UK suffering most, but interference continues everywhere

Jeremy Beckman

Editor, EuropeNick Terdre

Editor, NorwayNeil Potter

Contributing Editor

Returns from Chevron/Conoco's Britannia platform, nearing completion in the Central North Sea, may be hit by threatened changes to the UK tax regime.

- Esso's Jotun floating storage unit built by Kværner Masa-Yards in Turku, Finland. This is one of several major floating production projects coming to fruition in Norway at present. [18,879 bytes]

- Probable UK field developments coming on stream 1998-99 [113,084 bytes]

- Location of current and future field developments in the Danish North Sea. [66,550 bytes]

- Until now, production from Mittelplatte sector has been limited to these artificial island facilities for environmental reasons, but shore-based extended reach wells should bring increased oil yield. [18,521 bytes]

The net result for offshore European producers appears to be a whole set of new regulations, suspended field developments, and a general increase in interference by the state in petroleum activities.

At present, the established North Sea players may endure the changes. Long-term investments cannot be jettisoned at a single stroke. But there will certainly be a temptation to re-direct efforts at prolific deepwater plays elsewhere, however difficult the ruling regime, if European states continue to violate the oil industry's rights.

Drilling and development activity in the four major western Europe sectors active in the North Sea and Eastern Atlantic vary considerably in response to internal and external activity drivers.

Norwegian sector robust despite delays

Despite government attempts to dampen the high level of activity in Norway's offshore sector, investments are still riding amazingly high. Back in March, oil and energy minister Marit Arnstad announced that a year's delay would be imposed on 12 selected field development projects in order to reduce 1998 investments in the sector by NKr 5 billion to NKr 62 billion and release some pressure from an economy close to over-heating.At end-May, the Central Bureau of Statistics (SSB) forecast 1998 investments of NKr 73.4 billion. This figure is not directly comparable with that of the ministry, as it measures a wider range of activities, but to put it into perspective, it represents a 17.4% increase over last year's final figure of NKr 62.5 billion, which was itself a record.

So even at a time of ultra-low oil prices, which elsewhere are prompting a slowdown in activity, in Norway investments are still at boiling level - which must say something for the sector's robustness.

The optimistic mood that currently grips the sector is based in part on the success of the Norsok movement to reduce project costs and times. But one problem in particular has so far remained impervious to Norsok's methods: the cost and time overruns on newbuild production ships.

Late production ships

Esso Norge, which had hoped to have the Balder production ship in operation by early 1997, is now tentatively targeting mid-1999 and faces an increase in project costs of some NKr 3 billion, equivalent to almost two-thirds of its original estimate. The hull for Statoil's Åsgard A production ship was delivered two months late and incomplete, necessitating one million carry-over hours of work and a four-month delay in start-up. The additional work involved accounts for a substantial part of the 24% increase in the estimated cost of the vessel to NKr 6.89 billion. Saga's Varg project has also experienced considerable cost overruns and delays.Problems have arisen, even when a project is run according to Norsok principles, with an integrated team made up of operator and contractor personnel. This is the case with Åsgard A, says Svein Bredahl, who is Aker Maritime's project manager for the ship.

To a large degree, the problems stem from using shipyards whose main business is the construction of standard ships rather than offshore units, Bredahl says. There are many differences. For example, the production ship hull is not standardized, but tailored to field requirements. It is designed to stay in one place for the duration of the field production period rather than being brought periodically to shore for maintenance. And changes are normal during the course of construction, which is not the case with a standard ship.

The EPC contract which is normally placed for a production ship puts a lot of responsibility on the yard's shoulders, Bredahl says, and it is put under further pressure if the schedule is such that construction has to begin before engineering is complete.

The extensive interface between the hull and the topsides, which requires close coordination between the hull builder and the topsides supplier, has also proved to be a source of setbacks.

Away from tradition

To an extent, the situation can be blamed on the lack of tradition in building production ships. "If we went into a second project, both the yard - Hitachi - and we ourselves would improve, I'm sure," Bredahl says.For Finn Aamodt, managing director of OLF, the Norwegian Oil Industry Association, which, together with the contractors association TBL, is running the Norsok program, these problems are not an indication that Norsok has failed, but that more work has to be done to bring them under control.

"We need to look very seriously at projects going beyond their budgets," he says, "And this we shall do in Norsok phase two."

The first phase of work focused on developing standards and redrawing contract terms to reflect the new cooperative approach rather than the old adversarial attitude. In phase two, it will be important to find ways of implementing in practice the intentions laid down in phase one, Aamodt says.

He accepts that in some respects, unrealistic goals were set. "For example, we had the ambition of completing a fair-size project in 18-24 months, but now companies think that it will be more cost-effective to do it in 30 months," he says. "I have great hopes of more realistic prognoses in phase two."

UK operators under fire as unease, apathy set in

In the UK, the collective drive towards lower cost field solutions has been replaced by an atmosphere of unease and, in some cases, apathy. The root cause is the Labour government's twin-pronged assault on the petroleum tax regime and the UK's power generation market.Labour signaled impending tax changes last year after returning to power with a huge parliamentary majority. Its proposals were outlined in this March's budget, but the final decision has been repeatedly deferred. UKOOA, the offshore operators' association, has said that the delays are damaging UK sector activity. The government has countered that UKOOA itself is to blame, having requested extensions to the consultation process.

In fact, UKOOA has maintained consistently that there is no need to change the fiscal regime. And a recent review by Commerzbank Oil and Gas in London illustrates why. The previous Conservative administration instituted petroleum tax cuts in 1993 following years of falling production and consistently lower oil prices. Simultaneously, Britain's oil industry was in the midst of an overheads purge.

By end-1997, the result was a 20% average return on upstream capital expenditure among the UK sector oil majors, compared to 12% a decade earlier. But the government's revenues had fallen to one-fifth of the peak generated in the mid-1980s.

Labour extracts due

To reverse this decline, the Labour government put forward two new tax options this March which would impact some operators more than others - hence the muted response from individual oil companies. A verdict may have been announced since this edition of Offshore went to press. Whatever the outcome, someone will have to pay as Labour honors its pledge to up spending on public sector health and education.Exploration activity has suffered from the uncertainty. At this May's IADC meeting in Paris, for example, BP's Peter Rattey said his company would drill no new UK exploration wells this year due to the tax threat and high rig costs.

There has also been a noticeable plunge this year in UKCS seismic surveys, and the old North Sea/Irish Sea acreage offered under the latest licence round did not trigger dancing on UKOOA members' porches. Planning on two oilfield developments, Fina's Otter and BP's Clair, was officially halted due to the tax uncertainty - although both projects are also long-running sagas of technical setbacks and partner disagreement.

UKOOA's damage claim is harder to quantify in development terms. A procession of new UK fields is due onstream between now and end-1999. And fast-tracking of discoveries is continuing, particularly in the Outer Moray Firth and the Central North Sea.

But a high percentage of these upcoming projects are subsea and extended reach, which will not silence the protests of the UK Offshore Contractors' Association. Their latest research warns of a 50% drop in sales by UK oil service suppliers if the new taxes are set too high, forcing a third out of business.

Muted development

The fabricators' problems have been compounded by the low oil price, which has muted enthusiasm for further West of Shetland development. Only Greenpeace has kept that sector in the news of late, by sending swimmers into the path of a Conoco seismic vessel.Another headache for the industry - again, politically influenced - concerns the government's plans to slow down growth of gas-fired power stations on the UK mainland. By forcing generators to adopt a wider spread of power sources, the government claims it will benefit consumers in terms of lower electricity prices. One of these sources happens to be British coal, the future of which depends on further state intervention.

Loss of coalmining jobs is more emotive to the British public than similar cuts in the gas industry, which might invalidate a new Arthur D Little study commissioned by UKOOA. This concluded that restrictions on gas-fired power stations could cause:

- Investments in new UK sector gasfields totaling $3.5 billion to be delayed

- UK offshore gas exploration to be reduced by $1.12 billion

- 1,300 UK gas industry jobs to be lost

- $2.8 billion lost North Sea revenue to the UK Treasury.

Dutch sector fears further restrictions

Political uncertainty is also overshadowing the Dutch offshore oil and gas sector. The country's May election resulted in a victory for the so-called "Pink Cabinet" coalition of socialists (PvdA), liberals (VVD) and democrats (D66). However, former minister of economic affairs Hans Wijers who provided the legal basis for liberalization of the Dutch energy markets, will not, it appears, be a member of the new administration.Last November, the previous Cabinet approved the proposal for a new act on Dutch mining activities. This will replace all existing legislation - some of which dates back to 1810 - with all-encompassing legislation covering exploration and production off and onshore. The proposed Act was to have been submitted to Parliament earlier this year, but with a new cabinet unlikely to be have been formed until this month, that procedure will likely be delayed until September.

The Ministry of Mines has stated in advance that "storage underground will be explicitly dealt with, while special attention is being paid to effective production, removal of mining installations, abandonment of pipelines, subsidence and earthquakes which are the result of production activities. Existing regulations and ministerial decrees will be amended for the purpose of implementing the new legislation."

But Dutch shelf operators are far from happy with some of the finer print gleaned from the proposals. Nogepa, the Dutch organization for oil and gas producers, claims that the new legislation, through allegedly toughening criteria under which licences are granted, will actually deter companies from operating in The Netherlands.

Producers unhappy

A key threat appears to be that the Ministry of Economic Affairs can refuse to take back a production licence once it has been awarded. In theory, the operator could thereby be forced to develop an unprofitable field. Another clause is said to allow the government the right to refuse issuing a licence on the grounds that dumping could lead to pollution of the seabed or water table.Barend Smits, Nogepa chairman, said that the draft Mining Law will lead to less financial flexibility for his members at a time when the industry needs more flexibility. "The law has been written with what appears to be a deliberate effort to rob producers of existing rights." Companies, he adds, could lose investments already committed to exploration.

A number of his members, he pointed out, were already exiting the production sector or reducing their activities in The Netherlands, or alternately concentrating more on gas transport and storage operations.

NAM, for instance, is reported to have acquired Fina's entire holding in block M-1 A, a deal which marks the end of Fina's Dutch sector activity. Occidental too is selling interests in eight gas-producing licences in order to concentrate on other regions with longer-term potential.

On a more positive front, Gasunie, the monopolistic Dutch gas utility, is considering investing in a new undersea pipeline linking the UK with continental supplies. There is consensus that the UK will have to start importing gas some time soon in the new decade.

Pino ter Gast, gas purchase director at Gasunie, has commented that: "Hub-Holland is situated in the northern part of The Netherlands with the onshore Groningen Field as the focal point. In addition, it consists of a wide range of smaller gas fields both onshore and offshore and is directly connected to the Norpipe and Europipe North Sea trunklines. It is capable of delivering in excess of 600 MMcm/d of gas.

"Hub-Holland proposes to get connected to the UK and is looking for potential customers, which can be divided into three groups: producers of high load-factor gas, traders and shippers, and end-users. From the map it should be clear that there is no sense in making use of the existing UK-Belgium Interconnector for our plans."

Gasunie has since issued pre-qualification documents for this project. These cover survey work and supply of pipe and both non-metallic and concrete coating services for a 155 km, 42-in. diameter pipeline from Callanstoog in north Holland to a riser platform on Shell's Corvette Field in the UK southern North Sea. This summer, Shell is laying a 20-in. line from Corvette to the Leman A platform, from where gas in this area is routed to the Bacton terminal in Norfolk, UK.

But Gasunie also maintains that this route is just one option. Another would be to lay the line direct to Bacton. No final decision has been taken yet on the route or pipeline size as the diameter would depend on market expectations.

Several very large underground storage facilities have recently been built in mainland Holland, but uncommitted Dutch shelf gas is being kept as a long-term strategic reserve. So where is the gas to come from for an import-export contract?

By 2001, The Netherlands will be importing Russian gas at a contracted rate of 80 bcm over 25 years, and there will also be a connection between these reserves and Hub-Holland. The capacity at the delivery point vastly exceeds the daily quantities so far agreed between the Russians and Gasunie for its own market. "You can be assured," says ter Gast, "that we will do our utmost to convince the Russians that the route via Hub-Holland to the UK is best for all parties concerned."

Another alternative would be to route gas from Norway. Ullage in the existing Norpipe and Europipe North Sea trunklines could be used to send gas to The Netherlands during the summer, then onwards to the UK come winter time. Gasunie wants to discuss this possibility with Norway.

Denmark capitalizing on production success

One nation that seems to be relaxing state interference and welcoming outsiders is Denmark. Since February 1997, an "open door" procedure has been in place, inviting oil companies to bid for licences in acreage east of 6°15' longitude. These terms do not require the companies to commit to drilling wells before seismic has been shot.According to the Danish Energy Agency's 1997 review, the policy has been a success, with five licences granted last year, leading to a resumption of exploration in the relatively neglected offshore areas outside the Danish Central Graben. This year, 10 applications were also received for the country's 5th licensing round covering waters west of 6°15' longitude. Several newcomers were awarded acreage including Arco, Marathon, and Saga. The resultant exploration commitments are estimated at DKr 1.7 billion.

Foreign interest has been stoked by Statoil's Siri discovery in Tertiary sandstones 25 km east of the Central Graben, and by Amerada Hess' appraisal work on the old Arne South discovery to the south-west. Both fields are currently undergoing major developments by Danish standards which will provide a substantial boost to Danish oil production.

Siri's scheme is based on a production platform connected to an oil storage tank on the seabed, with oil offloaded to tankers via a buoy. One novel aspect of the development is the plan to simultaneously inject gas and water through three deviated wells to aid oil recovery. Arne South also features a wellhead/processing platform and seabed storage facility.

Arne South's gas will feed into a new 300-km-long, 24-in. diameter Danish North Sea trunkline commissioned by Dansk Olje og Naturgas. This will terminate at DONG's gas processing facilities in Nybro on the Jutland west coast. The line also has spare capacity which could be used to import Norwegian supplies and also gas from hitherto undeveloped Danish fields.

Minor sandstones

Specifically, the Energy Agency hopes the line will spur exploitation of known minor sandstone reservoirs dotted across the Danish sector. Until Harald, Denmark's first sandstone development, came onstream last year, all previous Danish offshore production had originated from chalk structures, which were easier to identify during the early days of seismic mapping. Most of the sandstone discoveries are marginal, but the emerging oil and gas infrastructure could trigger some creative thinking.Otherwise, the dominant DUC consortium continues to find new ways of squeezing extra reserves from producing fields. Horizontal wells are under review for this purpose in the Tyra Field's oil zone. Earlier this year, Maersk appraised the Adda accumulation with a view to development as a satellite tieback to Tyra. The well drilled two separate horizontal sections, one in the lower Cretaceous and the other in the lower part of the Upper Cretaceous. If development proceeds, it would be the first on the Danish shelf to co-produce from two independent reservoir zones.

As part of the Joint Chalk Research Program with Norway, Danish companies are also looking at ways of improving recovery from their chalk reserves. Techniques under study include injecting and then igniting atmospheric air in the reservoirs, and also blowdown of pressure in water-flooded chalk.

German development gets underway

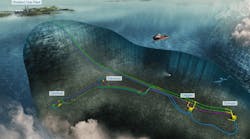

Current activity in the German North Sea is also unprecedented. Wintershall has commissioned a shallow water production platform for A/6-B/4, the sector's only commercial gas discovery to date (450 bcf of gas and 4 million bbl of condensate within two separate reservoirs). Gas will be exported via a new 120 km, 24-in. pipeline to Amoco's F3-FB platform in the Dutch sector.Wintershall and BEB plan four further exploration wells offshore Germany, report analysts Wood Mackenzie. And RWE-DEA plans a surge in production from the near coastal Mittelplatte reservoir via shore-based extended reach wells. A more detailed report will appear in a forthcoming issue of Offshore.

Copyright 1998 Oil & Gas Journal. All Rights Reserved.