Schedule, cost, timing, rate-of-return, and variable risks play role in deciding on mobile production platform

John E. Van Meter

Paragon Engineering Services

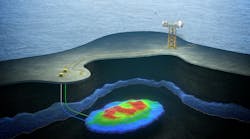

Conversion of jackup drilling rigs to production units is a product of the development of marginal fields. platform costs can be spread over several fields, making this option more attractive.

For more and more applications, oil companies are considering the use of mobile offshore production units (MOPUs), especially jackups, instead of conventional platforms. A variety of economic considerations usually come into play in making such a decision.

This article presents a detailed discussion of the three main economic items that are usually taken into consideration in the decision-making process: schedule, cost, and risk. When compared with conventional offshore developments, MOPUs have demonstrated potential economic advantages in each of these areas.

In regard to schedule, an available jackup can generally be fitted for production and routed to its location in less time than required to build a conventional site-specific structure and facilities. Construction market conditions may often dictate that it is less costly to retrofit an existing jackup than it is to build and install a conventional platform.

The fact that a jackup can easily be moved to another location or retrofitted for another purpose minimizes the financial and market risks of using them for marginal reservoirs or other applications with high degrees of uncertainty. Each of these factors, schedule, rate of return, cost, and risk, are discussed below:

Schedule

Four primary factors tend to fuel oil companies offshore schedule constraints:

- Lease term-related considerations

- Reservoirs in which competitive lease holders may take action to recover common reserves

- Time value of money (rate of return) considerations

- Cash flow criteria.

Modern lease terms, both domestic and international, possess well defined limitations regarding the time allotted to develop reserves. Events such as the need for complicated seismic evaluations or the farm-in of a soon-to-expire lease can create schedules in which failure to produce may result in loss of the lease. In such situations, the application of a MOPU, even at a premium cost, may be justified.

Competitive situations frequently occur today as new seismic techniques reveal reservoirs which may be marginally economic even when existing operators have facilities in place. In such circumstances, it is vital that management be able to move decisively toward development.

Use of a MOPU is evidence of such action. Even if the ultimate aim of management's actions is to achieve a unitized development, the existence and availability of a MOPU may be the operator's best negotiating tool.

Rate of return

A project's rate of return may be greatly influenced by the development schedule. In the event that there are material, labor, or yard space shortages that would delay construction time of a site-specific conventional facility, either lease of an existing MOPU or retrofitting of an alternate-purpose jackup may significantly shorten the time required to achieve production.

This assertion is especially true in water depths of more than 150 ft, where design, construction, and installation times can be significant. The increase in net present value from several months of accelerated production can be several million dollars, with a corresponding increase in project rate of return.

As more and more smaller operating companies move into the offshore arena, cash flow criteria represent a significantly greater factor than in the past. Accustomed to onshore operations in which leased equipment is a way of life, the operators recognize the large demands that offshore construction places on capital and cash resources.

The need to bring early production onstream to assist in project financing becomes the overriding consideration in some cases. In others, management may simply be more comfortable with the reduced up-front cash demands of a leased facility, especially one that can easily be relocated. The use of MOPUs provides for an excellent fit in such cases.

Development costs

In any project evaluation, analyses of alternate development costs comprise the key to long-term success. The considerations for use of a MOPU are extremely complex due to the multifaceted market for jackups. Since jackups can be used as drilling rigs, accommodation platforms, construction facilities, and pipelay spreads as well as for production operations, activity levels in all of these areas can affect jackup availability and price for use as a MOPU.

Additionally, technical constraints may limit the number of units suitable for a particular application. Water depth, environmental conditions, seafloor geotechnical considerations, and production payload requirements all contribute to the determination of the proper jackup applications.

Construction yard activity also affects overall MOPU cost. If conventional platform yards are in need of work, costs for those platforms will be relatively low. However, this factor may also reduce the cost of any jackup refurbishment or repair that may be required. The overall cost evaluations must be made in regard to the specific MOPU and its technical requirements in order to facilitate determination of the cost effectiveness of this alternative.

Two cost considerations that generally favor MOPU use are installation and abandonment costs. Since the facility can be relocated with minimal construction and logistics equipment, the cost of MOPU installation and abandonment is considerably less than that for conventional platforms. For short-lived fields, reduced abandonment cost is significant because these costs disproportionately affect net present value and rate of return due to the fact that the discount period is short.

Finally, the effects of a leased facility on tax and/or cost recovery formulas should not be overlooked. This factor may be especially important in overseas concessions.

Risk

In newly developing areas, new projects pose significant risks. Political concerns may make timely development essential while not providing adequate time to properly evaluate new reservoirs. MOPUs are often used for extended well tests in such areas. This concept allows further definition of reservoir characteristics, early development and cash flow, and a minimal-risked investment that can be recovered with relative ease.

MOPUs can also be used in times when product market risks are high. The ability to release an unprofitable facility with possible alternative applications makes the risk acceptable in some cases.

Finally, where time frame uncertainties call for temporary production operations, MOPUs offer the perfect solution. Temporary compression facilities, phased development options, and highly competitive fields are examples in which the low-risked monies of MOPU use represent an optimum balance between aggressive management and prudent operations.

The case for mobile production units:

- Less time to convert rig than build platform

- Less costly to convert rig than build platform

- Ideal for approaching lease expiration date

- Offers lease drainage protection

- Accelerate schedule to first production

- Ease of relocation when risks are high

- Reduced up-front capital costs

- Option to build or convert mobile unit

- Wellheads at surface

- Lower abandonment costs

- Leased facility better for tax consequences

- Facility can be released when product prices fall

- Allow option to develop field in phases

- Conversion requires dock space, not yard space

Conclusions

Given the above schedule, cost, and risk factors, several general situations come to mind as potential mobile offshore production unit applications. Some of these applications are mentioned above, but it is useful to summarize the most likely occasions for MOPU utilization:

- Extended well tests.

- Short-lived fields.

- Applications in which the project is cash or capital constrained.

- Competitive fields and other schedule-driven projects.

- Clearly, MOPUs are potentially useful, practical, and economic in a wide variety of applications.

AUTHOR

John E. Van Meter serves as technology manager for Houston-based Paragon Engineering Services, Inc. He has worked as a project manager and engineer for onshore and offshore oil and gas production facility projects since 1974. He is in charge of training offerings, new ventures, international ventures, Process Safety Management (PSM) and Safety and Environmental Management Program (SEMP) services, and technical translation projects for Paragon.

Copyright 1995 Offshore. All Rights Reserved.