Analyst assesses impact of grounded helicopters

Offshore staff

LONDON – The fatal helicopter crash in April 2016 near Turøy, Norway, involving the H225/EC225 has created uncertainty surrounding the future supply of Airbus’s heavy aircraft, a recent update from analyst firm Douglas-Westwood (DW) posits.

In its soon-to-be published World Offshore Helicopters Market Forecast 2017-2021, DW has analyzed the impact of the H225 issues.

In spite of the European safety regulator’s decision to lift the flight ban on the Super Puma models, the Super Pumas continue to be grounded bythe UK and the Norwegian Civil Aviation Authorities, with operators such as Statoil dropping the Super Pumas for good.

Should the grounding of the H225 continue, the most significant effect would be seen in Western Europe. As of December 2016, the H225 alone accounts for 65% of the region’s total large helicopter supply.

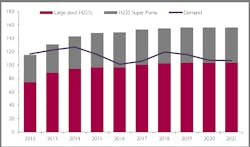

In 2016, helicopter utilization across the medium (including next generation medium) and large aircraft is estimated to have averaged 58%. The large segment is anticipated to have seen a higher utilization at 68%, compared to medium units at 49%. This implied utilization rate is inclusive of the 52 Airbus Super Puma units in Western Europe.

In 2017, DW forecasts large helicopter utilization at 59%. In the event that all 52 units are removed from Western Europe’s supply, the utilization rate is projected to improve considerably to 105% for large helicopters (i.e. implying a slight undersupply) – the most significant increase in utilization compared to other regions.

This undersupply in Western Europe creates an opportunity for helicopter manufacturers to address the potential gap in the market. The undersupply would most likely be met by a combination of large helicopters from other regions and a surplus of medium and next generation medium aircraft already in Western Europe.

As of December 2016, CHC has announced its new contract with Wintershall Norge As for the provision of helicopter drilling support services off Norway using a Sikorsky S-92 from March 2017.

While the market for helicopter support services has been hit significantly since the oil price crash, and recent helicopter accidents have amplified this effect, for some aircraft manufacturers, the potential of a shift from an oversupply to undersupply will present opportunities for suitably-placed suppliers.

12/19/2016