Offshore staff

LONDON –Infield Systems has released its Global Perspectives Subsea Market Report To 2016. The report aims to provide a comprehensive analysis of its many facets. Information highlights the differing market dynamics, the changing investment opportunities, the emergence and implementation of new technology, and the dominance of different companies and manufacturers in each region.

The dual challenges of sustaining production in mature regions and effectively tapping uncapped reserves in growth areas boost the potential for subsea capital expenditure through the forecast period.

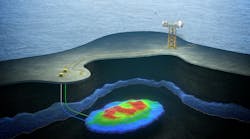

Operators are forced to venture into remote and harsher locations, Infield points out. These projects require top- tier equipment that can cost significantly more than the standard equivalent. Infield Systems estimates that ultra-deepwater installations will account for almost 25% of the annual tree market by 2016.

Prospects for manufacturers are also positive. The outlook shows a well-supplied market with a total capacity of 690 trees. Towards the end of the forecast period, Infield Systems expects higher utilization rates and the start of a saturated market, driven mostly by the increasing demand for subsea trees in main phases in Brazil and West Africa. Global subsea tree manufacturers' utilization rates are expected to increase to an average of 75% in the next three years, up from 49% in the 2009-2011 period.

Advances in technology are being tested and deployed in response to the offshore industry's demand for solutions to these challenges, which also include boosting flow rates in low pressure reservoirs, accommodating a larger number of fields tied back to host facilities, and ensuring the energy and cost efficiency of a project. Projects that could benefit from the use of advanced seabed technologies include: the mature fields of the North Sea and the US GoM, where a large number of small developments are expected to be tied back to existing platforms in order to be commercially viable.

Infield Systems also expects West Africa will be one a key region for implementing subsea processing. In Africa, oil companies such as Total, BP, ExxonMobil, Chevron and Eni will try to take advantage of the area's ample resources to leverage against the declining reserves from other mature areas. Total leads the subsea bill with a projected $8 billion spend within the forecast period.

Asia is increasingly important as it is the fastest growing region in terms of energy demand, and the hub of the global LNG sector, notes Infield Systems.

Australia is emerging as a major player in the global natural gas market. Post 2013, a significant backlog of major projects is predicted to provide a boost to the market. More than 50% of the forecast subsea market is expected to relate to subsea tiebacks to, a floating or fixed platform or a terminal.

Europe is one of the largest energy markets in the world yet it faces oil and gas production decline. The declining production in this mature region dictates the need for additional expenditure on infrastructure, EOR technologies, and exploration to sustain or enhance existing levels.

Latin America, particularly Brazil, has the potential to be a major offshore energy frontier. Petrobras has begun to reveal reserve estimates for its presalt finds that stand to significantly increase Brazil's total estimated level of reserves. Thirty-eight percent of the projected subsea capex will be needed to develop the presalt projects.

North America finds itself in a challenging period. With global recession followed by theDeepwater Horizon disaster, the last two years have seen a change in the regulatory environment governing operator activities across the region. Any future subsea equipment and infrastructure will need to comply with these regulations and have higher safety specifications, something that will lead to greater capital expenditure per development.

2/7/2012