Evolution of the next generation, integrated energy company

Helix Energy Solution’s full cycle approach can reduce F&D cost by 20%

null

David Paganie, Senior Editor

The fun will not last. Most of us have been around long enough to know that the oil and gas industry is cyclical. If history is any indicator, oil and gas prices will likely drop to a level where corporate revenues will not be as robust as they are today. Simply defined, cycle means: a periodically repeated sequence of events.

Helix Energy Solutions, however, is taking a unique approach to “taking the cycle out of the industry,” or “smoothing out the cycle,” as they say, where the company will be prepared to maintain an economically favorable revenue stream during the good times and bad.

Helix (formerly Cal Dive) has been methodically building up its “cycle-free” approach over the past several years, with the intent of becoming a full-service, integrated energy company.

Offshore sat down with the leaders of this endeavor: Owen Kratz, chairman & CEO; Wade Pursell, senior VP & CFO; and Martin Ferron, president, to get their perspective on the evolution of this model.

Business model

Helix’s differentiated model originated in 1990, when it was operating as a primary abandonment contractor, among other things, under the name Cal Dive.

“During this time, we started noticing that we were shutting-in a lot of reserves,” says Kratz. In 1992, in response to this apparent, vacant niche in the industry, Cal Dive formed a subsidiary company, Energy Resource Technology Inc. (ERT).“Through this new venture, we used our inherent abandonment liability as currency to acquire our first field.”

Cal Dive’s acquisition strategy had two purposes: to enhance the production remaining, and prolong the life of the field to get the net present value (NPV) of the abandonment cash, explains Kratz. Since its inception, ERT has acquired interest in 200 offshore leases from over 25 different companies.

“This was the beginning of the formation of our model, which is now basically the model in the Gulf of Mexico for mature fields,” says Kratz.

This approach has three primary objectives. It reduces the effects of industry cyclicality, smoothes earnings out of cash flow to achieve better returns than typically seen in the service sector alone, and hedges risk.

“The way we smooth the cycle is during high-peak demand periods, we will use our fleet in the open market, and then during off-cycles, we will switch and use the assets on our own properties,” Kratz says. “Our goal is to achieve a 30% internal utilization through the cycle and around a 20% reduction in F&D cost over what other producers might achieve.”

Deepwater push; subsea intervention

The next major step in the evolution of the company’s integrated business model occurred in 1995. Around this time, operators were increasingly pushing out to deeper waters, and the company was aspiring to apply its model further upstream.

“In our initial upstream move from abandonment to development contracting, we purchased the first DP vessel to be permanently deployed in the GoM, theWitch Queen,” says Kratz.

At the time, the company understood that deepwater was going to be the dominant play for the foreseeable future. In addition, “There are going to be more mature fields and smaller discoveries in the Gulf,” says Kratz, “and the most cost-effective way to develop these reserves is through subsea production. However, there is legitimate risk and high intervention cost associated with subsea production.”

In 1997, the company acquired the first rig alternative subsea well intervention vessel,Uncle John.

“To get value out of the reservoir, you have to transfer risk,” explains Kratz. “We realized that by taking on abandonment liability, you mitigate risk. Well intervention creates value in the reservoir because it allows us to have a tool directly under our control to work the wells over and enhance production, and it transfers the risk of the high cost of well intervention.”

The next logical step in the model evolution was to add ROV capability, which it did in late 2001 through acquisition of Canyon Offshore Inc. The Canyon arm of Helix currently operates 26 ROV and burial systems including 19 heavy work class systems and 4 trenching and cable burial systems.

Shortly thereafter, in 2002, the company advanced its well intervention concept through purchase of Coflexip’s well intervention group, Well Ops UK. This, along with the Canyon acquisition, enabled Helix to gain a presence in the North Sea.

“We definitely have aspirations of transferring the model to the North Sea,” says Kratz.

To further enhance its subsea intervention services, the company launched the first vessel built in the world, theQ4000, to perform well intervention and construction work specifically in 10,000 ft of water.

“We took what we learned from using theUncle John for well intervention work and rolled it into the design of the Q4000,” says Kratz. The company also designed the vessel with spare capacity to add drilling equipment in the future.

Floating production

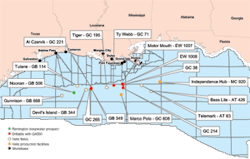

Later in 2002, the company took another step upstream through the formation of a 50/50 joint venture company -- called Deepwater Gateway LLC -- with El Paso Energy Partners LP. Under this JV, Helix obtained 50% ownership in its first deepwater floating production system, the Anadarko-operatedMarco Polo TLP. This was the first time, according to Helix, that an oversized facility was installed offshore to be supported commercially by not one reservoir, but by several subsea tiebacks. The success of this venture lead to the ability to sell the concept to the six independent producers involved in the Independence Hub project, adds the company. Helix owns a 20% interest in the project.

Helix currently is evolving its experience in floating production into a solution that allows for deployment of a scaled-down floating production unit to develop smaller, marginal fields sequentially.

“The key for this concept to be successful is it would need to be easily redeployed, using our existing assets,” says Kratz.

One benefit to this solution is that we could depreciate the asset over the life of the facility, rather than the life of the field, adds Pursell. The floater would be used on one of the company’s fields first, and then depending on its success, which could generate open market demand, the floater would be redeployed. Kratz says the floating production facility would be based either on a deep-draft or ship-shaped design. The floater could be fabricated, commissioned, and ready for service as early as late 2008.

Flowlines, engineering

In further evolving its full-service model, the company deemed it necessary to add additional infield flowline capacity to complement its subsea services. The deepwater, small diameter pipelay vessel,Intrepid, was acquired in 2003 to fill this void.

In early 2004, Helix strengthened its robotic concept by focusing on pipe burial for two reasons: it’s a market niche needed by the industry, and it lowers the cost for infield flowline installation.

Then in 2005, in order to grow the model geographically, the company needed more reservoir engineering and G&G capabilities, so it acquired Helix RDS. This acquisition of more than 180 skilled personnel also helps to strengthen its relationships in the North Sea, where the purchased company has existing operations.

In building a case for selling its concept on floating production systems and to add more value for its reservoir partners, the company determined that it needed some control over transmission pipelay capability.

In early 2006, Helix announced plans to convert an existing hull into a deepwater pipelay vessel namedCaesar. The $125 million conversion is underway in Holland and is expected to be completed in early 2007. The 485-ft S-lay vessel will be capable of installing pipelines with diameters ranging from 6-in. to 42-in. in greater than 6,500 ft of water.

Operatorship

Helix’s strategy over the years has focused primarily on adding integrated assets through acquisitions to mitigate the cyclicality of the oil and gas industry, and to position it as an attractive working interest partner for deepwater developments. More recently, the company realized the importance of not only positioning for partnership, but more importantly, to obtain the designation of operator in order to apply its methodologies.

A case-in-point is the recent Telemark field development situation. Helix acquired a 30%, non-operator working interest in the field on March 15, 2005; Hydro held the 70% majority working interest and was designated operator.

Then in late 2005, Hydro announced that it was opting out of the development. According to Helix, it did not support Hydro’s plans to launch a large-scale project. It was operating under the opinion that it was a smaller, marginal field. Shortly thereafter, Hydro failed to get sanctioning from its board and the operatorship was reverted to Helix. “Our experience with Telemark shows how ineffective you are as a non-operator,” says Kratz.

As a non-operator in the development of deepwater reserves, the company found it was required to pay a high promote and it was often relegated to a minority non-operator position. “We feel that with the acquisition and our subsequent operatorship of the Telemark discovery, it will be a real proving ground for us,” says Kratz. “The traditional development methodologies wouldn’t make this commercial, but ours should.”

“If we are really going to unlock the value of these small reservoirs, we have to be able to apply our methodologies,” he adds.

Portfolio

Helix recently added significant backlog to its portfolio of deepwater reserves with the announced planned acquisition of Remington Oil & Gas, valued at $1.4 billion. Closing of the acquisition is pending Remington stockholder and customary regulatory approvals, which are expected by around mid-year.

In the Remington acquisition, all properties are 100% owned and operated, giving it strategic control of the development plan. “This gives us a backlog somewhere in the range of $1 billion dollars in contracting work, as well as significant prospect generation,” says Kratz. Helix will gain through the acquisition around 279 bcfe of proved reserves and 150 identified prospects (19 deepwater) with possible risked reserves of over 1,100 bcfe. This backlog will provide around 5 - 7 years of drilling inventory.

Concurrently with the Remington announcement, Helix released plans to add drilling capacity to theQ4000. The $40 million upgrade involves the fitting of a modular-based drilling system, capable of drilling to a total depth of 22,000 ft with up to a 6.5-in. hole in 6,000 ft of water and a 4.5-in. hole out to 10,000 ft of water. The company plans to use the integrated semi to drill wells on its own properties, as well as in the open market.

The semi will be fitted with its drilling components while quayside, probably in Galvestion, according to Ferron. Installation of the drilling package will likely begin during the second half of this year, with commissioning and entrance into the market by the end of 1Q 2007.

Future plans

If theQ4000 performs well in the open market, then Helix says it intends to launch construction of a second Q4000. Preliminary engineering is already underway. “If we can conduct successful drilling with the Q4000 on our own properties and demand in the open market picks up for its services, then that becomes the trigger for us to build the next Q4000 vessel,” says Kratz.

He points out that the secondQ4000 will probably be a little more biased to drilling and intervention and less for construction. Pending board approval, the company anticipates a 24 - 30-month build time for the new vessel.

The next step in the evolution of Helix’s business model is to apply it in international regions where mature basins exist. The company plans to initially extend the model to Southeast Asia, which is the second-most mature producing basin in the world, and in the North Sea, where it is already somewhat established.

Kratz sums up the company’s underlying focus behind establishing this business model when he says, “We realized back in 1992 that service companies don’t get value in the reservoir because they create it. You get a fee for that, and you have to fight for that fee.”

Kratz insists that this business model has been around for some time and that other companies have actually copied this strategy at its outset, albeit on a smaller scale. However, it’s feasible that this newly differentiated, drilling, development and abandonment contractor, partner, and operator will likely set the foundation for the establishment of a new generation of offshore energy companies.