Addax expanding, extending production from 'marginal' Nigerian fields

Jeremy Beckman

Editor, Europe

Big oil and LNG top the industry's agenda in Nigeria. But the government also wants action on smaller fields that have fallen off the radar screen. In many cases, discovery dates back decades, but development has been patchy or half-hearted.

Regeneration is usually left to indigenous oil companies in partnership with independent operators. Addax Petroleum, founded in 1994 to develop upstream opportunities in West Africa, has been one of the more dynamic newcomers of recent years. Addax, which today operates five concessions in Nigeria and Cameroon, is part of the AOG Group, a $3 billion/yr global operation focused on Africa. Activities range from trading in crude and refined petroleum products to retail distribution and bulk storage.

According to Phil Dolan, Addax Petroleum Services' technical manager, "Our focus since 1994 has been on the shallow water, exploited areas, where we have looked to pick up low risk and low cost opportunities. Any project we take on has to be relatively straightforward – as a small upstream company, we don't want to be saddled with a large capex burden. In general, the companies that formerly operated our assets left to develop business elsewhere."

Addax's first offshore venture was to sign a production sharing contract (PSC) for the Espoir field offshore Côte d'Ivoire, which Phillips abandoned in 1988. A redevelopment plan was submitted in 1997, but four years later, Addax sold its remaining equity in the field to new operator CNR. By that stage, funds were more urgently required for rehabilitation work offshore Nigeria. In the mid-1990s, Addax also picked up two blocks offshore Benin, but quickly relinquished them.

In 1998, Addax acquired the assets of Ashland Oil Nigeria, which wanted to exit the country's upstream sector after nearly two decades of continuous operations. Under a straightforward transfer, Addax signed two 25-year PSCs with the Nigerian National Petroleum Corp. covering offshore licenses OPL 98, 90, and 225, and onshore license OPL 118, with a total area of 3,120 sq km. The acreage included six producing offshore oilfields and two onshore and one promising commercial discovery, Okwori.

Addax also inherited 150 Nigerian staff. This number has since been augmented to 170, as the work program has expanded. A 20-strong technical team is based in Geneva, providing support to the main managerial and technical staff in operating company APDNL in Lagos.

"We come from large and small oil companies and contractors," Dolan explains, "with collectively wide international experience, and across-the-board technical competence. The real value-added work is handled in-house, but we do outsource during peak periods."

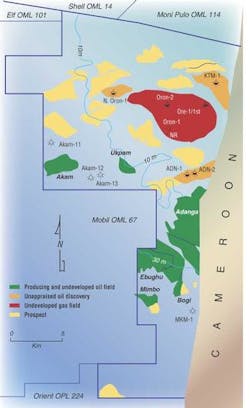

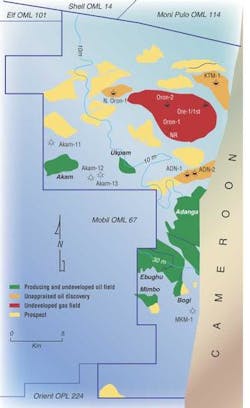

OPL 98

When Addax arrived, OPL 98, 70 km south of Calabar, had six fields in production, all discovered by Ashland during 1980-86. Akam came onstream in 1984, followed by Adanga in 1986, Bogi, Ebughu, and Mimbo in 1988, and finally Ukpam in 1989. Production facilities included six platforms installed in water 5-40 m deep and an FPSO leased from SBM and located at the Antan export terminal, which was also handling pro-cessed crude from Monipulo's Abana field to the north in license OML 114. By May 1998, these fields had produced 71 MMbbl – around 90% of what was then thought recoverable – and output had dipped from a peak of 40,000 b/d to just 7,000 b/d with a 60-90% water cut.

More than 60% of the remaining reserves appeared to lie in Ebughu. This field had been developed using a nine-slot platform, with one horizontal and two vertical gravel-packed wells supplied with lift gas from the original discovery well. But production rates from these wells had struggled to reach 500 b/d, due in part to water ingress through the thin rim of relatively viscous oil. In 1998-99, Addax conducted a study over the field with a view to redevelopment, combining existing well and production data with newly reprocessed 3D seismic. It concluded that the Greater Ebughu structure could contain 250 MMbbl of oil, over 10 times larger than previous estimates, with potential extensions of the reservoir in five directions.

Reservoir modeling suggested that new horizontal wells could recover 10 times the volumes of vertical wells over a 10-year period. Later that year, in an attempt to improve field production and recovery, jackup Percy Johns drilled five pilot holes from a single slot before completing the well as a horizontal producer. As a result of this test program, four more horizontal producers were drilled and completed. These and other appraisal wells confirmed the presence of oil-bearing sand in Ebughu West. The program also added 5 MMbbl of reserves per pilot hole to the OPL 98 total, at an estimated cost of $0.2/bbl

In 2000, six more appraisal wells were drilled, confirming the field's prognosed east, north, and northeastern extensions. More horizontal producers were drilled in Ebughu the following year, with a second appraisal well and the first horizontal producer on Ebughu Northeast. The success of this campaign encouraged Addax to implement rehabilitation work on the other five producing fields, as well as drilling untested extensions identified from the reprocessed 3D seismic.

Among these fields, Adanga had produced more than 40 MMbbl when Addax moved in as operator, representing 90% of the presumed recoverable total, with some wells producing at water cuts of 60-90%. A technical review of the field in 2000 revealed several undeveloped reservoirs and unappraised fault blocks, particularly in the south.

The following year, a redevelopment campaign was launched, with five appraisal wells and two producers drilled in the South-A block, proving in-place reserves of 97 MMbbl, almost doubling the previous estimate. Two producers were also drilled in the Main-Central block, increasing production potential by 10,000 b/d. A second drilling campaign discovered 32 MMbbl in place in the previously undrilled blocks 4 and South-B.

Addax has since drilled 10 horizontal producers into the southern blocks and installed two new wellhead clusters at Adanga South and Adanga Southwest. The Adanga Southwest facility originally comprised a single-well with a free-standing conductor, connected to the Adanga production platform via two 4-in. flowlines.

null

Early in 2002, Addax drilled a discovery well on the Oron West prospect, also in OPL 98, with estimated reserves of 22 MMbbl. There are three other undeveloped oil finds in the license, North Oron and Adanga North, Kita Marine, and Oron East, a 1 tcf gas field with a modest oil rim. Mobil is currently implementing a gas-gathering system for its fields in a neighboring block.

"We will look to exploit Oron East's gas once an appropriate market is identified," Dolan says, "but with gas reserves so plentiful in this part of the world, that looks to be some way off. In any case, we have to put in a scheme on our producing fields to reduce flaring to an operational minimum by 2008, in line with the government's directive. At the moment, we are using some of our gas for lift and as fuel for the FPSO, but the remainder is flared."

This year, Addax has also drilled and completed a water injector on the Adanga field to help offset the natural decline in reservoir pressure in an isolated fault block.

"We're using this well for 'dump flooding,' which involves drawing water from a shallower water-bearing reservoir and allowing it to flow down the well and straight into the depleted formation," Dolan says. The well has been equipped with a downhole flowmeters supplied by Expro.

"A major reason why our production and reserves growth has been so spectacular is the fact that we have done pilot drilling using logging-while-drilling techniques to very quickly identify productive formations in areas where we have shot or reprocessed seismic," Dolan says. "We have also introduced some innovative well designs managed by our local operating company APDNL using Schlumberger and Anadrill for deviation services."

The Knock Taggart FPSO, which replaced the SBM's FPSO IV (since redeployed to Petrobras' Espadarte field offshore Brazil), was commissioned in 1999, on a fast-track schedule. This was formerly a Suezmax tanker, built in 1974, which had been acquired by Fred. Olsen in 1987 and converted nine years later to a floating storage and offloading unit. After a short spell as an FSO on Abacan's Ima field, also in Nigeria, Fred. Olsen converted the unit to an FPSO in Hamburg, with first oil achieved on OPL 98 within six months of the contract signing. The vessel was originally designed to process 60,000 b/d of fluids, including 30,000 b/d of 32° API crude. However, as production of Ebughu's 20° API crude was stepped up, this degraded the blend from the six fields to 24° API, leading to build-up of emulsions in the process facilities. In 2001, the process train had to be reconfigured to allow the heavier Ebughu crude to be processed separately.

The following year, peak production of 30,000 b/d was reached. But because output from the overall OPL 98 development was set to increase steeply, a second process train was commissioned, designed to handle 30,000 b/d of light crude. This was installed in mid-2002, along with a new accommodation unit.

Okwori

OPLs 90 and 225 are situated 90 km south of Port Harcourt, in water depths ranging from 50-200 m. There are several undeveloped discoveries in this acreage, the largest being Okwori, in 140 m of water in the southern part of OPL 90. The field, which lies on the Agbara-Okwori Trend, was discovered by Occidental in 1971. The first well testing light oil at over 9,000 b/d was followed one year later by an appraisal well. But activity did not resume until 1994-97, when new operator Ashland drilled four successful appraisal wells to delineate the reservoir's extent. These wells revealed the presence of unconsolidated sands, with high levels of porosity and permeability, and oil columns varying from 5-350 ft.

Although Ashland submitted a development plan in 1997, Addax decided to mount its own review on becoming the new operator. It concluded that the existing 3D data sets could not be reprocessed to the standard required for the reservoir overview, so 148 sq km of new 3D seismic were acquired last year. The results were integrated with data from the Okwori wells to generate top reservoir maps. The field is geologically complex and highly faulted. Of the approximately 110 mapped fault blocks, 49 have been penetrated and 28 were found to be hydrocarbon bearing. Okwori contains proven reserves in eight reservoir layers confirmed by the results of seven previously drilled wells and 3D seismic.

"This is a collapsed crest rollover anticline, naturally more faulted on the crest, less so on the flanks," Dolan explained. "We don't know yet how many of the compartments contain oil and gas, so additional appraisal is planned during the development. But the drilling is not really complex. The challenge is well placement, ensuring we access as much of the oil in place with the minimum number of wells."

Addax modeled production on several different development scenarios, eventually settling on a phased scheme that would maximize recoverable reserves and would also eliminate flaring of associated gas, in line with the new regulations. Okwori will be developed by eight production wells and one gas (storage) injector. Four of the wells previously drilled by Ashland will be re-entered. Four new production wells will be drilled, each having high appraisal value.

All of the wells will be tied back with an individual flowline to a leased FPSO and will be gas lifted to maximize production rates and recovery. Well completions are designed to permit zonal selectivity, although the principle of commingled production is adhered to. Features of the well design included:

- Deviated wells to ensure good recovery from the various pools

- Single string, multi-zone completions, with commingled production of up to 6,000 b/d per well

- Gas lift maintaining production at high water cuts, with a minimum of workovers

- Expandable sand screens to guarantee sand-free production.

Expected reserves exceed 40 MMbbl. Prod-uction will be based around a converted, spread-moored FPSO, leased for an initial four-year period, with fluids processing capacity of 80,000 b/d; produced water treatment facilities; compression facilities for gas lift (24 MMcf/d) and storage. The vessel requirements are for a Suezmax tanker able to store 920,000 bbl, with stabilized crude offloaded to trading tankers. Capital costs are estimated at $230 million, with first oil in February 2005.

Exploration of high-grade oil prospects is also planned. Any successes could be tied into the FPSO. This might also necessitate expansion of the facilities. More development wells in Okwori and in any future discoveries will form part of a subsequent development phase. Addax anticipates using the ABB Vetco Gray trees and direct/ hydraulic control system bought by Ashland.

Addax expects to increase its total production from 32,000 b/d in 2002 to 38,000 b/d this year, with a longer-term target of 70,000 b/d by 2005.

"To date we have spent $650 million in our Nigerian operation," Dolan says. "We have am-assed a significant reserves base – currently 220 MMbbl, with significant production, and this is recognized by our investment banks, which enabled us to secure the present revolving credit facility."

Last December, Addax also signed its first concession contract in Cameroon for the shallow-water Ngosso permit. This lies in the prolific Rio del Rey basin, 20 km east of OPL 98, and in a similar geological setting. The 474-sq-km permit covers blocks MLH-9 and PH-48a, previously operated by Elf and Pecten, and contains both shallow deltaic Miocene targets and deeper Eocene turbidite plays. There may be analogies with deeper structures discovered nearby off Equatorial Guinea.

Addax operates with 60%, with Tullow Cam-eroon as its sole partner. Next year, the partners plan a 200-sq-km 3D seismic survey, partly to re-assess three existing discoveries, which were below Pecten's commercial threshold, according to Dolan, and drilling may follow.