Offshore staff

FAVERSHAM, UK – Westwood Energy expects global deepwater spending to total $126.9 billion during 2017-21.

According to the analyst’s updated World Deepwater Market Forecast, the main focus of activities will likely be on Africa and the Americas, which are set to account for more than 78% of the forecast expenditure.

While project sanctioning has picked up over the past 12 months, operators remain cautious on project spending, the analyst says, and are increasingly selectingphased development concepts to limit the risk and financial exposure typically associated with deepwater production.

The updated report highlights 114 potential projects that will likely drive drilling and installation activity, an 11% increase compared to Westwood’s 3Q data update. Among the other main findings are:

- Asia will experience an increased level of investment in deepwater projects post-2017.

- Despite the low day rates for MODUs, subsea drilling and completion expenditure will grow at an 8% CAGR, and account for 32% of forecast expenditure.

- Subsea production equipment, SURF, and pipelines will cover 39% of forecast expenditure.

- Floating production units will account for 29% of forecast expenditure, driven at present by FPSOs such as Total’s Egina and Kaombo, both of which were sanctioned prior to the recent downturn.

If oil prices remain relatively stable above $50/bbl, lower drilling and equipment costs could stimulate further project sanctioning over the next 18 months, the report adds.

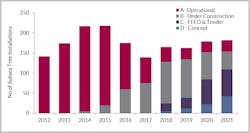

Analysis is based on Westwood’s SECTORS database, which lists more than 900 deepwater projects.

10/06/2017