Edward Burton

U.S.-Saudi Arabian Business Council

Saudi Arabia’s offshore hydrocarbon program is a crucial component of the Kingdom’s efforts to meet greater production targets. Saudi Aramco is shifting resources to bolster its current offshore activities, drill new wells, and adopt advanced technologies to optimize output.

In 2007, Saudi Aramco announced an ambitious plan to add more than 2 MMb/d of new oil production in order to raise the Kingdom’s total output capacity to more than 12.5 MMb/d by the end of 2009. More recently, reports have surfaced that Aramco is considering the possibility of an additional 2.5 MMb/d increase, bringing the total production to 15 MMb/d within several years.

The majority of the Kingdom’s oil production comes from onshore sites such as the giant Ghawar field, which accounts for 7% of total global oil supply. Saudi Aramco is working to increase output at Ghawar and other onshore fields such as Khurais and Shaybah. Additionally, the company recognizes that to meet its ambitious production goals, it must also increase offshore operations.

Saudi territorial waters contain vast reservoirs of oil and gas. The Safaniyah oil field, which was first brought onstream in 1957, remains the world’s largest offshore reservoir with an estimated 25-35 Bbbl of crude oil. The Manifa field, discovered slightly later than Safaniyah and now under re-development, contains another 10 Bbbl of Arabian Heavy crude. Other large existing offshore oil fields include Abu Safah, Zuluf, Marjan, and Berri. The largest gas field in the Kingdom is the recently discovered Karan field, which holds approximately 9 tcf of gas. Seismic imaging studies are reported to be delivering positive prospects in other subsea reservoirs as well.

In total, Saudi Aramco operates approximately 16 offshore fields. As part of its plan to expand operations in these fields, the company has increased the number of active offshore rigs from one rig in 2000 to 21 in 2009. Nineteen of these rigs currently are drilling and two are conducting workover operations. While the number of active rigs is expected to decrease slightly by year end, Saudi Aramco still has more offshore operations than any other company in the Gulf.

Contract cycles

In the last year, the number of new rig contracts has slowed. The only recently signed contract by Saudi Aramco was an extension of a preexisting agreement with Rowan for a jackup. In contrast, in 2008, the company signed six contracts. A similar on again-off again pattern can be seen in the previous two years. During 2006, six contracts were signed followed by only one in 2007. Industry experts believe Saudi Aramco’s cyclical pattern of contracts is part of a strategic plan to reflect fluctuations in the global price of oil.

The reduction in contracts is expected to be temporary. To meet its long-term vision to develop offshore fields, analysts say Saudi Aramco likely will tender new rigs and sign a number of contracts beginning in 2010, if not sooner. The length of Aramco contracts remains significantly longer than the typical jackup rig contract. The length of the average rig contract signed by the company in 2008 was 1,115 days, 30% longer than the worldwide average of 857 days.

Of the $60-billion budget announced by Aramco in 2009 for combined onshore and offshore oil and gas production, $6 billion is dedicated to six offshore flagship projects. The total investment figure was scaled down from previous targets of $120-130 billion. The revised plan appears to reflect Saudi Aramco’s desire not to bring key projects onstream in a weak economic environment and to capture falling construction costs. In contrast to other large oil companies, however, Saudi Aramco’s investment cuts have not been accompanied by significant project cancellations.

Offshore mega project

One of the offshore gas mega projects recently sanctioned by Saudi Aramco is the development of the non-associated Arabiyah gas field. Discovered in 2008, Arabiyah will help meet the energy needs of the growing Saudi petrochemical industry. According to Saudi Aramco officials, the project will produce 1 bcf/d of natural gas and be divided into several large components. These include

- Installation of two offshore gas platforms and a tie-in platform with subsea power and communications links

- Construction of 24-km and 36-km (15-mi and 22-mi) pipelines to connect well-head platforms to the tie-in platform

- Construction of a 100-km (62-mi) pipeline to transport gas to the Berri plant, which links to the master gas system.

Saudi Aramco already has asked contractors to submit their interest for a combined project management services (PMS) and front-end engineering and design (FEED) contract. Invitations to bid will follow shortly, with gas facilities expected to come onstream by February 2013.

Aramco has several other major offshore projects already under development. The most notable among them are the Karan Gas Field Development and Manifa Oilfield Redevelopment projects. The Karan field, discovered in Saudi territorial waters north of Dhahran in 2006, has an estimated output of 1.8 bcf/d and is Saudi Aramco’s first and largest non-associated offshore gas project. It is divided into an offshore and onshore package and comprises two flare structures and bridges, three natural gas processing platforms, up to 10 wellhead platforms and a 36-in (91-cm) export pipeline measuring 110 km (68 mi).

In 2007, Petrocon Arabia was awarded the FEED and project management consultancy (PMC) contract for the Karan offshore package, while Foster Wheeler received the FEED and PMC contract for the onshore component. Amid falling oil and commodity prices in November 2008, Aramco reassessed bids on the project in order to cut costs by nearly $1 billion, or 20% of the original overall project cost.

In March of this year, engineering, procurement, and construction (EPC) contracts for Karan were awarded to Hyundai Engineering and Construction Co. for the onshore package, GS Engineering and Construction Co. for the central processing facility, and J. Ray McDermott for the platforms and pipeline package. The project is expected to be completed by summer 2012.

Development of the Karan project has been synchronized with Manifa so the two projects can share infrastructure and benefit from economies of scale. In fact, Karan gas will be processed at the Manifa plant, rather than Khursaniyah as originally planned. Valued at $9 billion, the Manifa project, due for completion by September 2011, is the largest offshore oil development undertaken by Saudi Aramco.

The project aims to revive the offshore oil field to produce 900,000 b/d of Arabian heavy crude, 120 MMcf/d of associated gas, and 65,000 b/d of hydrocarbon condensate. Production from the oilfield started in 1957, following the drilling of eight development wells; the facilities were mothballed shortly after.

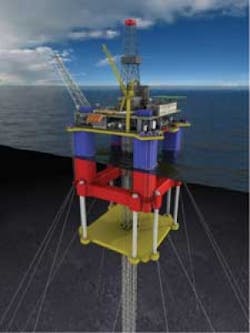

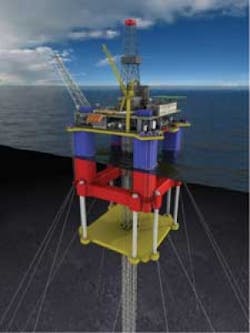

The scope of Manifa’s offshore facilities includes the construction of a 41-km (25.5-mi) causeway with laterals, 13 platforms, and 27 drilling islands for oil producing wells and water injection wells in shallow water. Onshore infrastructure will include 14 drill sites, a central oil and gas processing facility, and advanced water supply and injection facilities, as well as a pipeline network for oil gathering, water injection, and product distribution. Manifa’s water supply system will inject around 1.35 MMb/d of aquifer water into the oil reservoir to maintain the required pressure for optimum crude production.

Taking advantage of new technologies, the Manifa project will use state-of-the-art 3D seismic imaging. The advanced equipment has been incorporated with existing exploration techniques and will provide for seamless data gathering and large seismic volume integration.

The imaging technology is being used already at other offshore fields including Zuluf, Safaniyah, and Marjan. With the sophisticated devices, Saudi Aramco geophysicists were able to discern individual sand beds as small as 11 m (36 ft) thick. The seismic imaging technique was then combined with horizontal drilling to maximize recovery.

Red Sea study

In July, Saudi Aramco commissioned a 15-month 3D seismic study in the Red Sea. According to a Saudi Aramco official, the company has believed for some time that the Red Sea contains promising reserves of natural gas.

Other technological advances in offshore operations have emerged in the area of logging-while-drilling (LWD). Horizontal wells can be guided to the optimal location using advanced LWD techniques. Saudi Aramco reports that well placement with LWD measurements is in use everywhere the company drills for oil and gas of varying depths.

Further, in the Safaniyah and Zuluf fields, multiphase flow meters are replacing the conventional test barges. The flow meters are compact, can be operated remotely, and are unaffected by weather conditions and water depth.