Eldon Ball

Senior Editor

Technology & Economics

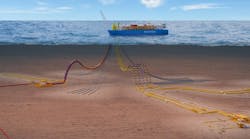

McMoRan Exploration Co. bases its exploration strategy on what it considers two extraordinary opportunities – the “deep gas play,” drilling to depths of 15,000 to 25,000 ft (4,572 to 7,620 m) in the shallow waters of the Gulf of Mexico, and the “ultra-deep gas play” of depths below 25,000 ft.

Deep gas prospects target large Miocene age deposits above the salt weld (i.e. listric fault) at depths typically between 15,000 and 25,000 ft.

Ultra-deep prospects target objectives typically at depths below 25,000 ft beneath the salt weld in the Miocene and older age sections that have been correlated to those sections, which have been productive in deepwater drilling by other industry participants.

McMoRan does not operate in the deepwater GoM.

“Our success at the Flatrock field demonstrated the validity of our ‘deep gas’ model,” says CEO James R. (Jim Bob) Moffett. “Our geologic models for the ‘ultradeep’ targets indicate the potential for large accumulations of hydrocarbons, comparable in size to discoveries in the deepwater Gulf of Mexico in recent years. Results from the Davy Jones and Blackbeard West prospects confirm our ‘ultra-deep’ model and provide additional confidence in the prospectivity of this exciting new exploration frontier.

“The potential of this play is significant. Because these prospects are in shallow water and generally near infrastructure, successful wells can be brought on production more quickly and at a lower cost than new discoveries in the deepwater.”

McMoRan is one of the largest acreage holders on the GoM continental shelf, with rights to approximately 1 million gross acres, including approximately 150,000 gross acres associated with the ultra-deep gas play.

Technological advantage

“We stay on the shelf because we think we have the technological advantage there because we’re one of the few companies that have drilled deep wells there below pressure,” says Moffett.

Moffett points out what McMoRan considers the advantages in equipment requirements for shallow versus deepwater.

In shallow water, the advantages are:

- Rig is stationary and supported on the sea floor

- Blowout preventers are above water – accessible to rig personnel and do not experience hydrate problems

- Kill weight mud remains to the surface when the well is temporarily abandoned

- No riser is needed

- Drilling targets are primarily natural gas

- 50,000 wells drilled in shallow water since 1947.

Whereas, in deepwater, the disadvantages are:

- Employs floating rig

- BOP is below water – accessible by remotely operated vehicle only and may experience hydrate problems

- Kill weight mud extends to the mudline only

- Riser is needed to connect the rig to subsea wellhead

- Primarily oil targets – if blowout occurs, potential exists for oil spill

- ~ 5,000 wells drilled since 1975.

McMoRan began to target deeper reservoirs in recent years after improved seismic interpretation capabilities indicated potential at depths where data previously was unavailable.

“Everybody gets it now that the 50,000 wells previously drilled on the shelf were drilled above the 15,000-ft level,” says Moffett. “But those wells all stopped above the salt weld. Now, we have a handful of wells that have been drilled below the salt weld, and as we’ve seen, we’ve taken a lot of the risk out of the deep and ultra-deep wells. At the same time, if you look at the sand quality of the Blueberry Hill prospect, for example, I think we’ve dispelled the fears that below 20,000 ft the reservoir quality would be poor.”

The company also considers itself well positioned for success because of its expertise in various exploration and production technologies, including the incorporation of 3D seismic interpretation with traditional structural geological techniques, offshore drilling to significant total depths, and horizontal drilling.

McMoRan notes that it employs 63 oil and gas technical professionals, including geophysicists, geologists, petroleum engineers, production and reservoir engineers, and technical professionals, most of who have considerable experience in their respective fields.

The company also owns or has rights to an extensive seismic database, including 3D seismic data on substantially all of its acreage.

During 2Q 2010, McMoRan completed engineering studies that it says will enable the company to complete and test the potential of the Davy Jones ultra-deep discovery well. It also advanced drilling of the Davy Jones offset appraisal well and the Blackbeard East ultra-deep well, and encountered positive results in drilling at the Blueberry Hill deep gas prospect.

“We look forward to reaching our target objectives in these wells, advancing our development plans at Davy Jones, and pursuing our exciting exploration strategy,” Moffett says.

Shallow water, deep gas

The Blueberry Hill No. 9 STK1, on Louisiana State Lease 340 in 10 ft (3 m) of water, began drilling in April and has been drilled to a true vertical depth (TVD) of 24,100 ft. McMoRan announced in early August that gamma ray and resistivity information from log-while-drilling tools indicate a possible hydrocarbon bearing zone in a high quality sand measuring 105 ft (32 m). Wireline logs will be required to fully evaluate this section. McMoRan is deepening the well to evaluate deeper objectives.

McMoRan holds rights to 1 million gross acres, including 200,000 acres in the ultra-deep trend, substantially all in shallow water on the shelf.

McMoRan owns a 42.9% working interest and a 29.7% net revenue interest in the Blueberry Hill well. Plains Exploration & Production Co. holds a 47.9% working interest. McMoRan’s investment in the Blueberry Hill field totaled $21.5 million at June 30, 2010, including $14.7 million in costs associated with the No. 9 STK1 well currently in progress.

McMoRan’s deep gas exploratory drilling plans in 2010 also include the Boudin, Hurricane Deep, and Platte prospects. Boudin, in 20 ft (6 m) of water on Eugene Island block 26, has a proposed TD of 23,050 ft (7,026 m) and will test Miocene objectives. McMoRan and Plains Exploration each hold a 45% working interest in Boudin.

Hurricane Deep is on the southern flank of the Flatrock structure in 12 ft (3.7 m) of water on South Marsh Island block 217. It has a proposed total depth of 21,750 ft (6,629 m) and is targeting the significant Gyro sand encountered in the Hurricane Deep well (No. 226) in 2007 and deeper potential.

McMoRan holds a 25% working interest in Hurricane Deep. McMoRan’s investment in Hurricane Deep totaled $21.9 million at June 30, 2010, and its share of costs to re-drill to 18,450 ft (5,624 m) is expected to be covered under its insurance program. Platte, in Vermillion Parish, Louisiana, has a proposed TD of 18,700 ft (5,700 m).

Shallow water, ultra-deep

McMoRan says that the data received to date from ultra-deep drilling on the shelf confirms its geologic modeling, which correlates objective sections on the shelf below the salt weld (i.e. listric fault) in the Miocene and older age sections to those productive sections seen in deepwater discoveries by other participants.

In addition to Davy Jones and Blackbeard West, McMoRan has identified 15 ultra-deep prospects in shallow water.

McMoRan’s ultra-deep drilling plans in 2010 include the Blackbeard East and Lafitte exploratory wells and delineation drilling at Davy Jones. Future plans also include the John Paul Jones prospect located north of Davy Jones.

In February, the Davy Jones discovery well on South Marsh Island block 230 was drilled to TD of 29,000 ft (8,839 m). McMoRan logged 200 net ft (61 m) of pay in multiple Eocene/Paleocene (Wilcox) sands in the well. In March, a production liner was set and the well was temporarily abandoned until equipment for the completion becomes available.

Flow testing will be required to confirm the ultimate hydrocarbon flow rates from the well. McMoRan completed the well design in the second quarter, and the long-lead equipment needed to complete, test, and produce the well is being procured. The completion and flow test are expected to be performed in 3Q 2011.

In April, McMoRan began drilling the Davy Jones offset appraisal well on South Marsh Island block 234, 2.5 mi (4 km) southwest of the discovery well. It is currently drilling below 12,000 ft (3,656 m) toward a proposed TD of 29,950 ft (9,129 m).

The offset appraisal well (Davy Jones No. 2) is expected to test similar sections up-dip to the discovery well, as well as deeper objectives, including potential additional Wilcox and possibly Cretaceous (Tuscaloosa) sections.

Davy Jones involves a large ultra-deep structure encompassing four OCS lease blocks (20,000 acres or 81 sq km). McMoRan is funding 28.7% of the drilling costs and holds a 32.7% working interest and 25.9% net revenue interest.

McMoRan’s investment in Davy Jones totaled $46.4 million at June 30, 2010, including $13.1 million in costs associated with the offset appraisal well in progress.

The Blackbeard East ultra-deep exploration well began drilling in March and is currently below 21,000 ft (6,401 m). McMoRan indicated at recent investor presentation that the well encountered multiple hydrocarbon shows in the Upper Miocene below the salt weld.

The well, in 80 ft (24 m) of water on South Timbalier block 144, has a proposed TD of 29,950 ft (9,129 m) and will target Middle and Deep Miocene objectives seen below 30,000 ft (9,144 m) in Blackbeard West, 9 mi (14.5 km) away, as well as younger Miocene objectives.

McMoRan is funding 32.0% of the exploratory costs and holds a 38.5% working interest and 30.7% net revenue interest. McMoRan’s investment in Blackbeard East totaled $19.3 million at June 30, 2010.

The Lafitte ultra-deep exploration well is expected to begin drilling in the second half of this year. Like Blackbeard East, Lafitte will target Middle and Deep Miocene objectives. Lafitte is on Eugene Island block 223 in 140 ft (43 m) of water.

Future operations

McMoRan says information gained from the Blackbeard East and Lafitte wells will enable it to develop plans for future operations at Blackbeard West.

As previously reported, the Blackbeard West ultra-deep exploratory well on South Timbalier block 168 was drilled to 32,997 ft (10,057 m) in 2008. Logs indicated four potential hydrocarbon bearing zones that require further evaluation and the well was temporarily abandoned.

In May 2009, the Bureau of Ocean Energy Management (then the MMS) granted McMoRan’s request for a geophysical suspension of operations (SOO) to extend its Blackbeard West leases in the Blackbeard area. The SOO allows McMoRan to evaluate whether to drill deeper at Blackbeard West, drill an offset location, or complete the well to test the existing zones. McMoRan’s investment in the Blackbeard West well totaled $31.3 million at June 30, 2010.

“We intend to continue to focus on pursuing opportunities within our expanded asset base and actively develop and exploit our recently announced Davy Jones ultra-deep discovery,” Moffett says.

“We may also seek additional financing for our future drilling and development activities. Capital spending will continue to be driven by opportunities and will be managed based on available cash and cash flow, including potential participation by new partners in projects.”

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com