GRAVITY BASED PLATFORMS: Formidable structure, easier construction, re-use all favor gravity based platforms

The gravity based platform has a considerable history offshore, but the variety of new gravity concepts is evidence of an industry continually seeking new and more economic ways to develop oil and gas reserves. This past year (2000) has experienced the installation of a variety of gravity platforms, tailored to satisfy contemporary economic drivers:

- Malampaya concrete gravity substructure (CGS), offshore The Philippines

- Hanze F2a steel gravity substructure (SGS), offshore The Netherlands

- Millom West suction bucket minimum facilities platform, in the Irish Sea

- River delta concrete barge production facilities, off Nigeria

- Legendre, a converted mat-supported jackup, located on the North-West Shelf off Australia.

Malampaya was the first CGS to be constructed in a developing country and exceeded expectations in both the construction quality achieved and the schedule. The structure was installed three months ahead of contract completion date. It is a remote hub development, located on the edge of the continental shelf, and will provide gas and condensate processing facilities for a field located in 850-meter water depths.

Hanze SGS is a novel design that provides oil storage in the base in conjunction with early drilling capability by jackup. The topsides facilities will be installed using a floatover technique in 2001. The use of a steel base, constructed using plate-line fabrication techniques and dry transported from Korea, offers an economic alternative to gravity based platforms that could have been constructed in Europe.

Millom West was originally conceived as a concrete gravity-based platform with steel legs. The designer was unable to develop a satisfactory design for the foundations, which led to a concept modification whereby a steel bucket was introduced at each of the four legs in place of the concrete base. The steel bucket concept is a combination of gravity base and skirt pile that is attractive where stiff foundation soils are present or very poor surface soils overly competent soils as found at Millom West.

Nigerian river delta barge production facilities have been constructed for a number of years on the Gulf coast of America and dry transported complete, thereby allowing rapid start-up of oil production in difficult terrain.

Legendre has been developed by converting a steel mat-supported jackup into a self-installing platform, which can be classed as an SGS when in place. This is an interesting concept but is one that cannot be replicated too frequently given the number of candidate jackup rigs available for conversion.

To illustrate how gravity platform concepts have adapted to today's economic climate, it is worthwhile examining the history of gravity platforms and the economic drivers that shaped their development, before examining modern trends in gravity platform development.

Development

The early development of gravity platforms in the 1970s was driven by the generic requirement to store large volumes of oil and support a heavy topsides in deepwater. A large number of platforms were constructed of this type, characterized by the Olav Olsen's "Condeep" concept.

All of these structures were partially built in a drydock and then completed afloat in sheltered waters. At that time, there was no pipeline infrastructure, and the capacity of heavy lift vessels was only a few thousand tons. It was determined that the oil storage requirement could be used to design a structure with sufficient buoyancy and stability to transport a heavy topsides from an inshore location to site.

Therefore, topsides could be assembled inshore, mated with the substructure at a sheltered deepwater location and extensively hooked up inshore, before the whole facility was transported to the field and installed.

The constraints that drove the early development of North Sea concrete gravity structures (CGS) changed over time. The pipeline infrastructure grew and became more economic and the capacity of crane vessels increased. The mold was finally broken through the construction and installation of the Ravenspurn North CGS in 1989.

Ravenspurn was dramatically smaller than the earlier versions, as it was not designed for oil storage or topside transportation. The reduction in size also permitted it to be the first to be entirely constructed within a drydock. The topsides were installed offshore using a heavy-lift vessel in what was a record lift at the time.

This platform, designed by Arup Energy, started a new style of "lightweight" concrete platforms characterized by square, rather than circular, cell construction, designed for shallower water applications, typically less than 100 meters water depth.

The Ravenspurn development opened up the world market for CGS units since the only construction facility needed was a dock of around 12 meters draft, which could generally be purpose-built for each field development. Eight platforms have subsequently been constructed on this basis, the latest being Malampaya.

The new lightweight platforms installed in regions remote from significant marine centres, such as Rotterdam and Singapore, have also taken advantage of the fact that the layout of the shafts of a CGS readily suits a barge floatover method of deck installation. The Wandoo CGS (Australia) was the first to exploit the economic advantage that this technique confers.

CGS applications

Historically, one concrete gravity platform is installed, on average, every year. The key characteristics singly, or in combination, that make CGS units the preferred solution are:

- Requirement for oil or condensate storage

- Heavy topsides

- Soil conditions that make piled substructures unattractive, such as on Australia's North-West Shelf

- Remote hub applications at the edge of the continental shelf where shallow water processing can be provided for deepwater subsea wells

- Desire to have a higher local content than has been achieved on previous field developments.

Arup Energy CGS units are all designed for ease of decommissioning and can be returned to inshore waters for dismantling and recycling. This has become a pre-requisite to CGS selection as detailed below.

Self-installing platforms

The substructure typically represents 15% of the total facility installed cost. Moreover, it is now considered that a concrete gravity substructure is a mature product, indicating there are probably only a few economic improvements that can now be made.

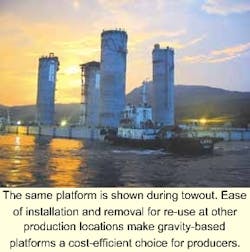

Therefore, in a market where cost reductions are expected, attention has turned towards ways in which gravity-based solutions can deliver further value improvements. One solution is found in using the benefits of the gravity base in delivering integrated platform solutions.

For any offshore installation the key cost drivers are the means of supporting the topsides process facilities and installing the platform offshore. This can be seen in the history of CGS units related earlier. By changing the way platforms are installed, great economies can be made. For example, Arup Energy developed the ACE range of self-installing platforms which combines the flexibility of gravity substructures, a novel but rational topside layout, and patented installation methods.

The main components of the generic platform concept are a steel gravity base, tubular or trussed legs, and a barge deck. The barge deck provides a large square or rectangular area for supporting the topside facilities. This has a number of benefits. Facilities can be laid out on a single level in a similar manner to an onshore plant. Equipment is linked by simple pipe runs requiring less 3D coordination than traditional facilities do. During facilities erection, the restrictions to crane access present on layered decks are eliminated. Facilities installation costs approaching onshore plant norms can be achieved. Fabricators indicate this equates to a 25-35% savings.

Subsea storage

A field development solution commonly adopted throughout Asia incorporates a number of fixed steel platforms as wellhead and production facilities together with a steel tanker floating storage and offloading (FSO) facility. The FSO is commonly leased and a 500,000-bbl tanker can command a day rate of US$20,000-40,000/day.

Providing concrete subsea storage tanks (CSST) to replace an FSO can be justified on capital cost grounds within a few years of use. On a whole-life-cost basis, CSST's offer a strong economic case, and a number of operators are giving them serious consideration.

Because of the high inherent durability of marine concretes, CSST's have operational lives substantially in excess of FSOs, with negligible maintenance costs. Consequently, they offer the facility of relocation and re-use on subsequent field developments. They can also be engineered for straightforward decommissioning.

Nearshore LNG terminals

The drive to reduce the quantity of associated gas that is flared on oil developments is leading to a growing interest in nearshore and offshore liquified natural gas (LNG) production and storage facilities. With the projected increase in worldwide trade of LNG and the growing reluctance of residents to accept the development of onshore terminals in the receiving countries, a number of offshore receiving terminal concepts have been proposed.

Recent savings in cost and delivery schedule identified by Arup Energy for offshore terminal concepts have made their development economic compared with onshore facilities and delivery times can better the shortest onshore schedules. These developments are sure to accelerate progress towards offshore terminals becoming a reality.

Decommissioning

In July 1998, the OSPAR Convention met in Sintra and issued Decision 98/3 on the Disposal of Disused Offshore Installations in the North-East Atlantic. Accompanying the decision was a statement that contracting parties "have no plans to create new concrete installations in any new oilfield developments in the maritime area." While the statement has no legal standing, it was unfortunately taken by some parts of the industry to be a ban on concrete platforms. Leading European designers and constructors met and agreed a joint communiqu, affirming that:

- Concrete platforms are now designed for complete removal at the end of their productive lives, as required by IMO guidelines and OSPAR Decision 98/3.

- The materials of construction can be re-cycled.

- Onshore or nearshore platform dismantling is feasible and associated costs will not be prohibitive, compared to other disposal options.

- Concrete platform construction, operation, and disposal can be managed to cause less impact to the environment than alternative field development options.

On the basis of the above considerations, the Sintra statement was considered unnecessary, but it remains the case that no concrete platform developments have commenced in the North-East Atlantic since the statement was issued.

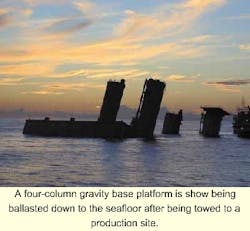

Regulatory developments such as the Sintra statement make the argument for adopting self-installing platforms more compelling, as nothing remains on the seabed when the platform is removed in a reversal of the installation sequence.

Conclusions

The strongest areas of growth for gravity platform concepts are ones that:

- Self-install, are removable, and relocatable

- Provide more economic topsides fabrication and installation than conventional solutions are able to offer

- Provide a cheaper way to store hydrocarbons.

Operators have a wide variety of designers and constructors to choose from in a mature market of gravity platform products. However, it remains the case that gravity platforms are under-represented in field developments worldwide. The merits of gravity-based platforms are becoming more visible and this may translate in a greater market share in the future.