High returns of light sweet Tui crude

Gurdip Singh - Contributing Editor

New Zealand’s Tui field is one of the best bets ever found by exploration groups in the Asia-Pacific. The light sweet crude is exported to international markets.

The field’s reserves have been upgraded several times and further appraisal continues with new exploration to test the potential of the surrounding areas, says New Zealand Oil & Gas Ltd. (NZOG), which supports the development by operator Australian Worldwide Exploration Ltd. (AWE).

NZOG and partners are contemplating a drilling campaign in 2010 to target near-field opportunities.

“The field is continuing to perform above initial expectations, with a current daily production rate of around 40,000 bbl of oil,” NZOG Public Affairs manager, Chris Roberts, toldOffshore magazine.

As of Oct. 1, 17.4 MMbbl have been produced since production began on July 30, 2007.

Tui’s light sweet crude is benchmarked against Malaysia’s Tapis crude, which commands a premium price. Gas produced with the crude is flared.

The oil is sold into the east coast of Australia, Asia, and Hawaii as the only refinery in New Zealand is not equipped to handle the light crude, he says.

Tui is New Zealand’s largest oil field ever and has created a significant impact on the country’s economy. Record export receipts in 2008 are partly due to Tui sales.

The reserves have been upgraded a number of times, with the initial proven and probable (2P) now at 50.1 MMbbl, extending the field’s production life to 2022. While reserves had been upgraded by 80%, production was 42% ahead of forecast and returns had been boosted by record international oil prices.

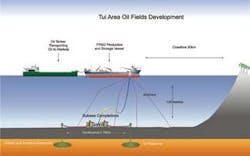

The field, off Taranaki coast, has four production wells which were drilled and completed with extended horizontal production sections ranging from 819 m (2,687 ft) to 1,850 m (6,070 ft) in the oil reservoirs.

The subsea system ties back wells to the FPSOUmuroa, which is designed to process up to 120,000 b/d of fluids (at water rates of up to 118,000 b/d) to allow stripping of oil from produced water.

Associated water is being produced but at a lower rate than that predicted by the original field simulation models, allowing a high oil production rate to continue for longer, says Roberts.

Plans are being developed to increase the fluid (water and oil) handling capacity of theUmuroa to 180,000 b/d, which will help increase oil recovery and provides the flexibility to tie in any future nearby discoveries.

The facilities have performed well. Total outages in the period up to June 30, 2008, were 17 hours.

NZOG achieved project “payback” -- recovery of all exploration and development costs for the Tui Area Oil Project -- by December 2007, four-and-a-half months following production start up.

Production

Tui is New Zealand’s first stand-alone offshore oil development. Production started four-and-a-half years after discovery, and 20 months after the investment decision.

Some 50 km (31 mi) off the coast of New Zealand in water depth of 120 m (394 ft) in the PMP 38158 permit, the Tui project cost $274 million, with the FPSO being the main operating cost, Roberts says, adding that NZOG’s share was $34 million.

The FPSOUmuroa charter has been extended through to 2022 under a new contract signed in May 2008, based on then reserves of 47 MMbbl. The new contract will support production from Tui, which had 50.1 MMbbl of oil reserves as of a June 20, 2008, assessment.

Initially, the FPSO has been leased to the Tui joint venture on a fixed five-year charter with five one-year options.

Additional tie-back options to the FPSO if other adjacent prospects are proven, will allow for rapid online production of additional reserves, Roberts says.

There is good potential of additional reserves as the Tui field has been yielding more and more oil at every assessment since July 2007 when pre-production reserves were 27.9 MMbbl. But a preliminary post-drilling review in August 2007 raised it to 32 MMbbl, with following assessments taking it to 50.1 MMbbl.

Exploration

The Tui-1 wildcat well, drilled in February 2003, landed the exploration partners with a 10 m (33 ft) oil column discovery from an excellent quality reservoir.

An April 2003 marine seismic survey over 250 sq km (97 sq mi) delineated the field accumulation and other nearby structures.

Based on the 3D seismic mapping, NZOG and partners drilled further exploration wells on nearby structures similar to the Tui field during 2004.

The Amokura-1 well, drilled in April 2004, encountered a 12-m (39-ft) oil column; the Pateke-2 well also encountered a 12-m oil column in August 2004.

In November 2005, the Tui joint venture partners made a unanimous decision to fasttrack the development of the Tui area oil fields.

The Tui oil accumulations are in the Kapuni-F sandstone units, deposited during the Paleocene in the “Kapuni” paleogeographic shoreface fairway. The reservoir is at a depth of around 3,650 m (11,975 ft) subsea.

Organic-rich shale sediments and coals of the Late Cretaceous and Paleocene are the likely oil sources, generated deep within the Taranaki basin “kitchen” areas, such as the Kahurangi sub-basin to the west and northwest of the Tui area accumulations.

The oil migrated vertically through faults and fractures and then laterally via carrier beds, finally accumulating in Paleocene sandstone reservoirs within structural trap closures. The structural traps are low relief, dip-closed features.

The reservoirs are clean, laterally extensive, high permeability marine sandstones, with the oil accumulations overlying strong aquifer drives.

Participants in Tui Area Oil Fields are:

New Zealand Oil & Gas Ltd. (through its subsidiary Stewart Petroleum Co. Ltd.), 12.5%; Australian Worldwide Exploration (operator), 42.5%; Mitsui E&P Australia Pty Ltd., 35.0%; and Pan Pacific Petroleum NL (through its subsidiary WM Petroleum Ltd.), 10%.