Russia Report: Sakhalin Island - ExxonMobil marks milestone with Sakhalin-1 start-up

Chayvo field development expected to continue for a year

Pam Boschee

International Editor

Once a penal colony unrecognized by much of the globe, Sakhalin Island now is a remote location gaining operational and technical prominence in the international oil and gas industry.

With production start-up last month in the first phase of the Sakhalin-1 project, ExxonMobil’s subsidiary, Exxon Neftegas Ltd. (ENL), began tapping the rich oil and gas reservoirs of offshore eastern Russia.

The initial phase of the project will produce 50,000 b/d of oil by year-end 2005 and 250,000 b/d by year-end 2006 from the Chayvo field. Companion Russian domestic gas sales will start at about 60 MMcf/d and are ultimately expected to increase to about 250 MMcf/d by the end of the decade.

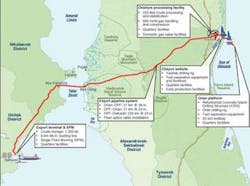

Sakhalin-1 includes the Chayvo, Odoptu and Arkutun-Dagi fields. Together they contain an estimated 307 million tons of oil and 485 bcm of gas. Sakhalin-1 was declared commercial at the end of 2001 and has an economic life of about 40 years.

ENL (30% interest) serves as operator of a consortium that includes: Japan’s Sakhalin Oil and Gas Development Co. Ltd. (30%); Russia’s Rosneft affiliates, RN-Astra (8.5%), Sakhalinmorneftegas (SMNG)-Shelf (11.5%); and the National Oil Co. of India, ONGC Videsh Ltd. (20%).

View from the top

In a recent interview withOffshore, ENL’s President and ExxonMobil Development Co.’s Sakhalin-1 Project Executive Steve Terni talked about Chayvo’s production future and later development of Odoptu and Arkutun-Dagi.

“We’ve installed two drilling facilities in this first phase. One is theYastreb, the onshore rig, which uses extended-reach drilling to tap reserves six miles from shore. At the same time, we set in place the Orlan platform, which sits right over the Chayvo reserve and will drill from there.”

Yastreb, which means “hawk” in Russian, is the world’s largest land-based drilling rig - 22 stories tall -- using extended-reach drilling (ERD). Orlan (“white-shouldered sear eagle”) will provide drilling capacity for up to 20 wells.

Yastrebis the largest fully winterized (+40/-40°C) and most powerful rig in the industry, according to ENL. With 12,000 hp (about 9,000 KW), the rig includes four 1,600-hp mudpumps at 7,500 psi (about 500 bar). It is skid-mounted for batch drilling and seismic design and is designed to withstand earthquakes.

ENL says the rig’s mud system is also unique in the industry. Compared with most rigs’ 1,000-bbl capacity mud system, says ENL,Yastrebhas a 2,000-bbl active, a 2,000-bbl reserve, and a 5,000-bbl bulk storage system.

The company adds that the rig has a pipe barn, which no other land rig has, which was designed to bring tubulars in, take them up, and store them. They can be picked up in 90-ft sections instead of 30-ft sections.

Combined,Yastreband Orlan will drill more than 30 ERD wells, which will be the largest number of such wells in any one location globally.

To date, seven ERD wells (four oil producers, two gas producers, and one injector) have been drilled at Chayvo and readied for initial production. Chayvo Z-2 (11, 134 m) and Z-1 (10,995 m) are the third- and fourth-longest ERD wells in the world, says ENL. Z-2 is the longest ERD well ever drilled by ExxonMobil.

Chayvo also claims the world’s first 13 5/8-in. casing installation using “mud over air” floatation and world record coiled tubing runs.

Terni says there will also be an onshore processing facility (OPF). The well streams from the two sets of wells will flow to the OPF and “from there we’ll be treating and selling some gas to domestic customers on the mainland of Russia. Those 20-year contracts are in place, and the customers are already receiving their gas.”

Once full production starts, crude oil will be processed at the OPF at the rate of about 250,000 b/d of oil and 800 MMcf/d of gas, says Terni. A 225-km export pipeline is being built from the OPF to the DeKastri export terminal, where crude will be loaded to specially designed tankers for delivery to international markets. With icebreaking support vessels and strengthened tankers, required because the strait between the mainland and the island is covered by ice for six months annually, year-round shipping will be possible, he adds.

“The oil will be initially sold into the domestic market until our export facility is complete, but the long-term plan is to export oil. Once that starts around mid next year, we won’t sell any more oil into the domestic market.”

Initial natural gas production will be sold to two domestic customers, OAO Khabarovskenergo and OAO Khabarovskkraigas, in the Khabarovsk Krai in the Russian Far East. The buyers will transport the gas to the Khabarovsk Krai through the pipeline systems of SMNG-Shelf and Daltransgas.

“There will be surplus gas that will have to be re-injected until such time as we develop the export market for the balance of the gas. We’re in discussions with the Chinese and Japan for possible delivery by pipeline.

“We don’t have an anticipated date for initiation for that delivery. We are in discussions now with CNPC in China, but no agreement has been concluded as yet.”

Long-term projections are for sustained export gas production from Chayvo, Odoptu and Arkuntun-Dagi to 2050.

Maximizing on lessons learned

Terni says, “The full development of Chayvo includes oil development in the initial investment phase with the companion domestic gas sale; the next step could be the development of the long-term export gas contract, which would be supplied from new additional wells at Chayvo.

“The development of the other fields will follow as capacity becomes available in the export pipeline system and at the processing facility. The current plan is to bring Odoptu on next.

“What we’re trying to do is optimize the use right now of theYastreb rig and the other facilities at Chayvo. The rig has a full schedule for drilling wells this coming year, and once that’s done, it could be moved up to Odoptu and begin drilling there.

“However, if we enter into an export gas contract, then we’ll leaveYastreb at Chayvo and consider another rig for Odoptu.”

He adds that the benefit of the company’s step-wise development of the fields is that “we’re taking one economic bite at a time.” Each of the steps will be justified on its own merits. “We’ll be able to take learning from our actual operating and execution experience in this remote location and frontier area and put that into our planning for subsequent phases. This will help us not only improve the management of the reservoirs from the operational perspective, but also help us control costs and finalize execution strategies for future phases.”

With Russian participation in construction at around 70% at the Chayvo site, Terni says the company is “getting to know the contractor community,” and the local resource base is growing with vendors and service contractors who are establishing themselves now in the new market and who “will be available for us the next time around.”

He also discussed the challenges of finding qualified manpower for a project of this scale on an island with an unemployment rate of only 1.5%. “If you look at the combination of operations and construction, the demand for people is very high. With this unemployment rate, there really is no pool of labor on the island per se. Many of our Russian contractors bring in skilled labor from other parts of Russia. That’s one source, and then there are some foreign contractors as well, engineers and skilled labor from other parts of the world.”

For foreign contractors and service providers who are interested in doing business with ExxonMobil for development of the remaining two fields, Terni recommends that “their best strategy is to hook up with Russian companies and learn how to do business in Russia.”

“We’re clearly going to be looking to domestic sources as a priority in terms of maximizing our Russian content. That has worked well in the first phase where foreign companies have worked directly with Russian companies to do much of our project, and I believe that will be the modus operandi in the future as well.”•

For further information about Russian companies now involved in Sakhalin, or about future contracting opportunities (all contracts have been awarded for Chayvo), visit www.sakhalin1.com, “contracting.”

Sakhalin-1 by the numbers

• Ranks as one of the largest single foreign direct investment projects in Russia today

• $40 billion in taxes, royalty payments, and state share of oil over the life of the project

• $100 million to the Sakhalin Development Fund over a five-year period

• $45 million in production bonuses

• $3.2 billion in contract awards to Russian companies (represents about two-thirds of total contracts to date)

• $200 million in Sakhalin infrastructure upgrades

• 13,000 direct and indirect local jobs will be created during the construction phase