Statoil makes Angola portfolio adjustments

Offshore staff

STAVANGER, Norway – Statoil is divesting equity in blocks 38 and 39 in the Kwanza basin offshore Angola. The transactions are part of Statoil’s continued optimization and portfolio adjustments process.

“The transactions will allow Statoil to unlock capital ahead of an extensive drilling campaign in the Kwanza basin,” says Gareth Burns, Statoil’s senior vice president of Global Strategy and Business Development.

Statoil has divested 10% to Ecopetrol in blocks 38 and 39. In block 39, the 10% divestment is accomplished through two separate but simultaneous transactions. Statoil acquired 7.5% from Total under one agreement. Statoil then divested a total of 10% in block 39 through a separate agreement, reducing its net equity by 2.5%.

The deals are subject to approval bySonangol E&P, the Angolan minister of petroleum, and the license partners.

On April 3, Statoil also announced the acquisitions by WRG Angola Block 38 Ltd and WRG Angola Block 39 Ltd (both 50/50 joint ventures owned by White Rose Energy Ventures and Genel Energy plc) of a 15% interest in block 39 from Statoil and a 15% interest in block 38 from China Sonangol International Holdings. These transactions have now received the approval of Sonangol P&P, the Angolan Ministry of Petroleum, and the license partners, and are expected to be completed shortly.

After completion of all transactions, block 39 will compriseoperator Statoil (37.5%), Total (7.5%), WRG (15%), Ecopetrol (10%), Sonangol P&P (30%); and block 38 will compriseoperator Statoil (45%), WRG (15%), Ecopetrol (10%), and Sonangol P&P (30%).

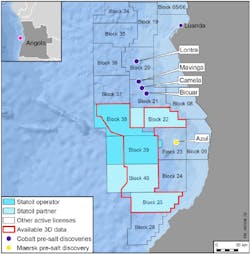

In addition to the Statoil-operated blocks 38 and 39, Statoil is partner in blocks 22, 25, and 40 in the Kwanza basin. The exploration blocks were awarded by Sonangol in December 2011.

The Angolan continental shelf is the largest contributor to Statoil's oil production outside Norway and is a key building block for Statoil’s international production growth. Statoil’s equity production from Angola equaled 200,000 b/d in 2013. Statoil has participating interests in four producing assets and several other licenses in the Congo basin.

07/07/2014