GULF OF MEXICO

David Paganie • Houston

Atlantis commissioned, sales begin

BP and partner BHP Billiton have completed commissioning theAtlantis semisubmersible production platform and associated pipelines and export facilities.

Gas sales have started, oil volumes are increasing, and additional wells will continue to be brought on stream with peak production expected by end-2008, according to BP.

“The water depths and reservoir structure make Atlantis among the most technologically challenging developments undertaken by BP,” says Andy Inglis, BP’s chief executive of E&P.

“The Atlantis South field is a significant hydrocarbon resource,” says Michael Yeager, chief executive of BHP Billiton Petroleum. “Although we have considerable drilling remaining, we are pleased to begin oil and gas production from this world-class field.”

BP operates Atlantis with a 56% interest. BHP Billiton holds the remaining 44%.

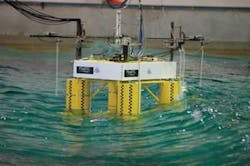

ETLP model tests positive

FloaTEC has completed model testing of its extended TLP (ETLP) design using the latest post-Katrina Gulf of Mexico environmental data. Model tests were carried out at the Offshore Technology Research Center (OTCR) at Texas A&M University.

Performance of the ETLP model was measured in simulated 1,000-year hurricane conditions, in a wind tunnel and wave basin. A model scaled 1:92 was used in the wave basin. Corresponding parameters for the actual platform include capacity to process 120,000 b/d of oil, 110 MMcf/d of gas, 80,000 b/d of water, and 100,000 b/d of water for injection, in up to 5,000 ft (1,524 m) of water. It has an integrated, 2 million-lb rig with capacity to drill to 35,000 ft (10,668 m) TD, 18 top-tension risers for drilling and production, and eight steel catenenary risers for production, injection, and export.

The ETLP is configured with four columns measuring 210 ft (64 m) high, 76 ft (23 m) wide, with 220 ft (67 m) between each column. It has a still water airgap of 106 ft (32 m), installed draft of 113 ft (34 m), wet tow draft of 35-40 ft (11-12 m), and 95,453-short ton (86,594-metric ton) displacement. The topsides (with rig) weigh 26,413 short tons (23,961 metric tons), 18,722 short tons (16,984 metric tons) dry, and the hull weighs 26,937 short tons (24,437 metric tons).

The scaled down glass fiber hull model was moored in the wave basin to measure its performance in 1,000-year hurricane conditions. Tests were run in 20 minute increments, which is equivalent to three hours in real time. Simulated conditions generated 114.5-ft (35-m) maximum wave height, 197-ft/s (117-knot) hourly wind speed, and 7.4-ft/s (4.4-knot) surface current speed.

Test results in the wave basin measured a maximum offset of 499.5 ft (152 m) with corresponding -24.88-ft (-7.58 m) setdown. The maximum horizontal acceleration on the upper deck was measured at 0.2124 g; vertical acceleration was 0.0407 g. The minimum air gap was measure at 8.08 ft (2.46 m). The tension on the risers recorded a maximum 8,874 kips and 572 kips minimum. No green water was reported on the top deck during the tests, according to OTRC.

Based on these test results, “we have an ETLP that is suitable for post-Katrina conditions in the GoM,” says John Murray, FloaTEC’s director of technology development. “We further plan to commercialize a dry-tree semisubmersible concept in 1Q 2008.”

Other ETLPs tested at OTRC include successfully deployed>Kizomba A and B offshore Angola, andMagnolia in the GoM, currently the world’s deepest installed TLP.

Waterflood to improve reservoir performance

Commissioning is under way on Shell’s Ursa/Princess waterflood project, which is expected to improve the fields’ reservoir performance.

According to Shell, waterflood is a method of secondary recovery in which water is injected into the reservoir formation to displace additional oil. The water from injection wells re-pressurizes the formation and physically sweeps the displaced oil to adjacent production wells.

The topsides injection system will inject filtered and treated water via two separate flowlines to three subsea sites – one to an existing well site northwest of Ursa, one to an existing well site southeast of the platform, and one to a new well site northeast of the facility, Shell says. Producing wells will include three Princess subsea wells and up to six Ursa wells.

The water filtration module cleans and deoxygenates seawater to prepare it for injection into the reservoir. The sulfate reduction unit module further treats the clean, deoxygenated seawater by removing sulfate to prevent the formation of scaling and corrosion in the wells. The water injection module then pumps the treated seawater at 7,500 psi into the reservoir. First water injection is expected in 2008.

J Ray McDermott fabricated the water filtration, water injection, and sulphate removal topside modules and associated interconnecting structures. The equipment was installed on theUrsa TLP and connected by Grand Isle Shipyard.

Ursa covers Mississippi Canyon blocks 808, 809, 810, 852, 853, and 854, in up to 3,800 ft (1,158 m) of water. Princess covers Mississippi Canyon blocks 765 and 766, in up to 3,650 ft (1,113 m) of water.

Shell operates the Ursa/Princess Waterflood project with a 45.39% interest; BP owns 22.69%; and ExxonMobil and ConocoPhillips each hold 15.96%

Petrobras hires Alliance for topsides engineering

Petrobras America has appointed Alliance Engineering as the owner’s topsides engineer for the first FPSO to be used in the US Gulf of Mexico.

Alliance will assist Petrobras for up to a three-year period with two work scopes for the Cascade and Chinook fields.

Alliance will support Petrobras with verification of the topsides design for a leased FPSO early production system. The FPSO is planned to be moored in 8,500 ft (2,591 m) of water for five years. It will have capacity to store 600,000 b/d of oil, process 80,000 b/d of oil, and export 16 MMcf/d of gas.

In addition, as part of a full field development scope, Alliance will assist Petrobras with the selection and planning of the final solution to replace the EPS and produce the fields over a longer term.

ATP acquires majority interest in Canyon Express

ATP has increased its ownership interest in Mississippi Canyon block 348 (Camden Hills field) from 16.67% to 66.70%. The company also has increased its working interest in the Canyon Express Pipeline System (CEPS) from 45.08% to 55.09%. ATP is already the operator of the CEPS and, after the transaction, is the operator of MC 348.

The CEPS provides the closest pipeline interconnect for the offshore deepwater leases that ATP bid on at Gulf of Mexico Lease Sale 205, according to ATP. Camden Hills is in 7,112 ft (2,168 m) of water and is connected to the CEPS, which consists of two 12-in. (30-cm) pipelines with capacity to move 500 MMcf/d of gas.

“ATP now operates CEPS and all of the properties (Camden Hills, Aconcagua, and King’s Peak) connected to the pipeline system, which provides ATP with the operational control of the entire system,” says George R. Morris, ATP’s VP of acquisitions.

“In addition, we were the apparent high bidder on two blocks in the immediate vicinity of CEPS at the recent Offshore Lease Sale 205. We have a rig contracted in 2009 for this area and its drilling program at the Canyon Express Hub will begin with four to six new wells to capture the undeveloped reserves that will be produced through the CEPS. We are also considering opportunities to transport third-party gas through the pipeline system.”

Western Gulf lease sale results released

Western Gulf of Mexico Oil and Gas Lease 204 drew $289,953,066 in high bids on 282 tracts from 47 companies. MMS awarded 274 leases with high bids totaling $287,081,023.

Statoil Gulf of Mexico LLC issued the highest bid on a tract at $37,588,800 for Alaminos Canyon block 810. This tract in greater than 2,000 m (6,562 ft) of water received two bids. BP issued the greatest number of high bids, 88, and Statoil GoM LLC topped the list of high bid spenders with $138.6 million.