Offshore staff

HOUSTON– A recent update from Raymond James & Associates’ US Research group advised that it was raising its 2017 and 2018 oil price forecasts by $5/bbl, predicting per-barrel costs of $75 for US crude benchmark WTI and $80 for European Brent.

“We are raising our 2017/2018 oil price forecasts by $5/bbl. Specifically, our 2017 forecast for WTI increases from $75 to $80 and Brent increases from $79 to $83–this marking the cyclical peak of the oil recovery,” the report noted.

“Similarly, we are initiating a 2018 forecast for WTI ($75) and Brent ($80), which is $5 higher than our previous long-term deck.”

The financial services organization said it was basing this increased assessment on several factors, seeing three key global oil supply variables that have recently turned “meaningfully more bullish.”

“Over the past few months, we've gained even more confidence that tightening global oil supply/demand dynamics will support a much higher level of oil prices in 2017,” the report read.

“We continue to believe that 2017 WTI oil prices will average about $30/bbl higher than current futures strip prices would indicate.”

The analyst maintained its long-term (2019 and beyond) forecast of $70 WTI and $75 Brent.

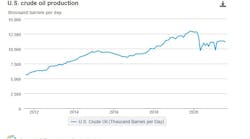

This $70 price deck should support sufficient long-term US oil supply growth to offset slowly rising global oil demand and falling non-US oil supply.

Raymond James specifically pointed to supply interruptions from Nigeria, Canada, Venezuela, and Libya; greater structural and activity-related supply declines from China, Colombia, Mexico, Brazil; and Angola; and lower projected 2017/2018 oil supply growth from the US due to emerging industry bottlenecks as its reasons.

“When we factor in modestly higher 2016 global oil demand growth, our global oil model has become meaningfully more bullish (or tighter),” the update read.

Over the next three years, the organization sees global oil inventories declining annually by around an additional 400,000 b/d to about 700,000 b/d each year over its previous estimations in January.

Its 2017 oil supply forecast has recently fallen by about 790,000 b/d, and 2018 forecast has fallen by about 1.4 MMb/d. It attributes the decreased rates as being due to steeper organic declines outside the US, unforeseen supply outages, and lower-than-expected domestic production.

In addition, the organization noted, there have been faster-than-expected organic supply declines due to sharp capital spending cutbacks and lower drilling activity in China, Colombia, Mexico, and Angola. On top of that, unanticipated supply disruptions have taken place in Nigeria (rebel attacks), Venezuela (electricity shortages), Libya (worsening anarchy), and Canada (wildfires).

Raymond James explained in a similar research brief from last month that these non-US oil supply declines are coming from both OPEC and non-OPEC countries and both onshore and offshore.

The analyst said that it “did not have enough basis at this point to adjust our existing long-term WTI/Brent price deck of $70/$75” for the long term (after 2019).

“While future US efficiency gains could easily drive the long-term equilibrium price deck lower than $70, we remain of the view that $50 to $60 would definitely not support a sustainable level of global investment for the long run.

“We are reiterating our long-term forecast of $70 for WTI and $75 for Brent,” it concluded.

Oil prices fell for the first time in three days today, against lingering uncertainty surrounding the vote to be held later this week that will determine if Britain will stay or exit the European Union.

The Wall Street Journal said the “oil market had been swayed of late” by the UK referendum, gaining over a two-day rally this week after last week saw more falling prices. The news organization said that WTI has currently settled at $48.32/bbl, with Brent trading at $49.62/bbl.

06/21/2016