NZOG exits Kupe fields

Offshore staff

WELLINGTON, New Zealand – New Zealand Oil & Gas (NZOG) has reached an agreement to sell its share of 15% interest in the Kupe gas and oil fields and production station to project partner and New Zealand compatriot Genesis Energy for NZ$168 million (more than $119 million).

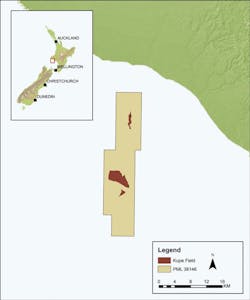

The Kupe Central Field Area is located about 30 km (19 mi)offshore New Zealand, in the Taranaki basin, within PML. Water depth is around 35 m (115 ft).

The agreement is subject to approval by NZOG shareholders and a special meeting will be arranged on Dec. 16. The approval of the Minister of Energy and Resources will be sought.

NZOG acting-CEO Andrew Jefferies said: “Since we worked with our joint venture partners to upgrade ourKupe reserves over the last year or so, we have been clear that the investment provides considerable upside for our shareholders. The transaction with Genesis allows New Zealand Oil & Gas to realize this upside now, while removing the risks of development and uncertainty around future market conditions.”

In April, the gas and light oil/condensate field’s reserves were upgraded from 5.22 MMboe to 6.02 MMboe. A 34.7% increase was previously announced in October 2015.

The effective date of the transaction will be Jan. 1, 2017, and includes NZOG’s entitlement to overriding royalty interests. The company said that it would return $100 million to shareholders in 2017 if the transaction is approved at December’s special meeting.

First discovered in 1986,Kupe entered production in 2009. It is operated by Origin Energy, which has a 50% interest. Genesis Energy currently holds a 31% interest and Mitsui E&P holds 4%. NZOG sells its gas from the field to Genesis, and its liquid petroleum gas to Vector.

“New Zealand Oil & Gas believes the offer from Genesis is fully priced. It is at the higher end of our valuation range and therefore the board recommends that shareholders should approve the transaction. A notice of meeting will be posted soon,” Jefferies said.

11/16/2016