IOR/EOR equipment moves toward seabed

Statoil among leaders in applied technology for better recovery

F. Jay Schempf

Contributing Editor

The release of fresh information concerning new subsea equipment for improved/enhanced oil and gas recovery (IOR/EOR) actually to be used or in testing before deployment was a significant topic among the technical presentations made at the recent Offshore Technology Conference (OTC) in Houston.

In addition to discussions of new “wrinkles” in pump-based subsea boosting – evolving technology being applied increasingly in remote deepwater regions – this also was the venue for detailed technical presentations regarding subsea compressors for more robust deepwater boosting, as well as for injecting carbon dioxide (CO2) and other gases to achieve either carbon sequestration or EOR.

Additionally, more comprehensive information was disseminated about the long-term testing of new subsea water treatment and injection tools developed for secondary recovery applications in seafloor wells at any water depth.

The impetus for subsea equipment of any type is the opportunity to gain long-term, trouble-free production from offshore wells without having to place such equipment on the surface where space is precious, particularly on floating deepwater production facilities. Key benefits from such technologies include improved production, reduced surface facility costs, higher net present value (NPV), and less chance of gas hydrate blocks in seafloor flow equipment in remote, deepwater reservoirs with high gas-to-oil ratios.

The main issue with a more rapid advancement in the use of subsea equipment, however, has always been reliability, along with safety and environmental concerns. Such equipment must operate for long time spans without the need for intervention. Premature equipment failures, should they occur at all, necessitate calling an intervention vessel or drilling rig to the site, creating undesirable consequences, i.e. production downtime during repair or replacement and the resulting interruption in the revenue stream.

Statoil leading the field

It is no secret that companies the farthest ahead in applying subsea IOR/EOR production technologies are those heavily vested in the North Sea, along the Norwegian shelf, and, looking forward, in the Norwegian (and Russian) sectors of the Barents Sea.

Statoil AS is thought to have placed the most emphasis, over time, on moving more production equipment to the seafloor. Among subsea technologies installed by Statoil, and in turn by other companies in Western European waters, are equipment for gas-liquid separation (processing), for connecting new discoveries with subsea production equipment to existing production facilities (tiebacks), for pump-boosting production from the wellhead to surface handling facilities, and for deepwater well intervention, to name a few.

In older and marginal North Sea fields developed from fixed platforms, for example, Statoil was among the first to use fixed platform-mounted separators and pumps to introduce raw or treated sea water bolstered with polymers or gases into injection wells to achieve secondary recovery.

Additionally, spurred by its long-standing ambition to achieve an average 65% ultimate recovery rate from its platform-operated fields and 55% from subsea fields (world average ultimate recovery is 22%), Statoil actively pursues various “semi-tertiary” recovery technologies, particularly injecting captured industrial CO2 into existing and new offshore fields for EOR.

So far, however, no companies are said to be actively engaged in straight miscible gas floods for enhanced recovery, and that includes Statoil. But Statoil and BP considered, and then shelved, plans to do so in Western European waters.

But when it comes to sequestering greenhouse gases in storage formations to isolate them from the atmosphere and fresh water aquifers, Statoil, once again, is a leading participant.

Applying wet compresses

Among subsea technologies getting special emphasis is subsea gas compression as a means of boosting deepwater natural gas production in fields where reservoir pressures become too low to maintain natural flow at economical production rates.

Statoil, along with Bergen-based Framo Engineering, detailed the results of a nine-month (August 2010 to April 2011) submergence testing program, using hydrocarbons, for a Framo wet gas compressor that probably will be used by Statoil, et al, in the Gullfaks South field, in water depths ranging from 445 to 720 ft (135 to 220 m) on the Norwegian shelf. Installation of subsea compression equipment in some form is slated for the field beginning in 2013.

The test, conducted as part of a qualification program contained under Statoil's Gullfaks 2030 Subsea Compression (GSC) project, is still ongoing, but results indicate that the Framo WGC 4000 multiple stage, full-scale axial wet gas compressor, equipped with contra-rotating impellers, meets the hydraulic capacity called for the Gullfaks application and is otherwise suited to field design requirements.

The 4,000-kW unit has the capacity to compress and pump 4,000 actual cu m/hr. (142 Mcf/hr.) of high liquid load/low gas volume fraction (GVF) with GVF ratios ranging from zero to infinity.

According to Tor Willgohs Knudsen of Statoil and Nils Arne Solvik of Framo, the maximum liquid load tested at full speed (4,500 rpm) through April 2011was in excess of 250 actual cu m /hr. (8.8 Mcf/hr), corresponding to a GVF of 95%.

They said tests reveal that the WGC 4000 is suited for Gullfaks requirements, and were the Framo compressor to be chosen by Statoil, one each would be installed near two of the Gullfaks South subsea production templates to boost gas flow. These installations, they noted, would accelerate gas production, increase the total recovery rate, and delay, if not eliminate, the need for a slow, low-pressure production phase from the field in the future which, ultimately, would necessitate well abandonment.

Framo's multi-phase compression technology features a compact device whose contra-rotating impeller system eliminates complicated upstream processing equipment, and its standard control system – activated by a low-frequency electric power setup – may be a welcome component for engineers who fear premature breakdowns in what is generally perceived as highly sophisticated seafloor equipment.

Another unit slated for Asgard

Framo Engineering is not the only subsea gas compressor manufacturer working to help Statoil boost lagging offshore natural gas production.

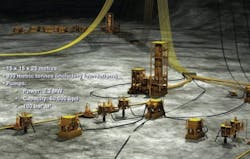

Each Asgard seabed compression unit will have a gas cooler, a liquid separator and a compressor, each powered from a production vessel.

This past February, Aker Solutions, under an NOK 3.4 billion ($635 million) contract with Statoil et al to provide the Asgard field with an area subsea compression system, chose MAN Diesel & Turbo Schweiz AG (MAN Turbo) to supply four hermetically sealed, single high- speed oil free intelligent motocompressor (HOFIM) counter-axial compressor units, each powered by integrated 8-MW, MAN Turbo M43 high-speed electric motors. The compressor systems are slated to be installed in the field as soon as 2014.

Statoil has determined that by that time formation pressures at Asgard's Midgard and Mikkel rich gas offset deposits, already developed with subsea wellhead and flow equipment in water depths ranging from 787-1,017 ft (240-310 m), will lag to the point that they can no longer produce unaided to the Asgard B platform some 75 miles (120 km) away. As operator for Petoro, ENI Norge, Total E&P Norge, and Mobil Development Norway, Statoil calculated that a subsea gas compression system, operating at a flow rate of 520 cu m/hr (79,000 boe/d) could add as much as 28 bcf of gas and some 14 MMbbl of condensate to ultimate Asgard recovery.

Each Asgard seabed compression unit will be comprised of a gas cooler, a liquid separator, and a compressor, each powered from Asgard's A production vessel. The seabed units, protected by trawl net-resistant enclosures, will be placed between the reservoirs and the receiving platform. From those points, the compressed gas will be pressurized sufficiently to reach the platform through existing seabed flow lines.

MAN Turbo has described the HOFIM compressors as having only a few components, including a hermetically sealed pressure vessel to hold the outer case of the hydraulic compressor and fully integrated motor, which are cooled by the process gas. Published accounts note that the rotating arms rise by dint of wear-free, electronically controlled magnetic bearings

The MAN Turbo compressors, expected to be robust enough to operate between required maintenance intervals of five years or longer, currently are being built and will be tested next year at a company fabrication facility in Zurich. Commissioning is scheduled for 2014.

Meanwhile, Statoil also is considering subsea gas compression boosting for the Troll field in water depths from 1,033-1,132 ft (315-345 m) in the northern North Sea, which holds 60% of Norway's natural gas reserves. The company also is mulling the use of subsea gas compression for the Snohvit field in the Barents Sea.

Others in the field

Framo and MAN Turbo are joined by other companies with subsea compressor units either being tested for specific deepwater projects or being marketed for near-term availability.

Aker Solutions, for example, has included a GE Oil & Gas Blue-C subsea wet gas compressor, rated for water depths to 3,000 ft (915 m), in the design, construction, and testing of a pilot subsea compression station for the Ormen Lange field in the Norwegian Sea, operated by Norske Shell, et al, in water depths from 860-2,821 ft (262-860 m). The GE-assembled compressor is in a six-month performance test in a salt water test pit at Nyhamna, Norway, using unprocessed hydrocarbons from the field. Final endurance testing will follow (see Offshore, “Subsea compression test could determine long-term future of Ormen Lange field,” April 2011, 100).

Norske Shell has not yet decided whether to use a surface system aboard a TLP built for the purpose, or use the seabed system, which would connect with the existing all-subsea production facilities in the field. Nevertheless, the company has determined that Ormen Lange gas will require gas production boosting “towards 2017.”

A list of other subsea gas compressor manufacturers includes Siemens Energy, which has factory and underwater tested its ECO II compression system, rated for use in up to 3,000 ft (914 m) of water, and Dresser-Rand's DATUM integrated compressor system is designed for subsea applications.

Packing down the CO2

Statoil appears to be leading the field around the world in the offshore injection of industrial CO2 for carbon capture and storage (CCS), using both surface and subsea equipment.

On land, CO2 and other gases have been used for tertiary recovery, particularly in the Permian basin region of Texas and New Mexico. But while no currently active purely offshore CO2 injection projects exist, Statoil is joined by various other offshore producers around the world in being solidly engaged in secondary recovery operations by injecting raw or treated seawater with CO2 and other gases to execute various forms of waterflooding (IOR).

Too, experience gained in sequestering carbon gases offshore helps to formulate sustainable future miscible gas injection programs to enhance recovery from offshore fields, perhaps even those in deep and ultra-deepwater.

Meanwhile, at the Sleipner East field in Norway's North Sea sector, where the produced natural gas contains some 4-10% CO2, Statoil is using surface scrubbing and absorption equipment, then injecting the separated carbon gas via dedicated fixed-platform wells into a brine-filled aquifer that overlies the Sleipner producing formation.

Statoil and the Norwegian government closely monitor the brine aquifer for signs of formation seal breakage due the effects of the CO2 injection. None are expected, however, and in any case, it is believed that the gas eventually will dissolve into the brine, becoming heavier, and then move downward, eventually mineralizing, locking the CO2 into the storage formation permanently.

Another Statoil offshore CCS project is ongoing at the Snøhvit offshore field in the Barents Sea, where the gas being produced by subsea wells contains 5-8% CO2. The produced gas is conveyed by a 90-mi (145-km) pipeline to an onshore LNG plant at Melkoya, outside of Hammerfest, where the CO2 is separated from the natural gas, then piped back to a subsea injection well, where it is injected into a brine-filled sandstone formation some 8,230 ft (2,600 m) beneath the seabed, safely below the Snøhvit producing formation. Shale cap rock above the storage zone traps and seals the CO2 to ensure that it is confined without leaks. Monitoring is ongoing. At peak capacity, some 772,000 tons (700,000 metric tons) of separated CO2 will be stored in the brine reservoir per year.

‘Total' seabed waterflooding

Another Norwegian company, Well Processing AS of Stavanger (soon to be renamed Seabox), recently completed a year of full-scale seabed testing of its subsea water injection treatment (SWIT) unit, which the company says provides at least the same level of reservoir protection as a topside seawater treatment plant without the need for precious platform deck space to house it.

Fixed to the sea floor, the SWIT unit takes in raw sea water and processes it prior to transfer into injection wells for IOR. Among other benefits, treating sea water prior to injection prevents reservoir pores from blocking oil flow or “souring.”

Well Processing's patented subsea treating process uses no filters, and the compact seafloor equipment itself can be operated continuously for two years without maintenance, says the company.

David Pinchin of Well Processing recorded the SWIT unit tests, conducted in 213 ft (65 m) of water in the Oslofjord in southeastern Norway. The test was supported by a joint industry project funded by Shell, TOTAL, ConocoPhillips, GDF SUEZ, and the Norwegian Research Council. The pilot unit reflected a design applicable to and output of 7,500-15,000 b/d of treated sea water for injection.

According to the company, the SWIT seafloor unit, contained in a “still room” enclosure, sterilizes sea water in a two-stage procedure involving long exposure to hypochlorite generated electrically, followed by exposure to electrochemically generated hydroxyl radicals, which are produced through a patented technology. The radicals work instantly and are reported to have more than twice the bacterial/fungicidal qualities of chlorine.

The unit also provides periodic shock doses of biocides, and the company reports that the system's sterilization capability reduces dosing intervals significantly over topsides methods.

The chemicals will need to be replenished every two years. It is handled in sealed containers and can be switched out manually in shallow water or by work vessels in deeper water.

According to company officials, the test demonstrated the SWIT unit's performance significantly delays the formation of biofilm, produces excellent disinfection of the treated sea water, and demonstrates a continuous reduction in solids content. Also, the system's simplicity enabled the unit to yield 99.6% uptime during the testing.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com