Gurdip Singh, Contributing Editor

India is working on a five-year, $5-billion oil and gas exploration and development spending program through 2012, boosted by renewed efforts to further lease out concession acreages to draw the world’s deepwater technologies for increasing supply of indigenous hydrocarbon resources.

In a recent presentation on the prospects of mining petroleum resources in India, the country’s Director General of Hydrocarbons V.K. Sibal highlighted the country’s efforts to promote deepwater exploration, where at least one discovery has underlined the potential of further discoveries.

One recent major discovery, D-6, is expected to start producing this year from the largest find in the Krishna-Godavari basin. It has brought about many changes and drawn international players to the Indian E&P sector.

Speaking at the 13th Annual Asia Upstream conference in Singapore, Sibal went on to say that India will keep its New Exploration Licensing Policy (NELP) VII round bidding 100% transparent.

The new NELP series follows the success of 2006’s NELP-VI, when 165 bids were received for the 55 blocks. Each block received an average of three bids and some even had nine to 10 bids, he says.

Thirty-six foreign companies from 17 countries, four more than the 32 Indian companies, put in bids for the NELP-VI. Surprisingly, India attracted 20 newcomers to its petroleum E&P sector under NELP-VI, which was one of the successful rounds, with 52 blocks signed compared with 1999’s NELP-1, when only 24 of 48 blocks were signed. The Indian government approved NELP in 1997 and implemented it two years later.

Sibal wants to repeat the NELP-VI success for the NELP-VII, which offers 19 deepwater blocks, nine shallow water blocks, and 29 onshore concessions to be awarded later this year.

According to industry observers, foreign companies have been concerned about a bias in awarding oil and gas mining concessions to Indian companies. But this is not the case, Sadananda Thakur, head of the NELP in the Directorate General of Hydrocarbons (DGH), says.

This is one of the many areas being tackled by the DGH to ensure a level playing field and to attract the state-of-the-art technology required to go deeper in the offshore basins.

“We want a win-win situation both for international and Indian hydrocarbon companies,” says Thakur, noting the strong expressions of interest from ENI, Petrobras, BP, and Chevron.

Deepwater without technology will remain challenging but India has started attracting some of the best in the world, including deepwater stalwarts and national oil companies of Brazil – Petrobras and the Malaysian NOC – Petronas.

E&P activities

The $5 billion E&P projected investment for 2007-2012 speaks for itself. The DGH’s five-year projection is nearly triple the $1.84 billion investment in 2000-2007, and about a seven-fold increase from $782 million in 1993-2000.

India has 855,232 sq km (330,207 sq mi) classed as deepwater out of the 1.145 million sq km (442,087 sq mi) offshore acreage total.

DGH data shows there are 478,209 sq km (184,638 sq mi) of offshore acreage on the east coast and 377,023 sq km (130,125 sq mi) on the west coast. The industry has drilled 70 wells on the east coast and 67 on the west coast.

It also has 98,715 sq km (38,114 sq mi) of shallow water on the east coast with 79 wells drilled and 19,078 sq km (7,366 sq mi) on west coast with 1,034 wells drilled.

India’s offshore acreages include 24 fields in the 236,000-sq km (91,120-sq mi) basins off Mumbai, and seven fields in the 145,000 sq km (55,984 sq mi) of the Krishna Godavari basin.

A further 14,000-sq km (5,405-sq mi) area is earmarked for new exploration in Mahanadi-northeast coast.

About 490,000 sq km (189,190 sq mi) of the 1.35-million sq km (521,238-sq mi) acreage is yet to be offered in India’s deepwater areas. DGH said 860,000 sq km (332,048 sq mi) already is under license.

Another 100,000 sq km (38,610 sq mi) of shallow water is available, with 300,000 sq km (115,831 sq mi) under license.

According to DGH, 2,056 wells have been drilled in Bombay basin, which has produced 487 million metric tons (537 million tons) of oil and 299 bcm (3.2 tcf) of natural gas as of March 31, 2007.

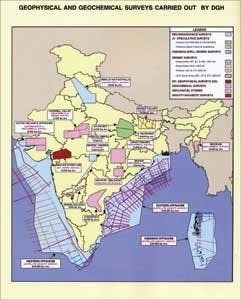

Sibal highlights exploration growth in the Indian petroleum sector, pointing out that the country had only 15% or 468,000 sq km (180,696 sq mi) of unexplored areas remaining in 2006-2007, compared with 50% or 1.56 million sq km (600,000 million sq mi) in 1995-1996 fiscal year.

But the poorly explored acreage has increased to 21% or 655,000 sq km (252,897 sq mi) in 2006-2007, compared with 15% or 498,000 sq km (192,279 sq mi) in 1995-96. The DGH wants to correct this.

The moderate- to well-explored acreage has increased to 20% or 641,000 sq km (247,492 sq mi) in 2006-2007 from 15% or 498,000 sq km (192,279 sq mi) 10 years ago.

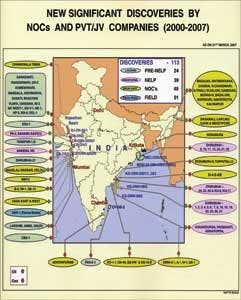

Hydrocarbon discoveries have more than doubled to 49 in 2000-07 from 22 in 1993-2000, he points out.

Sibal expects the industry to drill 459 exploration wells between 2007-2012. Comparatively, there was only a marginal increase in exploration wells to 193 in 2000-07 from 167 wells in 1993-2000.

The offshore drilling density is low at one well per 1,000 sq km (386 sq mi).

Sibal says the resources were estimated only in 15 out of the 26 basins.

The industry is already bullish, shooting 2D and 3D seismic surveys. He expects 263,692 line km (163,851 mi) of 2D and 108,232 sq km (41,789 sq mi) of 3D surveys to be shot between 2007-2012. The bullish sentiment was confirmed by a 2000-2007 2D seismic survey acquisition total of 123,247 line km (76,582 mi) and 86,672 sq km (33,464 sq mi) of 3D, compared with just 2D 24,091 line km (14,969 mi) and 5,304 sq km (2,048 sq mi) of 3D shot in 1993-2000. This has yielded 9.34 Bboe of oil and gas over the last seven years, up from 1.18 Bboe during the 14 years of efforts during 1993-2007.

Oil and Natural Gas Corp. (ONGC), Reliance Industries Ltd., and Cairn Energy Plc are among the main players in deepwater. ONGC is tapping into gas in the Krishna Godavri and Mahanadi basins, while Reliance and Cairn have oil and gas prospects in Krishna Godavri basins.

Reliance is also a major player in the shallow water, and BG of the UK is the foreign group.

Low-risk play

The Indian authority maintains that its deepwater has a low exploration risk. It is rated after the UK, Canada, the US, Norway, Australia, Ghana, Malaysia, and Oman as the lowest investment risk environment.

It is claimed to be a better place for investment compared with already internationally acclaimed hydrocarbon producing basins of Brazil, Qatar, Thailand, China, Libya, Vietnam, United Arab Emirates, Angola, Saudi Arabia, and Iran.

“In terms of entry risk, India scores in the medium risk range of ‘B’, ahead of other major resource holders being in the ‘D’ to ‘F’ range,” says Sibal.

The Indian oil production scenario has changed but it remains a significant importer, bringing in 1.7 MMb/d of crude oil to supplement its daily production of 650,000 b/d. However, India is able to export 400,000 b/d of products, thanks to the massive refining industry development in recent years.

Cairn Energy is aiming to hit it big in its offshore concession, albeit having been in the $950-million world class development onshore Rajasthan where it is developing four fields – Mangala, Aishwariya, Raageshwari, and Saraswati. First oil is expected in the second half of next year, with production peaking at 150,000 b/d.

Cairn Energy is busy in the offshore Ravva basin, which is a world class marine reservoir off the east coast, according to exploration director Dr. Mike Watts.

On the west coast’s Cambay basin, Cairn has been producing gas from the Lakshmi field since 2002 and Gauri since 2004-2005. Its 2007 production was 87,031 boe/d, down from 105,029 boe/d. But the Rajasthan production is expected to boost output by 150,000 boe/d, peaking in 2010.

New licensing policy

The DGH is also introducing the Open Acreage Licensing Policy (OALP), allowing E&P companies to access geoscientific data throughout the year at the National Data Repository (NDR) and bid for acreages at predetermined intervals two or three times a year. OALP will provide a continuous window of opportunity for companies to invest in exploration activities in India. This will provide a basis for bidders to select the size and shape of the block they intend to explore.

E&P companies are required to choose and bid for a full grid or a contiguous part of it.

The government is also in the process of establishing NDR, which will have diverse E&P data, collected in the past by different agencies. NDR will also have regional seismic lines and exploratory well information for the basins. In the first phase of NDR, the government is planning to populate only E&P data for those areas which are likely to be offered in the initial OALP phase. A professional team of 170 will manage the NDR, and 80 professionals were already working in the center at Noida. The rest are scheduled to join by next year.

PSC features

Some of the features of the terms under the Production Sharing Contract (PSC), based on the Model PSC, are:

- The possibility of seismic option alone in the first phase of the exploration period

- Up to 100% participation by foreign companies

- No signature, discovery, or production bonus

- No mandatory state participation

- No carried interest by NOCs

- Income tax holiday for seven years from start of commercial production

- No customs duty on imports required for petroleum operation

- Biddable cost recovery limit up to 100%

- Option to amortize exploration and drilling expenditures over a period of 10 years from first commercial production

- Sharing of petroleum profit with the Indian government based on biddable pre-tax investment multiple achieved by the contractor

- Royalty for on land areas is payable at the rate of 12.5% for crude oil and 10% for natural gas

- For shallow water offshore areas, royalty is payable at the rate of 10% for both crude oil and natural gas

- For deepwater offshore areas (beyond 400 m [1,312 ft] iso-bath) royalty is payable for both crude oil and natural gas at the rate of 5% for the first seven years of commercial production and thereafter at the rate of 10%

- Fiscal stability provision in the contract

- Freedom to the contractor for marketing of oil and gas in the domestic market

- Liberal provisions for assignment

- Arbitration and Conciliation Act, 1996, based on United Nations Commission on International Trade Law (UNCITRAL) model is applicable

- To facilitate investors, a Petroleum Tax Guide (PTG) is in place

- To enable bidders’ focus, blocks have been categorized as Type- S in on land area and Type-A and Type-B in on land and offshore area.

Footnote

India has an estimated sedimentary area of 3.14 million sq km (1.2 million sq mi), comprising 26 sedimentary basins, out of which, 1.35 million sq km (521,238 sq mi) area is in deepwater. At present a 1.38 million sq km (532,821 sq mi) area is held under Petroleum Exploration Licenses in 18 basins.

Before implementing the NELP in February 1999, 11% of Indian sedimentary basins were under exploration. Today, unexplored area in the country is only about 15%, down from 50% in the 1995-1996 fiscal year.

Of the 190 PSCs signed under the NELP, 106 are in operation and have yielded 113 discoveries since 2000. In the fiscal 2006-2007, 14 discoveries were reported by private and joint venture companies.

India’s total hydrocarbon reserves are estimated at 28 billion metric tons (31 billion tons) of oil and oil equivalent natural gas. But initial in-place oil and natural gas is about 8.99 billion metric tons (9.9 billion tons), according to data from the DGH, which, though, is estimating 32 billion tons (35 billion tons) of oil and oil equivalent gas.

Oil production in the last fiscal 2006-2007 year was 33.99 million metric tons (37.47 million tons) and natural gas output was 31.75 bcm (1.1 tcf).