Indian exploration moves into deepwater frontiers

India’s offshore has seen a high level of exploration and production activity over the past five years, and all indicators point to increasing E&P in the five years to come.

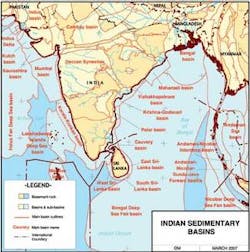

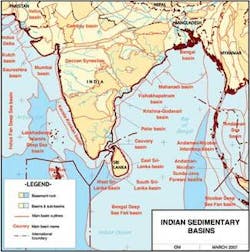

The majority of the offshore activity will take place in the Krishna-Godavari (KG) and Mahanadi basins, where exploration wells already are planned, and recent discoveries will begin moving into production.

New areas will see the drill bit for the first time in the next couple of years as well. The results of the NELP VI bidding round show a trend toward India’s frontiers. The launch of the NELP VI blocks has initiated exploration in an additional area of about 300,000 sq km (115,831 sq mi), 89% of which is offshore. A major part of this area falls in the deepwater blocks of the east and west coasts, and in the Andaman Sea.

Part of the upcoming activity will be undertaken by companies entering India for the first time. Bidders from 26 companies, eight of them foreign entities, were first-time participants in the NELP VI bidding, according to the Directorate General of Hydrocarbons (DGH).

In the past five years, there have been 97 significant hydrocarbon discoveries made in India, according to VK Sibal, director general of the DGH. The most noteworthy offshore discoveries are in the east coast KG and Mahanadi-NEC basins, Sibal says.

The DGH, under the Ministry of Petroleum & Natural Gas, has identified 50-60 blocks that will be offered in the next bidding round, NELP VII.

Positive exploration results and promising geology continue to draw investors to India.

Inside India

A report published by the DGH says India’s total hydrocarbon resources, including those in deepwater, amount to 28 billion metric tons of oil and oil-equivalent of gas.

India is the world’s fifth largest importer of oil and is the world’s sixth largest energy consumer, importing nearly 70% of its oil. Per capita consumption of petroleum products is only 12% of the world average, but domestic demand is growing rapidly. The Indian government would like much more of the country’s consumption to come from domestic production and is pursuing an exploration program to help uncover hydrocarbon resources.

The Oil and Natural Gas Corp. (ONGC) of India holds 57% of the country’s hydrocarbon acreage, operating 31 deepwater blocks, 18 off India’s east coast and 13 off the west.

ONGC’s foreign partners in the deepwater licenses include BG, Cairn Energy and Eni.

In December 2006, ONGC made an ultra deep discovery of about 21 tcf in the Bay of Bengal, but company official say ONGC will wait for the test results before estimating discovery size and making development plans.

ONGC exploration is ongoing in the Cauvery basin off the southeastern coast, and seismic surveys are under way off the Andaman Islands to the east.

Last September, ONGC extended a contract with WesternGeco for Q-Marine system services for more seismic surveys. The existing contract covered two Q-Marine vessels during 2005-2006 offshore India. The extension covers two vessels for two more seasons to target areas off the western and eastern coasts.

“The initial Q-Marine contract, and now this extension, represent the largest cumulative seismic acquisition effort undertaken in India to date and underscores the significant commitment of ONGC to explore, develop, and produce hydrocarbons in India through the utilization of the foremost seismic technology available today,” says D.K. Pande, director of exploration for ONGC.

ONGC has had a number of successes with its domestic drilling program and has made 20 offshore discoveries in the Mahanadi and Krisha-Godavari areas.

It looks as if, for the time being, however, ONGC will not be as active in deepwater exploration as it was in the past. The company’s deepwater drilling program encountered more dry holes than discoveries in the last three years, which has led to a decision to invest in maximizing production from marginal fields.

ONGC reportedly intends to develop 153 onshore and offshore marginal fields in the next few years.

Last June, ONGC awarded a service contract for the development of offshore marginal fields, Cluster 7, to the consortium of Malaysia’s M3nergy Berhad, Hindustan Petroleum Corp. Ltd., and Prize Petroleum Co. Ltd.

The scope of work includes geological, geophysical, and reservoir assessment, field development, operations, and maintenance of the fields over a period of two to three years.

The estimated life expectancy of the oil and gas producing fields off Mumbai is 10 years, based on estimated reserves of 30-40 MMbbl of oil.

Daily production is anticipated to hit 15,000 bbl, says M3nergy, which has 30% partnership in the consortium and will be the project executor.

In mid-August of last year, ONGC’s board agreed to fund development of the C-series marginal field 60 km (37 mi) off Daman in the Tapti Daman block.

The field, with water depths ranging from 19 to 35 m (62-115 ft), is estimated to hold reserves of 15.54 bcm (548.8 bcf) of gas and 4.46 MMcm (157.5 MMcf) of condensate.

First phase completion is scheduled by December 2008. Eight platforms and 17 wells will be drilled to develop this marginal field.

Though the field was discovered in the 1990s, ONGC says it became viable only recently due to rising natural gas prices.

State-run Oil India Ltd. also is actively pursuing offshore exploration. Recently, OIL stepped up E&P activities significantly, setting up the North East Frontier project to intensify its exploration activities in the frontier areas in the northeastern part of the country. The area is logistically difficult and geologically complex.

OIL’s corporate objectives spell out its plan for domestic E&P activity, including accelerating exploratory efforts to increase hydrocarbon reserves, expediently developing discovered fields, increasing recovery from brownfields, and adding exploration acreage.

The company recently signed PSCs with several private sector companies in efforts to boost exploration. OIL holds interests in blocks in the Orissa, Gujarat-Kutch and Saurashtra basins as well as the deepwater Mumbai, KG and Cauvery basins.

India’s private sector

Reliance Industries Ltd., a private Indian company, leapt into the oil and gas game a few years ago offshore India and made an enormous splash with a string of discoveries. The company gained momentum with one success after another and added blocks year upon year to its offshore acreage. Reliance is now gathering seismic data over a number of its leases in preparation for more exploration drilling.

In mid-September 2006, Reliance exceeded its data acquisition requirements for Cauvery block CY-PR-DWN-2001/3 with more than 2,550 line km (1,584 mi) of 2D data. The commitment for the block was 2,100 km (1,305 mi). The company also shot 2,700 sq km (1,042 sq mi) of 3D data that was not required by the lease agreement.

Reliance reportedly plans to drill eight exploration wells in the block, which is off the Tamil Nadu coast in the southeast.

Reliance also operates the 17,000-sq-km (6,564-sq-mi) D4 block off the east coast of mid-India. The block contains similar play types to the natural gas discoveries made by Reliance and Canada’s Niko Resources in the D6 and NEC-25 blocks.

Early last year, Reliance shot 2,366 km (1,470 mi) of 2D seismic over the block. Data interpretation is under way.

The east coast of India continues to be a promising exploration area for Reliance and will see additional E&P activity in the coming years.

In early February 2007, Reliance’s domestic exploration and production business comprised 29 domestic blocks spread over 308,000 sq km (118,920 sq mi) plus seven deepwater blocks awarded in NELP VI. Two of the newly acquired blocks are in the KG basin. The other five are in the Mahanadi basin, north of KG. The combined acreage of the blocks is 76,050 sq km (29,363 sq mi).

The company announced in February it would follow an aggressive exploratory program over the next four quarters.

Reliance plans to drill 14 out of the 29 blocks and to carry out extensive seismic studies on all the blocks. As of February, rigs had been contracted and seismic contracts awarded.

Early this year, Reliance completed drilling the KG-D6-AA1 and KG-D6-Q1 wells in the deepwater block KG-DWN-98/3 (KG-D6) in the KG basin.

Well KG-D6-AA1 is in the new 3D seismic area at a water depth of 1,858 m (6,096 ft). It was drilled to a depth of 2,862 m (9,390 ft). Well KG-D6-Q1, in 1,832 m (6,010 ft) water depth, was drilled to 2,945 m (9,662 ft). The Q1 well is 15 km (9 mi) southwest of AA-1 and 8 km (5 mi) northwest of the P1 natural gas discovery.

Both wells encountered pay zones in the distal part of the earlier established channel levee systems in the D6 block. Based on the evidence of data obtained from logging and modular dynamic testing (MDT), the clastic reservoirs in the sequences proved the occurrence of hydrocarbons in both wells and demonstrate continued high prospectivity of the block.

In March 2007, Reliance said development of the gas discoveries Dhirubhai 1 and Dhirubhai 3 is on schedule for first production by 2008. All of the major EPC/EPIC contracts have been awarded, and all long-lead items are on order. The pre-engineering survey for offshore installation also is complete, construction on the jetty is finished, and detailed engineering of the onshore terminal is nearly half done.

The project is in the fabrication phase now, Reliance says, and is on schedule to meet the target installation and commissioning dates.

Three additional development wells - A9, A16 and B13 - have been drilled as a part of the D6 development drilling program as well. These wells have reaffirmed Reliance’s reserve expectations from Dhirubhai 1 and Dhirubhai 3, Reliance says.

In the cretaceous section of D6 block, the MA-2 well has encountered the thickest hydrocarbon column discovered to date in D6, Reliance says. MA-2 reached a depth of 3,581 m (11,749 ft) and penetrated a gross hydrocarbon column of 194 m (637 ft) consisting of 170 m (558 ft) of gas/condensate and 24 m (79 ft) of oil. MA-2 is approximately 2 km (1 mi) from the MA-1 discovery well.

Reliance says the fast-track development of the KG-D6 MA Cretaceous means it, too, will be onstream in 2008. The DGH approved the commerciality of the MA oil discovery on Feb. 1, 2007.

Reliance reportedly is talking with state-owned GAIL (India) Ltd., to bid for oil and gas blocks in NELP VII. The two companies also could cooperate to transport Reliance gas from the KG fields that go into production next year.

GAIL (formerly Gas Authority of India Ltd.) signed PSCs for 15 oil and gas blocks in the latest bidding round. With these 15 blocks, GAIL has a substantial E&P portfolio of 24 Indian blocks.

Foreign operators

Cairn Energy PLC has been in India for 10 years. Though most of its acreage is onshore, the company has some significant offshore holdings. Cairn developed the shallow-water Ravva oil and gas field in the KG basin in the 1990s and participated in deepwater exploration in the same area in 2000-2001.

Ravva oil production levels, which were 3,700 b/d before Cairn took over a decade ago, increased to 35,000 b/d in 1997, with current levels standing at 50,000 b/d.

Cairn holds a 22.5% working interest in the Ravva field. The remaining shares are held by ONGC with 40% interest, Videocon Industries with 25% interest, and Ravva Oil (a wholly owned subsidiary of Marubeni Corp.) with 12.5% interest.

Exploration drilling in Cairn’s deepwater acreage in the KG basin resulted in a succession of oil and gas discoveries in 2000 and 2001. The large amount of capital required for deepwater appraisal and development, however, led to Cairn’s agreeing to relinquish 90% exploration interest in block KG-DWN-98/2 to ONGC. Cairn also has relinquished its 50% interest in block KG-OS/6.

The company won two offshore blocks in the NELP VI bidding round. The 9,400-sq-km (3,629-sq-mi) Palar basin block PR-OSN-2004/1 lies just off the east coast southwest of the Ravva field. ONGC-operated block KK-DWN-2004/1 is in the Kerala Konkan basin off the west coast. Cairn India Ltd. has 40% interest in the 12,324-sq-km (4,758 sq mi) block.

Canada’s Niko Resources established a presence in India in 1994 and has been adding acreage ever since.

The company had a busy year last year, pursuing what it calls “aggressive drilling programs” on the D6 block off the east coast and Hazira blocks offshore West India. Drilling resulted in several new natural gas discoveries on the D6 block (where Niko is a minor partner to operator Reliance), the development and commencement of commercial oil production on the Hazira field, and the discovery of hydrocarbons in the D6 block. The D6 discovery in June 2006 was Niko’s first deepwater discovery, testing oil and gas in two intervals.

Preliminary evaluation indicates 26 m (85 ft) of net oil pay and 72 m (236 ft) of net gas pay.

Overall, the company participated in drilling three exploration wells and nine development wells, achieving a 100% success rate last year.

Now, Niko is developing the natural gas discoveries in the D6 block with Reliance, with the expectation of first production by June of next year.

Niko expects 2007 to be the most active yet on D6, with three rigs working. Exploration drilling will continue in D6, with initial focus on evaluating the Cretaceous oil potential. Subsequently, the deeper water Pliocene natural gas and Miocene natural gas and oil evaluation will begin as well.

Niko also expects to begin developing the east coast NEC-25 block. The company has 10% interest in the 10,755-sq-km (4,153-sq-mi) block, which lies in the Mahanadi basin. Reliance operates the block, which has been declared commercial with six natural gas discoveries made to date, all within the original 1,800-sq-km (695-sq-mi) 3D seismic area.

BG is a relative newcomer to India, but it is investing to develop an integrated business. Upstream, BG plans to increase production at its Panna/Mukta and Tapti fields by 60% to 2009 through a major drilling campaign.

BG Group has emerged as a key private sector player within the gas industry in India, with a significant presence in both the E&P, and transportation and distribution segments.

Unquestionably, the company has made significant strides since it entered the Indian sub-continent a few years ago.

In February 2002, BG Group completed the $350-million acquisition of a 30% interest in the Tapti gas field and the Panna/Mukta oil and gas fields. In November, BG and partners announced the installation of compression facilities on the South Tapti field, which increased gas production capacity from 5 MMcm/d to 7 MMcm/d (180 MMcf/d to 250 MMcf/d). In April of 2005, BG Group and partners announced a $500-million investment to develop and expand the Tapti gas field. An extensive drilling program followed, reaching completion in January 2006.

In March 2007, BG said it expects gas production from the Panna/Mukta and Tapti oil and gas fields to increase to 17-18 MMcm/d (600-636 MMcf/d) this year. The fields were producing a combined 11 MMcm/d (388 MMcf/d) in 1Q 2007.

BG made a move into deepwater late in 2005. In December, ONGC accepted BG Group’s bid for 50% participation in three deepwater exploration blocks in the KG basin.

According to BG, the company is looking to play an expanding role in India’s growing natural gas sector by consolidating and further developing its upstream position through licensing rounds and acquisitions.

Natural gas demand in India is projected to more than double over the next two decades, and BG Group is working to enhance its position in the gas chain.

In March 2007, BG Group announced that it plans to invest $1 billion in India’s oil and gas sector over the next five years.

The company is obviously in for the long haul.

Another outsider in India’s offshore is Australia’s Santos Ltd.

In mid-February 2007, Santos announced it would spend $70 million for an eight-year work program on the first of two deepwater concessions in the Bay of Bengal.

Santos subsidiary Santos International Operations Pty. Ltd. has been awarded 100% working interest and operatorship of 16,500-sq-km (6,371-sq-mi) NEC-DWN-2004/1 and NEC-DWN-2004/2 blocks in the east coast basin in the northern part of the bay.

The blocks lie 175 km (109 mi) from the Indian coast in water depths ranging from 400 m to 2,300 m (1,312-7,546 ft).

The work program for block NEC-DWN-2004/2 includes 2D and 3D seismic surveys and one exploration well. The work program for NEC-DWN-2004/1 consists of 2D and 3D seismic surveys.

Santos says the blocks are situated well within the emerging Tertiary clastic Bengal Fan play that has proven successful in recent gas discoveries in the northern Bay of Bengal.

The two blocks are among the 52 offered under India’s NELP VI and recently awarded by the Indian government.