Offshore staff

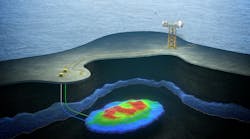

LONDON –The deep and ultra-deepwater oil and gas market is the key growth area offshore and also the most capital intensive says the Global Perspectives Deep and Ultra-deepwater Market Report from Infield Systems. The report covers the period of 2007 to 2016. The market outlook is strongly positive.

Technology advances added to a growing geological understanding of deepwater plays has international oil companies (IOCs), independents, and national oil companies (NOCs) all looking ahead to increasing prospects in deepwater, in both established areas and areas previously deemed marginal.

In addition to the environmental and geological challenges of deepwater operations, rising resource nationalism and increasing NOC involvement, puts geopolitics into the model for future of deepwater activities.

Petrobras is expected to continue to dominate the deepwater sector with its projected share of expenditure to 2016 forecast to reach 26% of the total global capex. The operator’s deepwater spend predominately centers on the presalt finds of Santos basin. Expenditure is also expected to remain high for Chevron, Total, Shell, BP, and ExxonMobil. The combined investment by the supermajors and Petrobras is expected to reach 65% of the global deepwater capex over the forecast timeframe.

Independent operators, such as, Anadarko, Noble Energy, Hess, and Tullow are also expected to substantially increase capex within the deepwater market over the next five years. For Anadarko, the rise in investment is particularly significant, with key projects including the Gulf of Mexico’s Lucius project, and new projects offshore Africa.

Regionally, the share of reserves coming onstream is expected to be highest from Latin America - forecast to be 39% of total global reserve additions during the 2012 to 2016 period, with more than 60% of such reserves in Brazil’s presalt basins.

However, the single largest deepwater field development expected onstream during the period is offshore Australia at a depth of 1,300 m (4,265 ft). The ExxonMobil-Chevron joint development at Jansz (Greater Gorgon), is expected on production in 2014 with reserves totaling some 2.8 Bbbl. Offshore Africa, Infield Systems anticipates strong deepwater investment to continue, with the region holding an equal global deepwater capex share to that of Latin America at 30% across the 2012-2016 timeframe.

Comparatively, North America’s capex share is expected to stand at 21%, followed by Europe and Asia.

Infield Systems expects the largest proportion of deepwater investment to be directed toward pipeline installations; comprising 39% of total global deepwater expenditure. Latin America and Africa are expected to account for the greatest proportion of deepwater pipeline spend. The single most capital intensive pipeline project is anticipated to be the Gazprom South Stream development at a water depth up to 2,200 m (7,218 ft), a project approved by Russia in December 2011. Deepwater subsea expenditure is also expected to remain high with projects offshore West Africa forecast to comprise the largest share of subsea demand over the period.

3/26/2012