Offshore staff

OSLO, Norway – SapuraKencana Petroleum and Seadrill have entered into a memorandum of understanding to combine their tender rig businesses.

The new enlarged fleet under SapuraKencana will comprise 16 tender rigs in operation, five of which are already 51% owned and managed by the company through its existing joint venture with Seadrill in Varia Perdana and Tioman Drilling Co.; and an additional five rigs units currently under construction, three of which will be acquired through this transaction and should be delivered in 2013.

Additionally, SapuraKencana will be offered the right to manage a further three tender rigs not currently part of the transaction,West Vencedor, T-15, and T-16.

The operating rigs and newbuilds are all under long-term fixed price contracts with companies including Chevron, Shell, PTTEP, and Petronas Carigali. The total order backlog as of end-October was $1.55 billion.

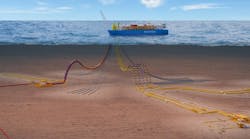

Most of the operating rigs are at work offshore Southeast Asia. Of the 15 operating rigs, nine are barges and six are semi-tender rigs, capable of operating in water depths of up to 6,500 ft (1,981 m).

SapuraKencana will take over the rigs, including the full tender rig organization, for an estimated price of $2.9 billion. The organization will continue to operate from the existing premises in Singapore.

One aim of the transaction is to develop a leading force in the Far East market. To support this position, Seadrill will receive a minimum of $350 million in new shares in SapuraKencana, on top of the 6.4% stake that it already owns.

The MOU further stipulates that both parties will look to expand their joint activities in Brazil, where they were last year awarded three contracts by Petrobras, and to establish a joint venture between Seadrill’s 40% owned subsidiary Archer and SapuraKencana.

This venture’s scope will focus on developing and expanding Archer’s wireline services in the Far East.

John Fredriksen, chairman, president and director of Seadrill, said: “The net proceeds received from the transaction will be redeployed as equity to aggressively grow our deepwater fleet and also open up for significant new investment in the jackup sector, a sector which recently has shown strong signs of improvement.”

11/05/2012