Offshore staff

EDINBURGH, UK – Two-and-a-half years since the 2014 referendum, the prospect of Scottish independence is again on the agenda, linked to the UK’s decision to quit the European Union.

Over the intervening period, as analystWood Mackenzie points out, there have been sweeping changes in both the North Sea industry following the oil price plunge.

Companies operating on the UK continental shelf (UKCS) have sought to survive the downturn by cutting costs to ensure cash flow.

Wood Mackenzie says the offshore industry has been a cornerstone of the UK economy, and will play a vital role in the campaign for a second referendum.

In August 2014, when the analyst previously assessed the implications of Scottish independence, the UKCS offshore industry was undergoing production under-performance, faltering exploration, and a very high cost environment.

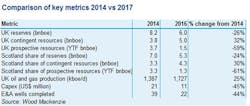

Although the picture has improved since, various issues still remain, notably that the UK’s commercial reserves have decreased by around 30%. This is chiefly due to 1.6 Bboe produced being replaced with just 0.1 Bboe of new commercial discoveries.

A further 1.3 Bboe has been removed through downgrades on developed and undeveloped fields, mainly as a result of the lower oil price. In some cases, the downgrades are due to fields ceasing production earlier because of the lower oil price.

The fiscal landscape has also changed. Currently government tax receipts are negative, as companies receive more in decommissioning rebates than they pay in tax.

During the run-up to the 2014 independence vote, the volume and value of reserves was central to the debate, with oil revenues expected to underpin an independent Scotland’s economy.

As of Jan. 1, 2017, Wood Mackenzie estimates that the UKCS has 6 Bboe of recoverable reserves, of which 5.3 Bboe - 88% - lie in Scottish waters. This split has been calculated using the Scottish Adjacent Boundary Order 1999, and includes producing fields, fields under development due to start production soon, and ready-to-go, pre-final investment decision projects.

Based on this reserves calculation, Wood Mackenzie estimates a pre-tax value of £44 billion ($454.39 billion) for fields in Scottish waters, adding that oil and gas tax revenue will therefore play a smaller part in the economic case for independence should a second referendum be held.

There could be an additional 4.3 Bboe of contingent resources for Scotland, some of which may be upgraded to reserves depending on factors such as cost reductions and the oil price, while there could be a further 1.3 Bboe of yet-to-find resources for Scotland.

Although 11 Bboe of total reserves and resources lie in Scottish waters, the analyst points out that the obligation to decommission the majority of fields equates to 80% of the UK’s total decommissioning cost.

Oil companies will therefore seek reassurances that, shouldScotland vote for independence, they will continue to have access to the decommissioning tax relief they currently receive.

However, Wood Mackenzie claims the outlook is not encouraging. It expects UK offshore investment to continue declining, given that capex has fallen by two-thirds since 2014, and it expects capex to halve from its current level during the next three years.

Critically, political uncertainty could also deter investors from committing to new projects, with the risk that time-critical field developments may become uneconomic if delayed in the short term.

Only 13 fields await an investment decision, 11 of which are in Scottish waters. On the bright side, fields that are sanctioned this year will benefit from cost reductions in the supply chain, which have helped lower the break-even price, increasing the likelihood of sanction.

03/17/2017