Tullow looking to extend prolific deepwater Ghanaian play

Exploration focus shifts towards Liberia, Latin America

Jeremy Beckman

Editor, Europe

Five years ago, Ghana was widely regarded as a high-risk, low-reward deepwater play. Events since have consigned that view to history, with Jubilee, the first of a series of major discoveries, due to come onstream before year-end.Offshore talked to Angus McCoss, exploration director of Tullow Oil in London, which has been instrumental in the transformation, along with US companies Kosmos Energy and Anadarko, and which is now looking to extend the Ghanaian play fairway out to South America.

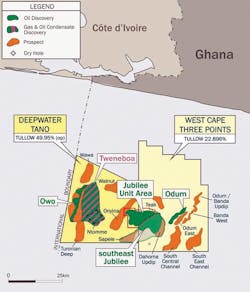

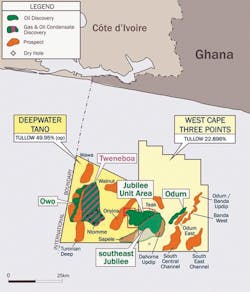

Tullow has a 49.95% operated interest in Ghana’s Deepwater Tano license, and 22.9% of the adjacent West Cape Three Points (WCTP) license, extending across a total of 2,605 sq km (1,006 sq mi). It is also unit operator of the Jubilee field development, with a 34% interest, while Kosmos Energy is the ttechnical operator. Kosmos, Anadarko, Ghanaian National Petroleum Co. (GNPC), and Sabre are partners in both exploration licenses, with EO Group also present in WCTP.

Between June 2007 and September 2010, Tullow has operated or participated in 15 deepwater exploration and appraisal wells across these permits, in water depths ranging from 1,079-1,428 m (3,540-4,685 ft), with only one failure, Dahoma-1 in WCTP. Aside from Jubilee and the South-East Jubilee extension which includes Mahogany Deep, the company has achieved commercial discoveries in Turonian and Campanian intervals on Tweneboa and Owo in Deepwater Tano, and on Odum in WCTP.

Offshore: When did the impetus build for deepwater exploration offshore Ghana?

McCoss: In 2004-05, Tullow began to look outward from the shallow water Espoir area off Cote d’Ivoire where we had developed a technical understanding of the regional geology over the previous five to six years of appraisal and development activities. Our connection with Kosmos Energy only arose when we applied for Ghana’s Deepwater Tano license in mid-2006, and they offered an acreage swap into the adjacent West Cape Three Points (WCTP) permit which they had held since 2004. Anadarko had joined at that time, having already had parallel discussions with Kosmos on WCTP.

Offshore: Had GNPC tried, but failed, to interest other companies in the deepwater potential earlier?

McCoss: Companies with an “appraise and develop” focus had mainly been looking at acreage in the shallow waters of the Tano basin since around 2000, as rising oil prices made some existing discoveries on the shelf potentially viable. Kosmos entered the prospective deepwater exploration trend in 2003-04, and Tullow came in next, picking up the top-ranking Deepwater Tano block following its relinquishment by Dana Petroleum. Dana had drilled a number of small discoveries on the shelf-edge which highlighted the deepwater potential, but didn’t push out into deepwater, as we and our partners did.

To be honest, there was not much competition for deepwater acreage off Ghana. In those days, the industry was attracted more to the big Tertiary plays in the Congo basin and the Gulf of Guinea. Strategically, Tullow didn’t want to get into those “hot” areas. The licenses tend to be small, the terms are bad and the big prospects are all drilled out.

But we always put geology before geography. If you are looking at backwaters, you have to come up with a new play. There were no prospective Tertiary sequences off Ghana, but we came to the conclusion that there probably was a Cretaceous turbidite play. Over the past ten years, our exploration teams in Dublin and London – and more latterly in Cape Town, following our acquisition of Energy Africa – had developed a knack for identifying stratigraphic traps. And this became our strategy, to harness all our geological creativity to go for stratigraphic traps in backwater areas.

Offshore: Was there much existing seismic and other study data to draw on in the deepwater Ghanaian permits before Tullow and others started their assessments?

McCoss:There was 3D extending into deepwater as well as numerous shelf wells, most of which had shows or were sub-commercial discoveries. As we analyzed the data, our initial interest in the syn-rift Albian shifted towards the post-rift Upper Cretaceous section which had much better reservoir potential and considerable materiality.

So we knew we had the reservoirs and that oil was migrating through the area. When our geophysical understanding was merged with that of Kosmos, the interpretation of a giant stratigraphic trap for hydrocarbons fell into place. The distinctive amplitude response at Mahogany, highlighted by detailed AVO analysis, supported our confidence to participate in the first deepwater well in summer 2007.

Offshore: Was it a problem for a company of Tullow’s size in those days to attract finance for such a high-cost program?

McCoss: Through managing and balancing the exposure to our Ghanaian blocks, we were able to fund our share of the first wildcat wells from our own resources. Our shareholders and banks, which are with us for the long term, recognize an opportunity to invest in high-value follow-up plays, which we’ve delivered with a high rate of success.

We didn’t have deepwater engineering capability at the outset, but if we did find something, we were confident our supporters would follow us through development. Nowadays you can go to the deepwater supermarket – the majors have identified most of the necessary technologies over the past 20 years.

Offshore: How long did it take to appraise and understand the main part of Jubilee in the run-up to the current Phase 1 development? [Jubilee, which straddles the two Ghana permits, was initially know as Hyedua on the Deepwater Tano side and Mahogany in WCTP]

McCoss: Appraisal of the core part of the field comprising the Phase 1 area took only 18 months. Although Mahogany-1 came in ahead of risked expectations, in hindsight it actually matched the geological model predicted from seismic very well, so the appraisal process was remarkably efficient and effective.

There were some surprises along the way, the biggest and most rewarding being the extent and quality of the reservoir sands, as well as the absence of a significant gas cap when initial fluid analyses predicted there ought to be one. In all turbidite stratigraphic traps there is always a feather edge and we can see that beyond the southeastern limits of the field in the WCTP license.

We have conducted high-rate drillstem tests, positive interference and water injection tests, and fluid analyses of this exceptionally sweet and light crude. All have given excellent insights into the Jubilee field. By placing pressure gauges apart across the field, we have also determined during DSTs that there is excellent reservoir connectivity over several kilometers.

Offshore: Was the pace of drilling constrained by deepwater rig availability?

McCoss:Because the partnership recognized the huge potential, we were able to move swiftly to put in place the rig capacity to drill out Jubilee, bringing in the semi-sub Eirik Raude, for example. The project did come at a time when the deepwater rig market was stretched, and we might have wanted to drill a few more exploration wells, but overall the pace of drilling was near-optimal.

Nevertheless, our campaign has been very intensive. We have drilled seven exploration wells, eight exploratory appraisal wells and 12 new development wells in three years. That’s an average of a major deepwater well every six weeks. While exploring for the field limits, only one of those 27 wells (Dahoma-1) encountered reservoir fully water-bearing below the oil contact.

A lot of that is down to not drilling back-to-back wells, but instead taking a few months to tie the well result to the seismic, then returning with a rig for appraisal drilling. Carefully scheduling our drilling activity and cycling through the prospects and fields allows data to be fully used, and is one of the key factors in our delivering this rate of success.

Offshore: Have all the successful wells flowed from the same geological horizons?

McCoss: All the wells have found oil in either the Turonian or the Campanian, but in detail the Jubilee, Odum, Tweneboa, and Owo discoveries are reservoired in distinct fans or channel systems. These systems all share good-excellent reservoir quality and will produce at sustainable rates for development in deepwater. There are other, deeper targets, in particular in the Deepwater Tano license, which we expect to explore in future wells.

Offshore: What is your assessment of the various finds to date, and the other prospects yet to be drilled?

McCoss: The biggest discovery has been Jubilee. Recoverable sources throughout the Jubilee Unit Area range from 500-700-1,000 MMbbl (P90-P-50-P10). That range is due to conceptual phasing – another tranche of investment in well density will get us to 1 Bbbl. The Southeast Jubilee area in the WCTP permit, which is not in the current development, has upside potential of 500 MMbbl (P10). Again, there is scope for more appraisal here.

Following the recent success of the Owo-1 exploration well in Deepwater Tano, which delivered a very long oil column, we are evaluating the resources split between the Tweneboa and Owo fields which will now be appraised as two separate structures. But the center of value in this license has shifted to Owo, because it’s light oil in a high-quality reservoir, similar to Jubilee. Tweneboa is a more normal, less channelized turbidite system, and it has gas condensate at the top of the reservoir, with oil in deeper intervals.

The heavier oil at Odum will require more appraisal, but on the other hand, the oil is in shallow-lying Campanian levels, which means less drilling time to get to the reservoir. While Jubilee comprises world-class turbidite reservoirs in sand-rich systems, those in Tweneboa and to the southeast of Jubilee are more typical, with normal levels of net to gross sands. What they do have in their favor is proximity to Owo and Jubilee, and their large recoverable volumes of hydrocarbons

Offshore: Do you plan to drill any further wildcats on the two licenses?

McCoss:Onyina, a 700 MMboe prospect in Deepwater Tano, is the next exploratory well on the schedule: from the seismic signature, it looks very much like a sandy turbidite system at Campanian level. It also has some positive AVO characteristics which may just point to good reservoir quality. This is also a really good address for charge, sitting as it does between Tweneboa and Jubilee.

Later this year we plan to drill Teak, a potential 200 MMboe structure which sits updip of Jubilee in the WCTP permit. It’s an independent prospect, but there is a remote possibility of a connection to Jubilee. On the seismic, we see a gas chimney above Teak, with evidence of migration from the Jubilee area. As for next year’s program, this will likely include some of the remaining exploration prospects.

Offshore: Is there pressure from GNPC to progress development as quickly as possible?

McCoss: GNPC is very pleased with the exceptional pace of the development of Jubilee and the E&A campaign. Naturally they want us to progress appraisal and development of the other discoveries at a reasonable rate, but they are very much aware of the large scale and the challenge of these projects, and the timescales involved.

Cote d’Ivoire – Sierra Leone

To the west of Ghana, Tullow is a partner to operator Anadarko in deepwater block CI 105 off Cote d’Ivoire, where a well late last year encountered water-bearing reservoir sands in the South Grand Lahou prospect. Much more successful was Venus-B1, the partners’ first deepwater exploration well off Sierra Leone (Tullow 10%) and the first-ever in the Liberian basin. The well, in 5,900 ft (1,798 m) of water in blocks SL 06/07 (total area 5,493 sq km, or 2,121 sq mi), intersected over 45 net feet (13.7 m) of hydrocarbon pay. To the south, Tullow also has a 25% interest in the Anadarko-operated LB-15, LB-16 and LB-17 blocks off Liberia, spanning nearly 10,000 sq km (3,861 sq mi). A 6,000-sq km (2,316-sq mi) 3D survey has been acquired, and a first well is imminent.

Offshore: What is your view on Anadarko’s comment that last year’s Venus B-1 discovery represents part of “two bookends” spanning 700 miles [1,126 km] across two of the world’s most prospective basins? And does this remain to be proven, following the disappointing outcome of the South Grand Lahou well?

McCoss: “Bookends” is an accurate reflection of critical geological play elements which are common to both basins, and Venus B proved that the play can work across most of the continental margin from Sierra Leone to Ghana. We have seen evidence on the seismic of top seals and geometries of episodic Cretaceous turbidite fans. Some of the prospects we have identified have positive AVO characteristics, but each prospect also carries irreducible drilling risks – is it plumbed properly, has it retained its charge? With South Grand Lahou, which was our only water-bearing wildcat, we think either it wasn’t plumbed correctly, or the hydrocarbons leaked – but all the other elements are still there, including source rocks.

Offshore: Is there total alignment among the partners concerning exploration priorities?

McCoss: We had a pow-wow in London with Anadarko after the Mahogany finds, and realized we had a shared strategic view of the West Africa Transform Margin. Both Tullow and Anadarko have built up a strong acreage position that focuses on our Upper Cretaceous Equatorial Atlantic plays, and we are confident of making other discoveries. The highest-ranking leads and prospects exhibit a similar stratigraphic setting, and similar reservoir types, trapping configurations and seismic amplitude responses to what we see in Jubilee.

Over the next 18 months we have a very active exploration drilling program off Sierra Leone, Liberia, and Cote d’Ivoire. We have looked at most of the acreage along this continental margin and we are now in the highest-ranked blocks, but there are other areas we are still interested in accessing, so further expansion cannot be ruled out. Our next wells, to be drilled towards the end of 2010 and into 2011, will target the 450 MMboe Mercury prospect off Sierra Leone and the 650 MMboe Cobalt, which is the first structure targeted off Liberia for this type of play.

Main prospects identified to date off Sierre Leone – Liberia, where Tullow has partnership interests.

Guyana/Suriname

In the northern part of Latin America, Tullow has exploration interests across the Guyana/Suriname basin. One of these is a 31.5% operated stake in the Guyane Maritime permit off French Guiana, covering an area of 32,120 sq km (12,401-sq mi)in water depths of 200-3,000 m (656-9,842 ft). Earlier this year the partners, including Shell, Total, and Northpet Investments, completed a 2,500-sq km (965-sq mi) 3D seismic survey over the southeastern part of the block.

Off neighboring Guyana, Tullow has a 30% interest in the 8,400-km (5,219-mi) Georgetown block, operated by Repsol, where 3D seismic has identified numerous Upper Cretaceous and Tertiary prospects. And in May this year, Tullow signed a Heads of Agreement with state oil company Staatsolie for a 2,369-sq km (1,019-sq mi) deepwater exploration license in block 47.

Offshore: Can you provide an update of your plans to extend the Equatorial Atlantic play to the Guyana/Suriname basin?

McCoss: We expect to drill at least two deepwater prospects around year-end and into the first half of 2011. We plan to drill Jaguar-1, a potential 700 MMboe structure off Guyana, and we are finalizing a location for Zaedyus-1, a 700 MMbbl oil prospect off French Guiana. Offshore Suriname, we are at a much earlier stage in the process, but we will begin our activities in our new deepwater license there once we have final government approval.

Offshore: Is there any prior history of deepwater activity in this region?

McCoss: There hasn’t been any industry focus on the deepwater systems in the Guyana/Suriname basin before, although we know now from regional 2D seismic and our own extensive 3D surveys and offset well data that these plays are well represented. As to why there hasn’t been any interest before, the fact is that Jubilee was very much a Cretaceous turbidites “play opener” in a backwater region between the industry hotspots for Tertiary turbidites.

Offshore: Which prospective geological intervals are you looking to test, and does it make a difference having two majors – Shell and Total – onboard in the French Guiana permit?

McCoss:The 3D seismic we have acquired over our acreage in Latin America looks very encouraging. We see turbidite fans developed at prospective intervals – again, very deep-lying Jubilee-type prospects. The water depths are deeper off French Guiana, shallower off Guyana.

We are principally chasing the Upper Cretaceous plays that we are familiar with in West Africa. We are delighted to have these two companies as partners, and they have quickly got up to speed on the plays. Clearly, in the event of success, their deepwater development expertise will also be valuable.

National oil companies and majors are becoming more interested in partnering with Tullow. We’re open to all opportunities, but we do want to retain a material position going forward. Tullow aims to achieve exploration-led growth first and foremost, yet we also have a strong in-house engineering and development capability and the funding capacity to continue to grow.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com