Spectacular potential remains to be realized offshore Alaska

Gene Kliewer, Technology Editor, Subsea and Seismic

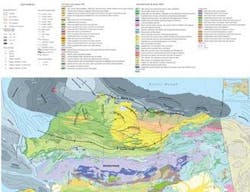

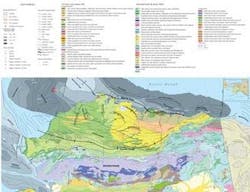

The North Slope and adjacent Beaufort Sea and Chukchi Sea shelves have the potential to add billions of barrels of oil and trillions of cubic feet of gas to US reserves, with exploration, development, and production into the middle of the 21st century, according to an extensive analysis by the Minerals Management Service.

Despite the Prudhoe Bay area success, little exploration drilling has occurred across much of the region, and stratigraphic exploration is a relatively recent addition to most exploration programs.

Exploration drilling is concentrated along the Barrow arch trend, and most of that in the Colville-Canning area. Oil is the exploration objective and will continue to be the primary focus in the near term until a gas pipeline is available.

In the near-term (2005 to 2015), the individual areas of drilling activity will continue at a pace at least equivalent to that of the last decade, so the frequency and size of finds ought to be similar. These assumptions may be conservative in the respect that they do not account for the discovery of fields in the upper range of resources ascribed to the various play types.

For the long-term (2015 to 2050), the assumption is that by 2040 at least 50% and possibly 75% of the assessment volumes of technically recoverable oil and gas will have been discovered and developed. A recent evaluation of the sensitivity of oil price to volumes of economically recoverable oil indicates that at prices of $51/bbl (far below the current range of oil prices), more than 90% of the estimated technically recoverable resources of the 1002 Area are economically recoverable.

Economically recoverable oil resulting from the long-term exploration and development of new fields in state waters of the Beaufort Sea and the adjacent Colville-Canning area is expected to add an additional 2.05 Bbbl of oil to the ultimately recoverable reserves of the area. Long-term exploration has the potential to add 21 tcf of non-associated gas and 2.3 tcf of associated gas to the 35 tcf of proven reserves as of Jan. 1, 2005, and the 10.0 tcf forecast to be discovered between 2005 and 2015. No reserves growth is indicated for gas, but with reserves growth in the major medium to light oil fields there will be a concurrent increase in associated gas.

The Colville-Canning and adjacent state waters of the Beaufort Sea account for virtually all current oil production and more than 95% of the known gas resources of the North Slope. The major oil fields include the Prudhoe Bay, Kuparuk, Endicott, Pt. McIntyre, Milne Point, and Alpine fields. Prudhoe Bay and Point Thomson fields contain the largest gas accumulations. All of these fields are in the northern area, on or near the Barrow arch and between the Colville and Canning rivers.

Near term (2005 to 2015)

The future of near-term exploration drilling depends on access to infrastructure for new operators and the construction of a gas pipeline.

The most recent assessment of North Slope oil and gas resources estimates a range from 2.6 to 5.9 Bbbl of oil at a risked mean of 4 Bbbl. Non-associated gas estimates range from 23.9 to 44.9 tcf with a risked mean of 33.3 tcf. The mean associated gas estimate is 4.2 tcf. The risked mean for the NGLs is 478 MMboe.

The northern portion of the Colville-Canning area and the shallow Beaufort Sea will continue to be a focus of exploration and development activity for the next decade. It is anticipated that the major producers will continue to add production through the discovery and development of smallish satellite oil fields and new medium-size accumulations.

Recently active small to intermediate size companies are expected to continue to explore acreage that is proximal to infrastructure and develop new fields, such as the recent finds at Oooguruk and Nikaitchuq. These opportunities are present both in the shallow nearshore state waters of the Beaufort Sea and onshore.

Future exploration of the Beaufort OCS probably will center in those areas offshore from currently developed infrastructure and will target conventional (structurally defined) oil plays and/or the areas near existing but as yet undeveloped discoveries.

For the near term, exploration in the Beaufort OCS will most likely be confined to the relatively shallow portions of the Beaufort shelf and restricted largely to that portion of the shelf between Harrison Bay and the mouth of the Canning River.

Exploration wells will be drilled with multiple objectives and test Brookian through upper Ellesmerian target horizons. The 1998 assessment by Scherr and Johnson provides estimates for the three plays (Upper Ellesmerian, Beaufortian Rift, and Brookian Unstructured Topset) ranging from 1.61 to 7.27 Bbbl of oil with a mean of 3.32 Bbbl. The assessment of these three plays includes a range of 2.1 to 14.8 tcf, with a mean of 5.2 tcf. While adding gas reserves will not be an objective during the next decade, it is highly probable that the discovery of oil will carry with it some quantity of gas.

Even 25 to 40 years into the future, the plays of interest will be unchanged from the historical targets. The most noteworthy exception would be the Brookian Foldbelt play to the east, offshore from the 1002 Area. This play is virtually undevelopable unless the adjacent portions of the 1002 Area have been opened to exploration and development.

Once again the primary oil exploration targets are Brookian Clinoform and Topset plays, plus the Triassic Barrow Arch play. The principal area for oil prospects in all of these plays is north of 70º north latitude. The eastern limit of the Triassic Barrow Arch play is at about 147º west longitude and the Brookian plays extend entirely across the area. From 2015 to 2050, exploration of the northern portion of the Colville-Canning area should test virtually all identifiable prospects with economic potential. The bulk of the discoveries are expected to occur prior to 2030.

Chukchi Sea OCS

The MMS recognizes 22 plays in the Chukchi Shelf Assessment Province, with aggregated unrisked undiscovered technically recoverable means of 15.5 Bbbl of oil and 60.1 tcf of natural gas. These estimates reflect the redefined boundaries of the Chukchi and Beaufort shelf assessment provinces. The redefinition of these provinces transferred the area west of Point Barrow from the Beaufort shelf to the Chukchi shelf assessment province.

Seismic data and the limited exploration drilling in the Chukchi Sea have documented all the reservoir intervals found in the Prudhoe Bay area, plus potential reservoirs of the pre-Mississippian Franklinian sequence. The presence of the major source rock intervals of the Shublik formation, Kingak Shale, and Pebble Shale have been documented by drilling.

The future for Alaska North Slope oil and gas ranges from very promising to limited depending on how many of the following assumptions apply:

- The 1002 Area of ANWR is opened for exploration and development soon

- Exploration is allowed in the most prospective areas of NPRA

- The Beaufort Sea OCS and Chukchi Sea OCS are available for exploration and development without major restrictions on area or timing

- An Alaska North Slope natural gas pipeline is operational by 2015 to 2016

- Oil and gas prices remain near the current high values

- Alaska and federal fiscal policies remain stable and supportive of the huge investments that will be required.

Because of the remoteness of the Chukchi Sea plays from the existing infrastructure and any future gas pipeline from the North Slope, there will be a long lead time from the establishment of commercial quantity of reserves to first production. It is estimated that 10 to 12 years may be required. This timeline may be abbreviated by two to four years if a portion of or all the necessary infrastructure has been extended to western NPRA prior to the development of the Chukchi Sea resources.

Recent activity

StatoilHydro was the high bidder on 16 leases, of which 14 were joint bids with ENI Petroleum, in Chukchi Sea Lease Sale 193 in Alaska. StatoilHydro will be the operator of all leases, which are located 60 km (37 mi) north of the Burger gas discovery in the Chukchi Sea.

The Chukchi Sea lease sale area comprised 5,354 blocks of 5,609 acres in water depths from 20 m (66 ft) to 80 m (262 ft).

StatoilHydro’s winning bids are subject to review and final approval by the MMS.

Under pressure from the state to either develop or lose a rich North Slope natural gas field, oil companies led byExxonMobil with Chevron and BP are looking to settle the legal battle for control of the long-dormant deposit.

The companies have filed a proposal in state Superior Court in Anchorage laying out a series of steps in a $1.3 billion plan to tap the Point Thomson field, which has not produced oil and gas despite being discovered more than 30 years ago. Exxon cited the field’s high reservoir pressures and lack of a natural gas pipeline as why it has gone untapped.

Next to the Arctic National Wildlife Refuge about 60 mi (97 km) east of Prudhoe Bay, Point Thomson is believed to hold about a quarter of the North Slope’s 35 tcf of natural gas plus an estimated 300 MMbbl of oil.

Exxon made another big move announcing a $1.3-billion plan to drill five wells starting next winter and produce 10,000 b/d of condensate, by 2014.

Shell has offered to scale back on drilling in the Beaufort Sea in an attempt to have a court order blocking their plans lifted.

Alaskan natives of the Inapiut tribe won a court order last summer that blocks Shell’s plans to drill in waters that are a traditional hunting ground of the tribe and near calving grounds of the endangered Bowhead whale, which is a target of native subsistence hunting.

Shell has offered to prove that drilling will be manageable. Shell plans to use one drilling rig instead of two in the Sivulliq prospect if the court order is lifted.

Shell paid $44 million for the Sivulliq prospect in a 2005 federal lease sale. The company recently paid $2.1 billion for drilling rights in the Chukchi Sea. This move has also come under fire from environmental groups as the lease includes an important polar bear habitat.

Fox Petroleum Inc. has started a Prudhoe Bay exploration program. Fox has appointed a geological consultant to define targets by the end of the year.

Based on geological assessments the consultant has identified areas of interest and Fox is contracting for the acquisition of additional seismic data. Once this data is acquired, it will be analyzed alongside the existing information from geophysical surveys and well drilling and testing.

Arctic Commons claim

In a related issue concerning ownership of international arctic resources, Arctic Oil and Gas Corp. and partners have made an international Arctic Commons hydrocarbons claim with the UN and the five arctic countries. This claim is for the exclusive exploitation, development, marketing and extraction rights to the oil and gas resources of the seafloor and subsurface contained within the “Arctic Claims.”

Under international law, no country owns the North Pole or the region of the Arctic Ocean surrounding it. The five surrounding Arctic states, Russia, the US, Canada, Norway, and Denmark (via Greenland), are limited to a 370 km (230 mi) exclusive economic zone around their coasts. The “Arctic Claims” is the open area in between all of the Arctic-bordering countries.

Peter Sterling, CEO of the company, stated, “Our claim is solid and we intend to vigorously assert the Arctic Hydrocarbons Claim made by Arctic Oil & Gas and its partners. Given that a preliminary assessment by the US Geological Survey (USGS) suggests the Arctic seabed may hold as much as 25% of the world’s undiscovered oil and natural gas reserves, competition to claim parts of the Arctic seabed is likely to intensify as Arctic energy reserves become more accessible and the price for oil rises. Since we have already filed our claim with the United Nations and the five Arctic countries, we believe that we have the right to manage this vast area of natural resources.”

Arctic Oil & Gas Corp expects to focus on marine Magneto-Tellurics, a form of electromagnetic data acquisition, in combination with seismic data to target the region.

Editor’s Note: This report excerpts from a detailed analysis of the oil and gas resources on Alaska’s North Slope. Details appear in “Alaska North Slope Oil and Gas: A Promising Future or an Area in Decline?” DOE/NETL-2007/1279, May 2007. The assessment includes: a review of the regional geology relative to oil and gas resources; an engineering and economic assessment of currently producing fields, known fields with announced development plans, and known fields with potential for development in the next few years; impact of major gas sales on oil and gas resource development; estimates of the minimum economic field size for developments in each of the exploration areas, and a discussion of economic value of sharing facilities when developing new resources.