close to India, and the distance to Japan is the same as to Europe," Vardeman said.

Tanzania search resumes

The gas play extends north to Tanzanian waters, and here there have been three deepwater discoveries to date, Pweza-1, Chewa-1 and Chaza-1, with combined recoverable reserves in the range 3-4 tcf. All were drilled by BG International and Ophir Energy during 2010-11. The same partnership has contracted the deepwater drillshipMetroStar I for a second exploration campaign at the end of last year. Jodari-1, the first of the initial trio of planned wells, should be completed this month.

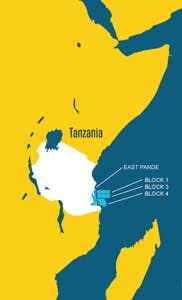

Jodari-1 is in Tanzanian block 1, which Ophir was awarded in late 2005. The following year it also picked up adjoining blocks 3 and 4 – the three concessions cover a total area of 20,853 sq km (8,051 sq mi) over the Mafia Deep offshore basin and the northern portion (45%) of the Rovuma basin, in water depths ranging from 100 m to over 3,000 m (328-9,842 ft).

Ophir commissioned infill 2D and 3D seismic surveys over all the blocks during 2006-08 which it used to build an inventory of drill-worthy prospects. In June 2010 BG farmed into 60% of each of the PSCs and in mid-2011 assumed operatorship from Ophir after completion of the three discovery wells. Ophir, meanwhile, has extended its holdings, taking a 70% operating interest last year from RAKgas Tanzania in the 7,500-sq km (2,896-sq mi) East Pande block which overlaps the Mafia Deep offshore basin and the Mandawa sub-basin.

More recently, the company acquired London-based Dominion Petroleum, gaining operatorship of Tanzanian block 7 and Kenyan offshore blocks L9 and L15 in the Lomu basin. "Our seven blocks make us in acreage terms the leading independent operator offshore East Africa," said Ophir CEO Nick Cooper.

BG/Ophir's three gas discovery wells were drilled on blocks 4 and 1. During the second half of last year, the partnership acquired a further 5,000 sq km (1,930 sq mi) of 3D seismic data over the blocks which BG is currently interpreting at its headquarters in Reading, UK.

AfterMetroStar I has completed work on Jodari-1 and Mzia-1 in block 1 and Papa-1 in block 3, the drillship will be sub-let to another operator for a few weeks, at which point the partners will look to integrate results from these wells with the 3D seismic data to determine their next drilling priorities. Later in the year the drillship should return to spud two further wells. The drilling program is then expected to continue into 2013, as the rig is under a long-term contract.

During a Capital Markets presentation in London last October, Ophir outlined a pool of gas prospects in blocks 1, 3, and 4 with combined potential of 30 tcf. "However, it's important to look at the bigger picture," Cooper explained, "and to think of the overall Tanzanian offshore play as potentially having three parts." First there is the shallow Tertiary, Oligocene-Miocene rocks where the three discoveries have been made to date. Drilling in that play is relatively predictable with an approximate 60% chance of success, "and our finds at that level alone could prove sufficient for two LNG trains," Cooper noted. "But this is a very fast-evolving play, and we and other operators need to push it to the limit."

The second part involves the company's first three wells, drilled in 2011, which target prospects totalling around 8 tcf in the riskier, deeper Upper Cretaceous system. "If we reach a threshold of 8-9 tcf, that could satisfy two to three LNG trains," Cooper explained.

"The third part of the play depends on whether Anadarko's and ENI's Tertiary stratigraphic fan discoveries off Mozambique extend north into Tanzania," he added. "In block 1, we have a substantial portion of the Rovuma offshore basin, and we also have faulted structures which have drawn our initial exploration efforts closer to the coast. After Eni's Mamba South discovery, there is now the potential for the stratigraphic fans to extend northwards. Ophir and BG will therefore be shooting 3D seismic in the outboard area of block 1, as we see potential for the stratigraphic structures in Mozambique's part of the Rovuma basin to enfold the entire delta."

Cooper also believes that the whole basin north to Kenya has a potential oil rim. "It is likely that dry gas will predominate in the middle of the basin, but there could be oil around the basin rim. Anadarko's Ironclad discovery had an oil leg, and the Mnazi Bay gas field onshore Tanzania produces some condensates."

Recently, theFugro Geo Caribbean acquired 2,200 sq km (849 sq mi) of 3D data for Ophir over the East Pande license. Future plans include a new campaign of 3D acquisition on block 1 (2,500 sq km, or 965 sq mi), and further 2D seismic over block 7 to compliment the existing 3D data.

Despite the ambitious program to the south off Mozambique, Cooper feels there is sufficient demand for a second new LNG complex onshore Tanzania. "Tanzania right now is 18 months behind Mozambique as regards drilling progress, but our commercial framework for LNG is well advanced and we are now looking to see whether Tanzania will experience further significant discoveries."

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.