Offshore staff

LONDON – Independent Oil and Gas is negotiating to acquire a currently disused gas pipeline in the UK southern North Sea.

The company has entered into a memorandum of understanding that contains exclusivity provisions that run until Feb. 28. Assuming the negotiations are successful, IOG would assume operatorship of the pipeline and liability for its future decommissioning, and of the associated onshore facilities.

The reception terminal has the capacity to receive more than 400 bcf of gas at rates of up to 200 MMcf/d for more than 20 years.

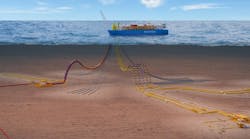

Following the acquisition, the company plans an intelligent pigging inspection to ensure the pipeline’s integrity for safe re-use, and will then re-commission it to enable evacuation of gas from IOG’s Blythe andVulcan Satellites hubs. This would involve the installation of inter-field pipelines and tie-in points.

The existing pipeline, with its 300 MMcf/d capacity, could also accommodate gas from IOG’sHarvey discovery, subject to further appraisal, and further supplies from third-party users.

Britain’s Oil and Gas Authority (OGA) is said to be supportive of the proposals, which have been incorporated in the draft Blythe field development plan that IOG submitted to the OGA last month.

In the UK northern North Sea, IOG operates the heavy-oil Skipper field, where an appraisal well was drilled last summer.

Samples of oil retrieved from the well show a high density of around 11° API, a high viscosity, and a high total acid number. However, the oil is said to be mobile in the very high permeability reservoir and also mobile at ambient conditions due to its low wax content.

IOG is performing evaluations that include building a reservoir model to simulate the oil’s mobility in the reservoir. If it can come up with an economic field development plan, the oil properties will be challenging, it says, in terms of refining and marketability.

Depending on where and when the crude is sold, it would likely trade at a significant discount to the prevailing quoted Brent oil price.

01/16/2017