Offshore drilling permits show dismal numbers in new report

Offshore staff

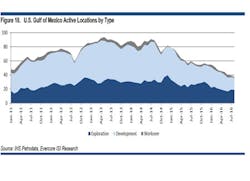

NEW YORK–Evercore ISI’s Oilfield Services, Equipment & Drilling group released its latest report detailing US drilling permit data, which the analyst firm said it monitors as a “leading indicator” for near-term drilling activity.

Updated monthly, this edition of the report did not contain many bright spots for theoffshore industry, with Evercore noting that it found its downturn to be “sinking to new depths.”

July’s total of six new drilling permits fell 45% from June, and was down 50% year-over-year. New well permits fell from seven to three, or 57%. Evercore found “a particularly accentuated decrease in deepwater,” from three in June to just one in July.

Side track permits held firm at two, which was on par with June levels.

The news worsened for ultra-deepwater: In July, there were no new permits (new well, side track, and bypass) for ultra-deepwater prospects.

However, the sharpest decline year-over-year has been the shallow-water permitting, Evercore continued, which it found to be down 69% from this time last year. Only three shallow-water well permits were issued. This figure was down 95% from 2014.

“We believe that offshore drilling will continue to show depressed activity as long as shallow-water permits remain at historically low levels,” Evercore said. “Offshore planning suggests more offshore negativity moving forward, as a mere threeBHP Billiton plans were submitted in July (down from four in June).

“Overall, we remain cautious in allocating optimism to the offshore space, as crude prices haven’t quite yet increased to levels needed to support appreciable offshore activity growth.”

The bigger picture

In addition,Evercore ISI also recently informed on global floater numbers, following the 2Q 2016 earnings season. The group found the global floater fleet to be only 35% contracted in 2017. This is about 10-to-15% lower than levels from a year ago, despite 25 floaters being retired in the last 12 months.

“As a result, contractors are agreeing to term contracts at rates near breakeven as they look to shore up utilization into 2019,” Evercore said.

The consensus view is for retirements to re-accelerate as 36 floaters, or 21% of the contracted fleet, roll off contract before year end, it continued.

“Incremental opportunities seem few and far between as operators remain cautious to start up new projects in the second half. Additional early terminations are also likely, following a busy first half as customers continue to retrench.

“The floating rig count is tracking slightly below our base case forecast, introduced in February, while the jackup count is performing slightly better than expected. However, the outlook is mixed … with MidEast demand holding up, Asia being opportunistic, Europe uncoordinated, and LatAm in continued disarray.

“A few offshore developments have received FID YTD, but expect projects with 2H FID targets to be deferred as oil continues to show volatility.”

Weighing in on the recent weakening prices, the analysts found that “there seems to be a heightened importance on near-term oil price levels, with a massive divide in psychology towards opposite ends of the $40/bbl- $50/bbl spectrum.

“A sustained oil price closer $50/bbl would greatly improve operator sentiment as we approach the upcoming budgeting season for 2017. We are somewhat agnostic to the ultimate shape of the oil price recovery, but remain steadfast in our conviction that oil prices will ultimately move higher in the intermediate term as the extent of the impending supply shortfall is realized.”

08/10/2016