Decommissioning activity projected to hold steady following BOEMRE ruling

Mark J Kaiser

Siddhartha Narra

Center for Energy Studies, Louisiana State University

Bureau of Ocean Energy Management, Regulation, and Enforcement (BOEMRE) issued new requirements in the form of Notice to Lessees and Operators (NTL) 2010-G05 for decommissioning idle wells and structures on active leases in the outer continental shelf (OCS) Gulf of Mexico effective Oct. 15, 2010. The goal here is to describe compliance cost and decommissioning activity expected to arise from the NTL.

Overview

Recently, the BOEMRE issued new guidelines and measures in the form of NTL 2010-G05 for decommissioning idle wells and structures on active leases. NTL 2010-G05 dissolves the lease boundary in determining decommissioning timelines and redefines the regulatory requirements at the individual wellbore and structure level by specifying the maximum number of years that wells and structures are allowed to remain idle before they have to be abandoned.

For wells that have not produced for five years or more, operators will have three years to either permanently or temporarily abandon the well. For structures that have not produced for five years or more, operators will have five years to remove the structure. Over the next few years, decommissioning activity will focus on idle infrastructure to satisfy the NTL mandate. Longer term, the new regulations impose uncertain consequences for production operations and will impact cost outlays, efficiency, and development opportunity in the region.

At the beginning of 2011, a total of 3,112 wells and 783 structures were idle for five or more years and fall under the NTL guidelines. Over the next three years, an average of 1,037 wells each year will be plugged and abandoned, and over the next 5 years, 157 structures each year will need to be removed to satisfy the NTL mandate.

NTL 2010-G05 requires operators to accelerate their decommissioning scheduling and planning activity. The accelerated activity will bring forward decommissioning liability in shallow water (< 500 ft [152 m]) estimated to range between $1.5 and $2.9 billion.

Early signs are that operators are performing their NTL requirements in a timely manner, and because of the slowdown in well permitting activities since the Macondo oil spill, adequate equipment and vessel capacity continue to exist in the market to address these requirements.

Benefits

Idle infrastructure represents a financial liability to operators and possibly the federal government. If a well or structure is destroyed or damaged in a hurricane, the financial liability is likely to increase because the cost to abandon and remove storm-damaged infrastructure is higher than decommissioning operations under normal, planned conditions. In some cases, the financial liability may be significantly greater than conventional operations. Thus, removing idle wells and structures reduces the financial liability of decommissioning downer structures and lowers the chance that the federal government will have to perform operations on behalf of bankrupt companies.

NTL 2010-G05 gives operators the choice to perform permanent or temporarily abandonments. Permanent abandonments reduce decommissioning risk because removing conductors decreases the chance the structure will be toppled by hurricane waves. Temporary abandonments will be performed at producing structures to save the well for re-entry or to wait on heavy-lift vessels to cut and remove conductors in a batch operation.

Within the next three to five years, the number of wells and structures idle for five or more years will be significantly reduced. Cleaning up the Gulf should reduce insurance premiums since extreme exposures are being reduced and a portion of long-term liability will be eliminated.

Of course, because NTL 2010-G05 brings forward a portion of future decommissioning liability, in the near term, company financial statements may be negatively impacted. Longer term, company balance sheets will be strengthened since liabilities are being reduced. As idle inventories clear, companies will be in a much improved situation with regard to their decommissioning exposure, and insurance premiums should eventually fall.

NTL well, structure definition

We define a well that has not produced for five or more years to be an NTL 2010-G05 well (or simply, an NTL well). Similarly, an NTL structure is defined to be a structure that has not produced for five or more years. For example, a structure with one producing well, a three-year old idle well, and a six-year old idle well would have one NTL well. A structure with one five-year old idle well and three wells idle for more than five years would have four NTL wells and be classified as an NTL structure.

NTL well, structure inventory

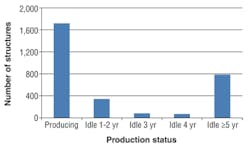

The OCS Gulf of Mexico inventory of all producing and formerly producing wells and structures is shown in the previous table.

A total of 2,995 structures and 9,513 wells populate the OCS GoM. A total of 1,714 structures and 4,714 wells are currently producing; the remaining 4,479 wells and 1,281 structures are idle. The majority of the structures and over 80% of the wells exist in shallow water less than 500 ft.

A total of 783 structures and 3,112 wells have not produced for five or more years and are classified as NTL wells. These wells and structures will need to be removed according to the NTL timelines over the next three to five years.

The idle age of wells and structures are classified according to one to two, three, four, and five or more years without production. Wells that are idle for one to two years have a greater probability of moving back into production, while wells three years or older are less likely to return to production.

All idle wells, regardless of their idle age, have a probability of returning to production, and the consequences of this observation were previously explored, where we estimated the opportunity cost of NTL 2010-G05 and the value of lost productiond (Kaiser and Yu).

A total of 783 structures and 3,112 wells have not produced for five or more years. Next year, 68 structures and 199 wells will likely become NTL wells, and in 2013, 85 structures and 267 wells will reach five-year idle status.

About two-thirds of all NTL wells (2,108) exist on producing structures. Producing structures also host 680 wells that did not produce in the last two years, 191 wells idle for three years, and 149 wells idle for four years.

Operator NTL inventory

Operators are listed according to their NTL well and structure inventories. Chevron and Apache lead the list, followed by Stone Energy, Mariner Energy, and Energy Partners. In total, these five operators hold over half of the NTL structures and about 40% of NTL wells.

Chevron holds 489 NTL wells and 122 NTL structures, and on their idle infrastructure, 145 temporarily abandoned wells will need to be permanently abandoned prior to structure removal. Similarly, Apache holds 468 NTL wells, 95 temporary abandonments, and 77 NTL structures that will require abandonment in the near future.

Well abandonment activity

NTL 2010-G05 requires NTL wells to be abandoned according to defined time horizons which leads to an expectation on future activity. In 2011, we expect that 1,037 NTL wells will be plugged and abandoned followed by 1,103 wells in 2012 and 1,192 wells in 2013. The chart on page 95 includes both permanent and temporary abandonments and only represents activity required by the NTL; well abandonments performed during the course of normal business operations are not represented. After 2013, abandonment activity in support of the NTL requirements drops substantially.

Structure removal activity

NTL 2010-G05 induces idle removals by mandate, and because regulatory horizons are well-defined, activity levels are bound in relatively narrow intervals. The expected number of structures that will need to be removed according to NTL 2010-G05 is shown also.

In 2011, 157 NTL structures are expected to be removed, followed by 171 structures in 2012, 188 structures in 2013, and 223 structures each in 2014 and 2015. Any increase above the expected level one year will lead to a decrease over the remaining time period. The following figure is not a forecast of total structure removal activity, only removals required by the NTL, and thus represents a lower bound on total removals.

Compliance cost

The time and cost to perform decommissioning activities depends on a number of factors; and, as in most offshore activities, cannot be modeled accurately. Removal operations are subject to conditions specific to the job and time of operation. Supply and demand for construction vessels are a dominant factor impacting project cost and volatility. Additional factors include the physical characteristics and condition of the well and structure, location, disposition options, plugging methods, access issues, contract type, execution standards, the opportunity for scale economies, and the occurrence of exogenous events. Because the number of factors and events influencing each project is large and/or unpredictable, it is usually difficult to identify a primary set of factors that determine outcome in all cases; for individual cases and post-mortem analysis, main factors can be identified.

We estimate the total undiscounted cost of decommissioning activity in shallow water induced by NTL 2010-G05 to range between $1.5 – 2.9 billion. Operator exposures have also been estimated. For example, Chevron’s NTL liabilities are estimated to range between $267 and $603 million; Apache’s NTL liabilities range between $235 and $468 million.

Editor’s note: This article represents highlights of an upcoming Executive Report from PennWell on the impact of NTL 2010-G05 on decommissioning activity and operator liability in the Gulf of Mexico.

References

Kaiser, M.J. and Yu, Y., “New Decommissioning Requirements Will Lower Gulf of Mexico Production,” Oil and Gas Journal, 108(41): 26-37, November 1, 2010.

U.S. Department of the Interior, Bureau of Ocean Energy Management, Regulation and Enforcement, Gulf of Mexico OCS Region. NTL No. 2010-G05. Notice to Lessees and Operators of Federal Oil and Gas Leases and Pipeline Right-of-Way Holders in the Outer Continental Shelf Gulf of Mexico OCS Region. Decommissioning Guidance for Wells and Structures. October 15, 2010.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com